Companies House Advanced Integration

£194 per year

Connect to the Companies House database to create new clients and synchronise data

TaxCalc Companies House Advanced Integration turns the collation and maintenance of important client data from a slow and monotonous process into a quick and easy task.

Key features

What makes our software stand out? It’s not just what it does. It’s how it does it.

Speedy client creation

Significantly reduce the time it takes to set up new corporate clients in TaxCalc.

Live synchronisation

Compare data within your TaxCalc database with live data held by Companies House.

Full relationship history

Download all officers, past and present, including dates of appointment and termination.

Companies House Advance Integration in action

Find out how Companies House Advanced Integration

can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Unlocking the power of connected data.

Client creation

Minimise the time it takes to onboard new clients onto TaxCalc.

- Create new clients directly from Companies House database

- Pre-populate company name, number, registered office address and SIC code from the public record

- Pre-set usual year end date, confirmation statement date and incorporation date from the public record

- Pull down all officers of the company, past and present, together with their appointment and termination dates

- Choose whether officers are to be clients, contacts or already exist in the TaxCalc database

- Choose whether to populate officers with their service address

Synchronicity

Ensure your client data, and the public record, are always fully up to date

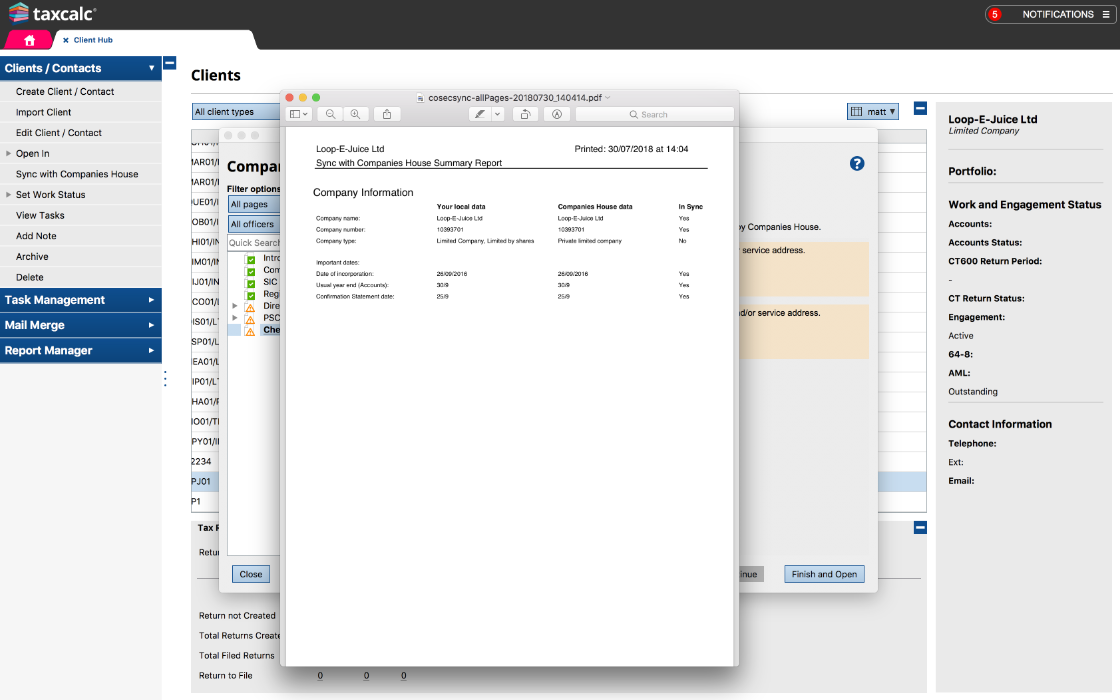

- Check data validity at any time using our Companies House Sync Wizard

- Print a summary report comparing locally held data with that on the Companies House record

- Choose whether or not to update the TaxCalc database with information held by Companies House

- Use TaxCalc Check and Finish® validation to clearly identify any data mismatches

- Update Companies House with any recent changes using TaxCalc Companies House Forms

- TaxCalc Accounts Production will verify company name and accounting period end date match Companies House in order to avoid a filing rejection

Companies House Advanced Integration in action

Find out how Companies House Advanced Integration

can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

System requirements:

TaxCalc is optimised to work on the specified versions of the operating systems listed below and all software releases are tested on them. An internet connection is required to receive updates and use certain parts of the software (e.g. file online to HMRC).

