eSign Centre

From as little as 90p per envelope.

Digital document signing delivered

TaxCalc eSign Centre dramatically reduces the time spent obtaining client approval for accounts, tax returns and other important documents. Using our tried and trusted SimpleStep® workflow, preparing documents for electronic sign-off couldn't be easier.

Key features

What makes our software stand out? It's not just what it does. It's how it does it.

Multi-document envelopes

Just like a real envelope, include as many documents for signing as you like.

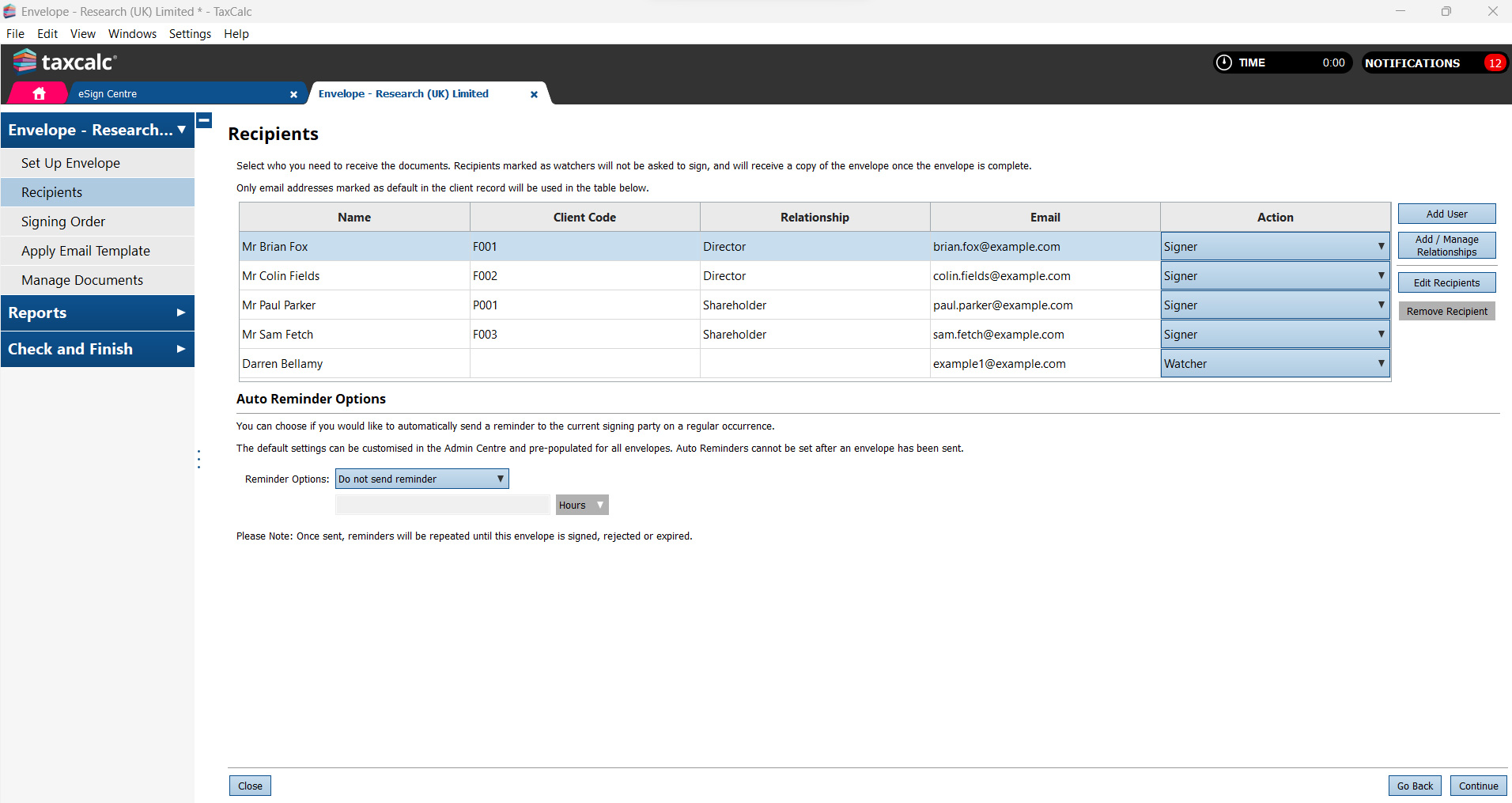

Flexible recipients

Choose whether your recipient is a signer or a watcher, even copy in your colleagues.

