TaxCalc Blog

News and events from TaxCalc

Right Said FRED 67. Or not?

We always try to share information and insights to support your life in practice. In this case, it’s the curious case of additional disclosures required by Micro-Entities (FRS 105)

Until recently, it hasn’t been necessary for accountants to provide much in the way of notes to Micro-Entity accounts. But that’s now changed.

Following the UK implementation of the EU accounting directive by The Companies, Partnership and Groups (Accounts and Reports) Regulations 2015 (SI 2015/980) (the ‘2015 Regulations’), a Micro-Entity is now required to include an additional three disclosures (where appropriate).

These additional disclosures (as highlighted within the proposed changes to FRS 105), should be applied earlier than has been inferred by FRED (Financial Reporting Exposure Draft) 67. Instead of applying to periods starting on or after 1 January 2019, they are to be applied to periods starting on or after 1 January 2016.

What’s the story?

Quoting the Small Companies Regime, Part 2, regulation 5A (as applied by The Small Companies (Micro-Entities’ Accounts) Regulations 2013):

Nothing in Schedule 1, 2 or 3 to these Regulations requires the Companies Act individual accounts of a company for a financial year in which the company qualifies as a Micro-Entity (see sections 384A and 384B of the 2006 Act) to contain any information by way of notes to the accounts, except that the company is required to disclose by way of notes to the accounts the information required by paragraph 57 in Part 3 of Schedule 1.

Paragraph 57 relates to ‘Guarantees and other financial commitments’.

In addition, the Companies Act itself requires information to be included within the notes to the accounts.

Prior to the adoption of the 2015 Regulations, only section 413: ‘Information about directors’ benefits: advances, credit and guarantees’ was required to be disclosed by Micro-Entities.

What does this mean?

This means that for periods starting before 1 January 2016, a Micro-Entity is required to disclose (where appropriate):

- Guarantees and other financial commitments; and

- Directors’ advances, credits and guarantees

Micro-Entity accounts are deemed to give a true and fair view. So no other disclosures within the notes to the accounts are necessary.

So what additional disclosures are required?

The changes implemented under the 2015 Regulations, included removal of the statement ‘In the case of a company not subject to the small companies’ regime’ from both section 410A: ‘Off-balance sheet arrangements’ and section 411: ‘Average number of employees’. This means that both now apply to ALL companies (along with section 413).

Each of these is required to be disclosed within the notes to the accounts for periods starting on or after 1 January 2016.

In addition, the 2015 Regulations also inserted section 396 (A1), which requires Companies Act individual accounts to state:

- the part of the United Kingdom in which the company is registered;

- the company’s registered number;

- whether the company is a public or a private company and whether it is limited by shares or by guarantee;

- the address of the company’s registered office; and

- where appropriate, the fact that the company is being wound-up.

While there’s no mention of this being disclosed within the notes to the accounts, it will more than likely be the best option where to include such information.

Please note: Micro-Entities do not appear to be exempt from these changes - therefore all of the above applies.

The disclosure of the statutory information - e.g. section 396 (A1) - is one which most preparers of Micro-Entity accounts are aware of. However, it appears that disclosures of Off-balance sheet arrangements and Average number of employees have been overlooked.

The suggestion by some is that as FRS 105 only currently includes the requirement for the original two disclosures, the emphasis on those required by the changes to company law have gone under the radar. It’s only now that those disclosures have been included in the proposed changes by FRED 67 that the requirement has come to light.

In addition, the Companies Act section 472 was not updated as part of the 2015 Regulations to include the additional notes required by a Micro-Entity, which still only refers to two notes needing to be included at the foot of the balance sheet.

It is not expected that BEIS (the Department of Business, Energy and Industrial Strategy) will be updating this anytime soon, if at all, however the update to FRS 105 should be sufficient to clarify the situation.

Proposed changes to FRS 105:

The proposed changes to FRS 105 (as part of the FRC’s Triennial Review) includes each of the additional disclosures above. However, FRED 67 has proposed an effective date for all changes (to FRS 102 and FRS 105) for periods starting on or after 1 January 2019 (with early adoption encouraged), there appears to be no mention of an effective date of 1 January 2016 for the additional disclosures under FRS 105.

It is understood that the FRC is aware of this situation and will be considering the best approach to take for inclusion when the standards are finalised - expected to be by the end of the year.

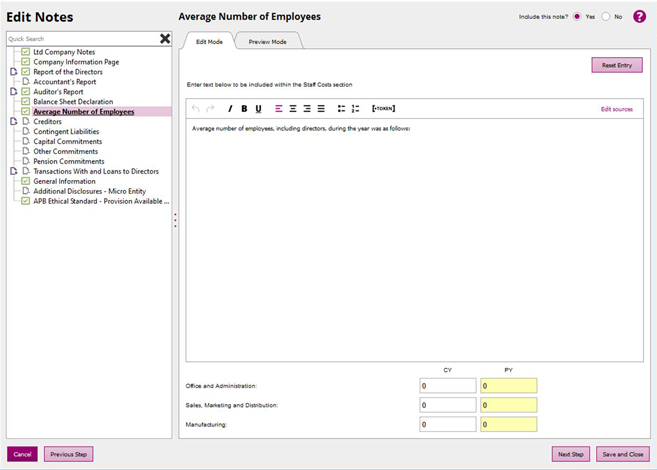

Currently TaxCalc provides in Edit Notes:

- A Transactions with, and Loans to, Directors note for disclosure of Directors’ advances, credits and guarantees.

- Miscellaneous notes for various types of commitments.

- A General Information note for disclosure of statutory information e.g. Registered office etc

- An ‘Average number of employees’ note (in version 5.8 update)

The Additional Disclosure note in version 5.8 could be used for ‘Off-balance sheet arrangements’, should they exist.

In summary

- Micro-Entities are only required to include two notes (where applicable) for periods starting before 1 January 2016; ‘Guarantee and other financial commitments’ and ‘Directors advances, credits and guarantees’.

- For periods starting on or after 1 January 2016 Micro-Entities are required to include an additional 3 notes (where applicable); Off-balance sheet arrangements, ‘Average number of employees’ and ‘Statutory information’ e.g. Registered office etc (unless that information is included elsewhere in the accounts).

- These additional disclosures are included within the proposed changes to FRS 105 (by FRED 67).

- FRED 67 however, suggest an effective date for these additional disclosures of 1 January 2019 and NOT 1 January 2016.

- The FRC is aware of this and will consider what to include in the finalisation of the standard to highlight the issue. This is expected in December 2017.

- TaxCalc Accounts Production provides the facility to include the disclosures required, with a dedicated note for ‘Average number of employees’ available in version 5.8. ‘Off-balance sheet arrangements’ can also be disclosed in Additional Disclosure Notes in version 5.8.

What are your thoughts?

We’ll always do our best to keep you ahead of the game, no matter what occurs. Look out for the latest innovations from TaxCalc: CloudConnect and Company Secretarial.