Mobile devices, tablets and Chromebooks are not currently supported.

Server installation:

Microsoft Windows (64-bit)

- Windows Server 2019

- Windows Server 2016

- Windows Server 2012

- Windows 11

- Windows 10 (All versions)

- Windows 8.1

Information about hosted desktop environments.

Standalone / Client installation

Microsoft Windows (64-bit)

- Windows 11

- Windows 10

- Windows 8.1

Apple Mac (64-bit only)

- 13.00 Ventura

(v13.1.006 onwards) - 12.00 Monterey

- 11.00 Big Sur

Linux (64-bit Kernel)

- 3.10 or higher, Debian (e.g. Ubuntu) or Redhat based distributions

- Graphical User Interface (GUI)

- Office productivity software (export to Word / Excel)

Additional requirements

- Appropriate hardware is required

- Adobe Acrobat Reader 9.0 or higher

- Microsoft Office 2010 or later (export to Word / Excel)

Information on partially supported systems and others which are no longer supported.

TaxCalc in action

See how TaxCalc's Advanced Companies House Integration add-on can help save time and streamline your client on-boarding and management process.

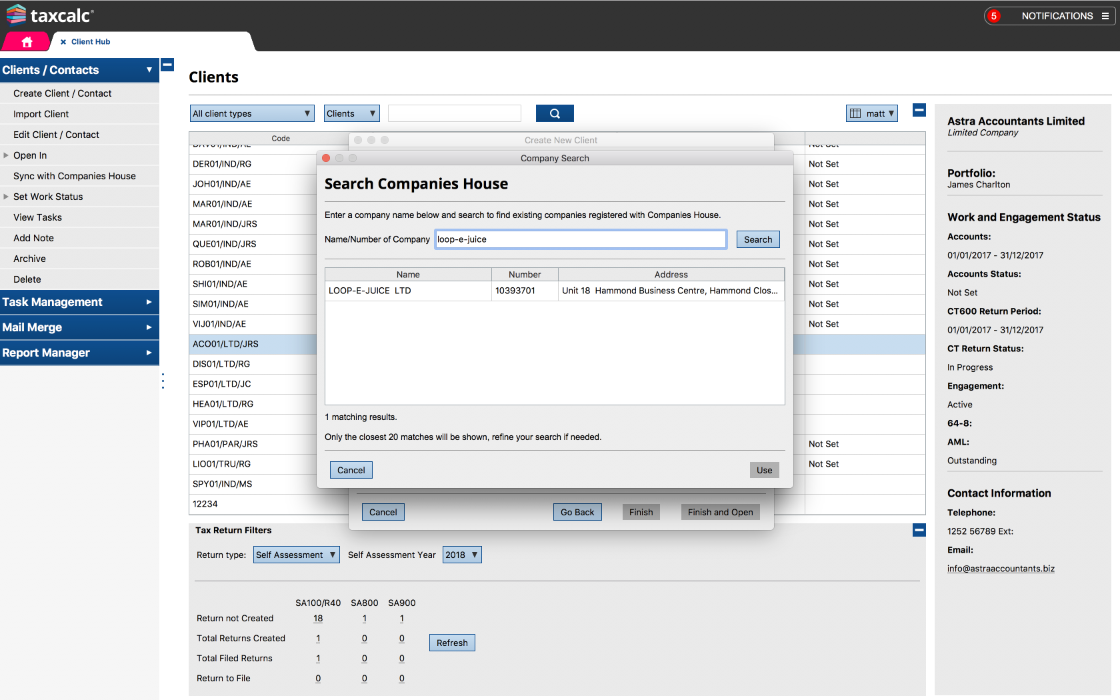

The search and results dialogue provides a simple summary of the public register based on the information entered. Allowing quick creation of a client with basic Company information.