Automatic reminders

No need to chase clients for their signature, the software does the chasing for you.

Get electronic approval in minutes and instantly track sign-off progress. With eSign Centre you can reduce costs and speed-up client approvals.

Buy now More featuresLevels of security

Whether it’s a quick sign-off or a critical client agreement, our e-signature options give you the flexibility and security you need.

Standard Electronic Signature (SES)

Simple, secure, and legally binding e-signatures for everyday documents.

Advanced Electronic Signature (AES)

Identity-verified e-signatures with certificate-based authentication for higher-trust, sensitive documents.

Learn moreeSign Centre in action

Find out how eSign Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Join a weekly demo

In 45-minutes see how TaxCalc can help you work smarter, not harder.

Register nowCall us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Bringing you one step closer to being a fully paperless office.

Secure document approval

Obtain fast and reliable electronic approval for all your client documents.

- Add multiple documents for signing to a single envelope

- Include internal or external documents within the same envelope

- Associated client documents such as a director’s personal tax return can be sent together with the company accounts and corporation tax return

- You and your team can co-sign any documents e.g. engagement letters

- Add multiple recipients, either as a signer or just as a watcher

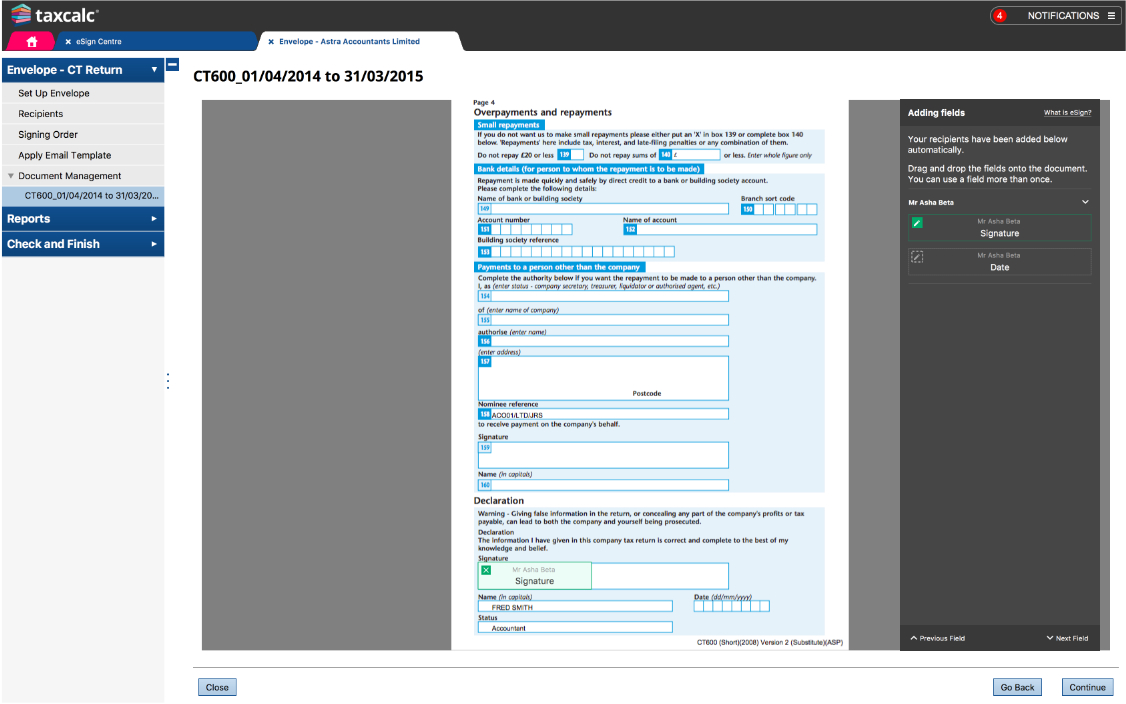

- Choose signature and date locations via a simple drag and drop mechanism

- Choose between Standard and Advanced Electronic Signatures

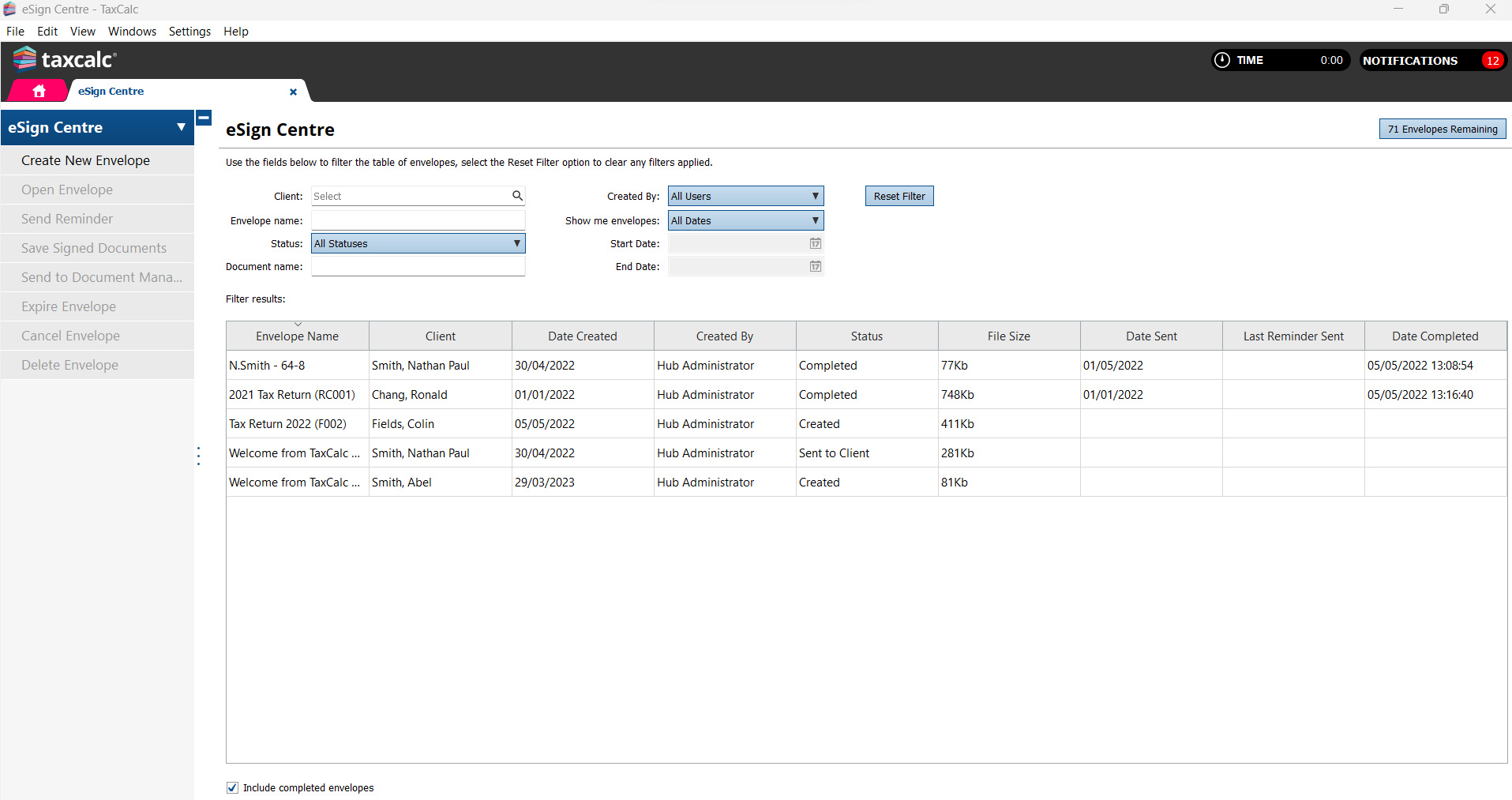

Full process visibility

A clear overview of all documents both signed and in progress

- Actively monitor progress of signatures, documents and envelopes

- Quick filters and default search parameters to quickly find the document envelopes you need