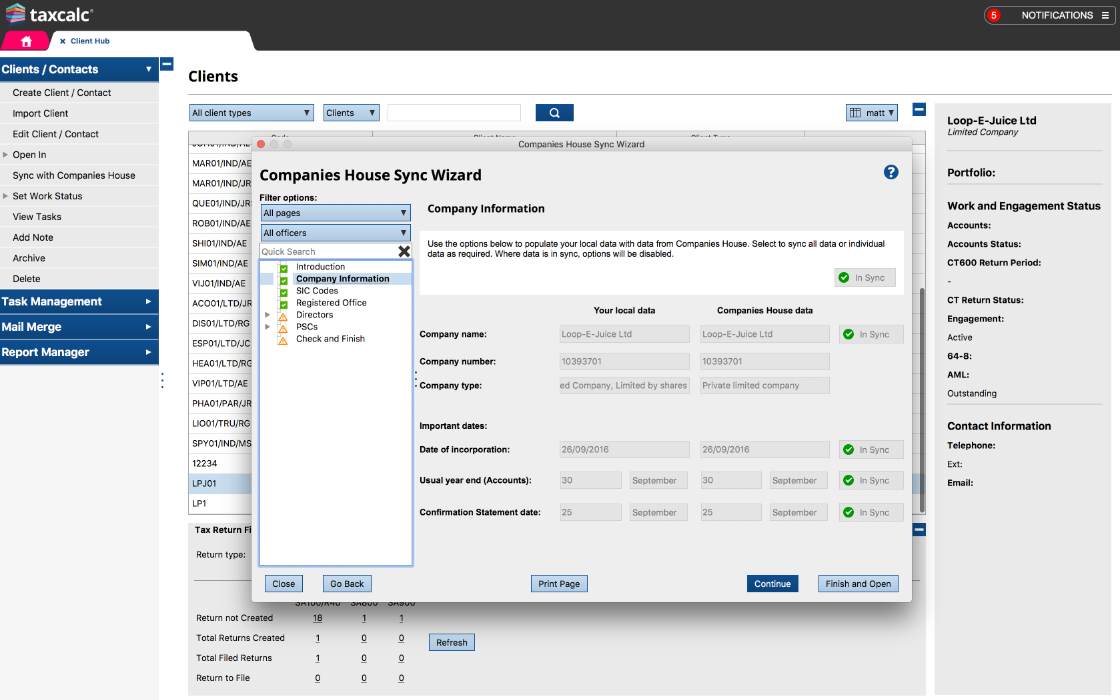

Sync Company Information, Important Dates, SIC Codes and Registered Office at the click of a button. Sync all items at once or select to sync one by one. You will be notified when the data is in sync.

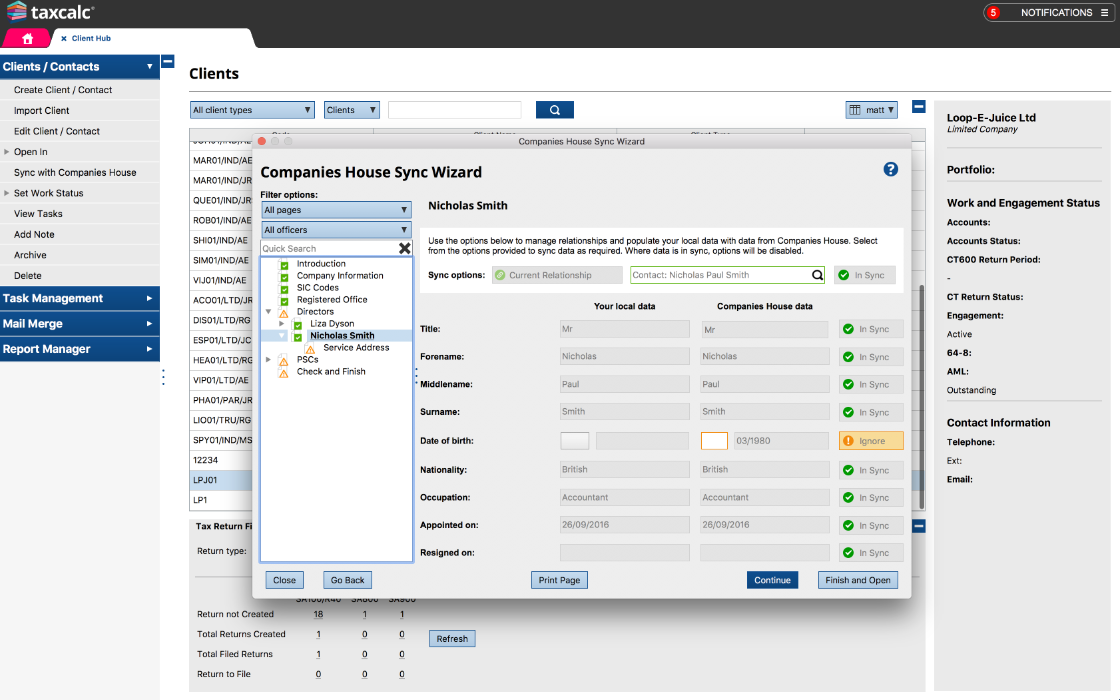

Sync both past and present Director, Secretary and PSC relationships held on the public register. Using the easy to follow sync options, quickly create a new client/contact, relationship and Service Address for each officer.

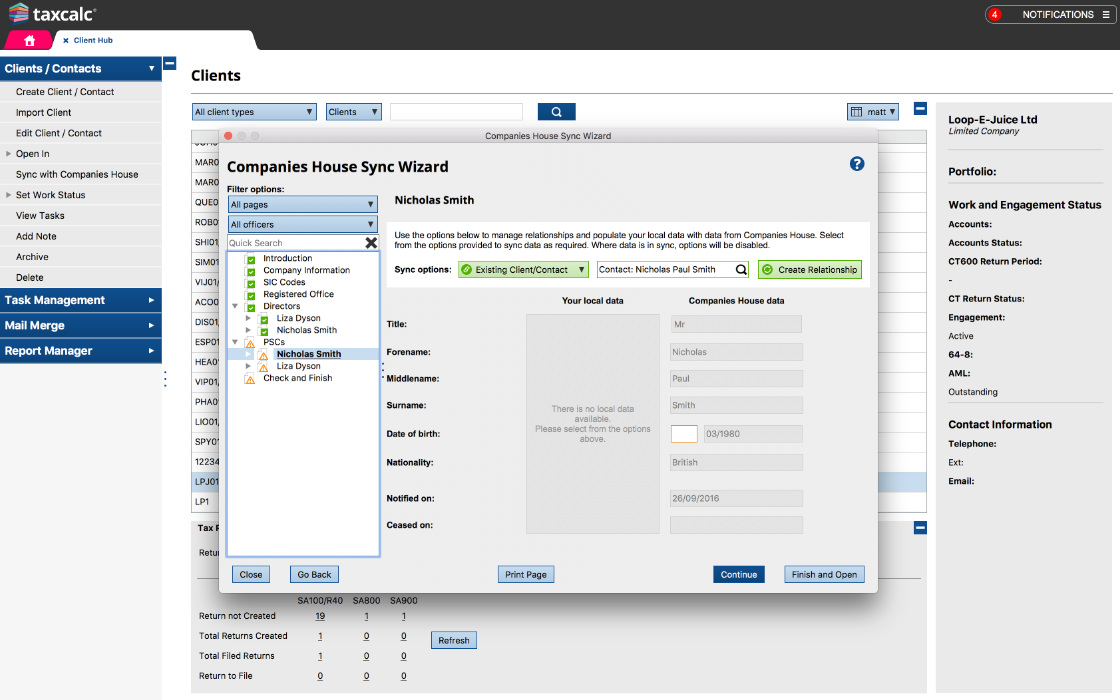

The sync wizard uses an intuitive search process to automatically select an existing client/contact or address where a match is found. Where a match cannot be identified a new client/contact can be created.

As with all TaxCalc products, the Companies House Sync Wizard ends with Check & Finish, which reviews and validates all pages and highlights any data not in sync or that may need your attention.

You can print each page or a Summary Report to provide a hard copy of data summarised within the wizard. This can be used to store on file or send to your client to verify the accuracy of data in preparation for submitting your client's Confirmation Statement.

Frequently asked questions

The questions below provide immediate answers to many aspects of Companies House Advanced Integration. If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

Why can’t I buy Companies House Advanced Integration if I already have Companies House Forms?

Companies House Forms 150 and above include Companies House Advanced Integration as standard.

Can I form a limited company with Companies House Advanced Integration?

No. You will need to use Company Incorporator for company formations.

What data can I import from Companies House?

In addition to company name, type, number, registered office and SIC code, Companies House Advanced Integration allows you to import and synchronise the usual year end date, confirmation statement date, incorporation date, past and present directors and secretaries, including their appointment and termination dates, service addresses and PSCs, including their nature of control.

Can I import directors’ dates of birth?

Only the month and year of birth are held on the public record. The day, if known, can be manually entered during the synchronisation process.

Can I synchronise data back to Companies House to update the public record?

If there is incorrect information on the public record then Companies House Forms can be used to electronically file the appropriate form to update the record.

Do all directors have to be clients?

No. You can choose whether a director is to be a client or a contact or whether to import them at all.

Companies House Advanced Integration in action

Find out how Companies House Advanced Integration

can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883