- Edit, expire, cancel or delete an existing envelope when necessary

- Save signed documents to a location of your choice

- Quickly send signed documents to TaxCalc Document Manager

- Envelope history report containing an audit trail of what happened and when

Automated and integrated

Speeding up the sign-off process

- Automated reminders to save you manually chasing recipients for their signature

- Pre-generated recipient lists to ensure documents always go to the right person

- Automatically complete stages of a workflow where documents have been sent for approval and signed

- Always using live contact data from your TaxCalc Practice Manager database

- Attach documents directly from key TaxCalc modules including Tax Return Production, Accounts Production, VAT Filer and more

eSign Centre in action

Find out how eSign Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Join a weekly demo

In 45-minutes see how TaxCalc can help you work smarter, not harder.

Register nowCall us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

System requirements:

TaxCalc is optimised to work on the specified versions of the operating systems listed below and all software releases are tested on them. An internet connection is required to receive updates and use certain parts of the software (e.g. file online to HMRC).

Mobile devices, tablets and Chromebooks are not currently supported.

Server installation:

Microsoft Windows (64-bit)

- Windows Server 2019

- Windows Server 2016

- Windows Server 2012

- Windows 11

- Windows 10 (All versions)

- Windows 8.1

Information about hosted desktop environments.

Standalone / Client installation

Microsoft Windows (64-bit)

- Windows 11

- Windows 10

- Windows 8.1

Apple Mac (64-bit only)

- 13.00 Ventura

(v13.1.006 onwards) - 12.00 Monterey

- 11.00 Big Sur

Linux (64-bit Kernel)

- 3.10 or higher, Debian (e.g. Ubuntu) or Redhat based distributions

- Graphical User Interface (GUI)

- Office productivity software (export to Word / Excel)

Additional requirements

- Appropriate hardware is required

- Adobe Acrobat Reader 9.0 or higher

- Microsoft Office 2010 or later (export to Word / Excel)

Information on partially supported systems and others which are no longer supported.

eSign Centre in action

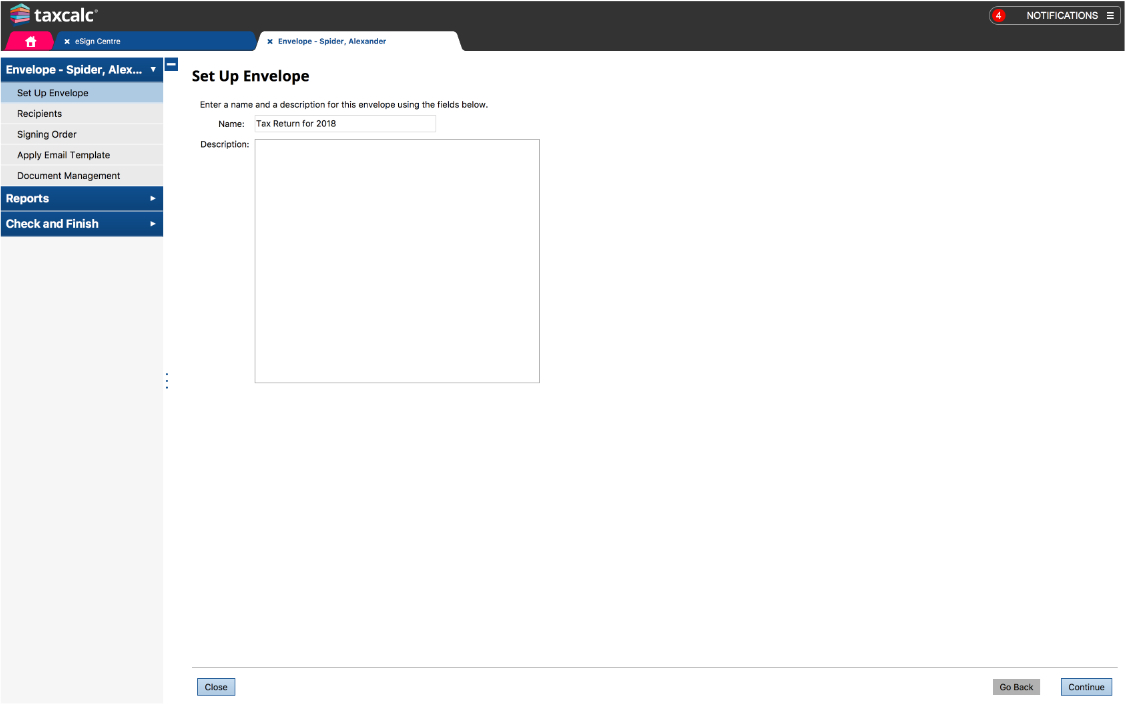

eSign Centre allows you to easily send documents from

TaxCalc to your clients for approval.

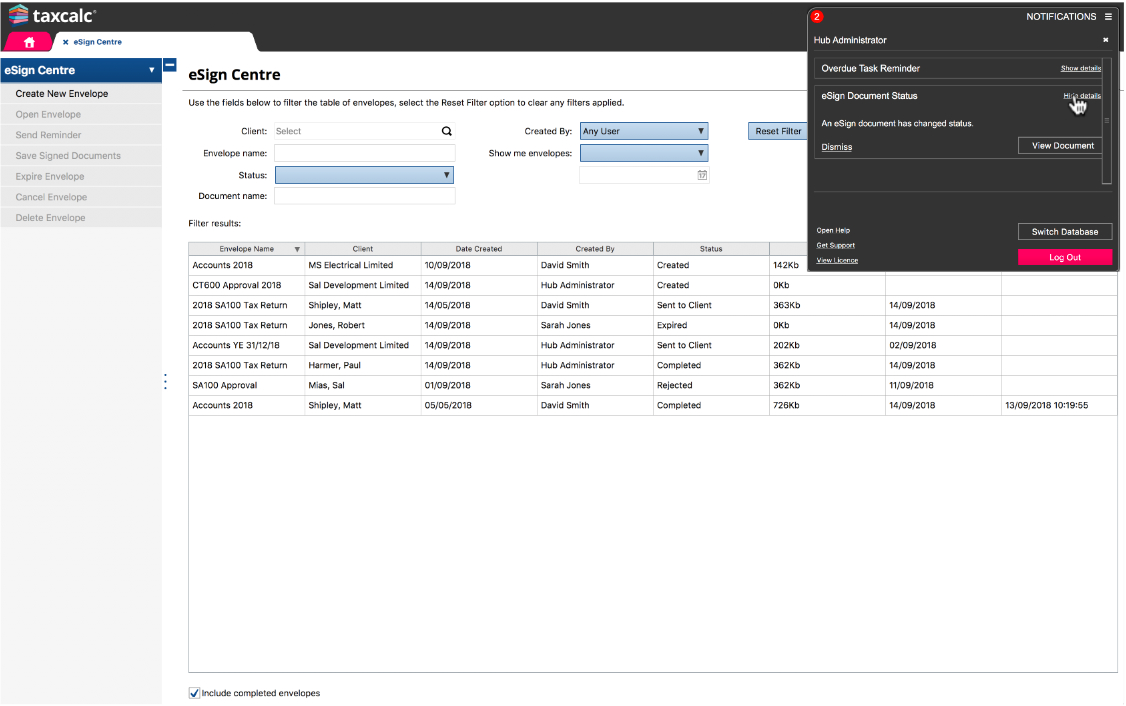

Manage documents that need signing and keep track of progress.

Easily create envelopes, add recipients and choose a signing order.

Add recipients directly from your Practice Manager and manage how they are notified or if they are required to sign the document.

Select where clients need to provide a signature, in multiple locations if needed.

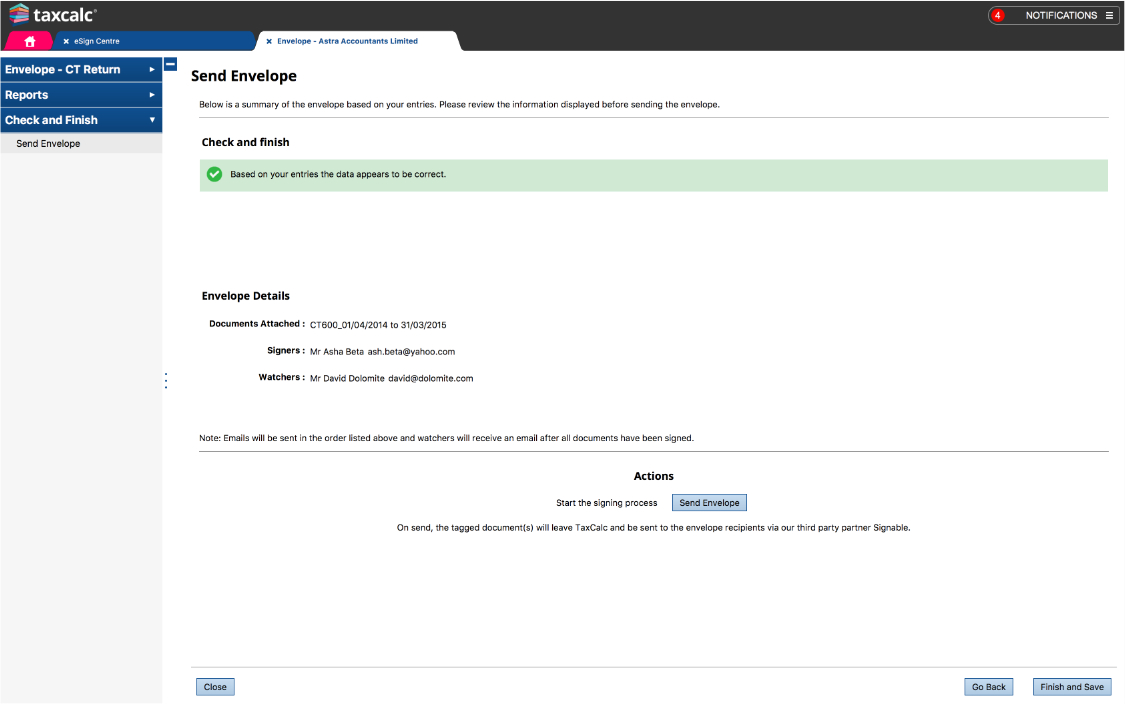

TaxCalc's Check and Finish will check your envelopes for errors before you send them to your clients.

When a client responds, or signs a document you'll know right away via TaxCalc's notification centre.

Frequently asked questions

The questions below provide immediate answers to many aspects of eSign Centre. If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

Getting started with eSign Centre

Electronic approval for your client documents.

How long do eSign envelopes last?

Once you have purchased your eSign envelopes they will remain on your account until they are used.

Can I buy more envelopes before I’ve used up my existing envelopes?

Yes. eSign envelopes are pay as you go, so if you are running low, you can choose from one of our envelope bundles to top up at any time.

Who can I send an eSign envelope to?

You can send envelopes to your clients, your team and anyone with a formal relationship to the client within TaxCalc such as partners, directors, secretaries, shareholders, trustees, PSCs, PRs, spouse or other family members.

Can I send more than one document within an eSign envelope?

Yes. An eSign envelope created for a client will allow multiple documents to be included at the same time.

Can I choose the order in which documents are signed?

Yes, and you can re-order those documents once attached to an envelope.

Can I change the email settings to be able to send the documents from my own email account

No. Unfortunately it is not possible at the moment to customise the email configuration. The email sent to your client will be generated by our partner Signable.

Does TaxCalc eSign Centre provide Advanced Electronic Signatures?

Yes, eSign Centre, via our partner Signable, provides an option for Advanced Electronic Signatures (AES). AES offers an additional layer of security for your documents. Utilising digital signing measures and identity verification techniques, AES shields documents from tampering and fraud, keeping sensitive information safe.

Can I take a trial of eSign Centre?

Yes. We provide one eSign envelope to try out for FREE, if you’re an existing customer or taking a trial. Once this has been used, envelopes can still be created but you will need to buy additional envelopes to send them to your clients.

eSign Centre in action

Find out how eSign Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Join a weekly demo

In 45-minutes see how TaxCalc can help you work smarter, not harder.

Register nowCall us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883