Companies House Forms

From £101 per year

Library of forms at your fingertips

TaxCalc Companies House Forms saves time keeping Companies House up to date by filing forms securely online from within TaxCalc.

The software features a library of the most commonly used forms, including managing officers and shareholders, and the annual Confirmation Statement

Key features

What makes our software stand out? It's not just what it does. It's how it does it.

Data synchronisation

Client records automatically updated at point of submission to Companies House.

Compliance prompts

TaxCalc suggests forms you may need to file whilst working away in other TaxCalc products.

Data population

All forms pre-populated from data already held on the TaxCalc client record.

Companies House Forms in action

Find out how Companies House Forms can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Everything you need to keep the public record up to date.

Completion and filing

With speed and accuracy.

- Pre-population of forms from the TaxCalc database

- Global address book for efficient completion

- File online or print and post

- Historic record of addresses

- Form creation via event triggers across the TaxCalc suite

- Window to track progress with Companies House

Forms supported

Everything you need and more.

- CS01 Confirmation statement

- AA01 Change of accounting reference date

- AA03 Notice of resolution removing auditors from office

- AA06 Statement of guarantee by a parent undertaking of a subsidiary company

- AD01 Change of registered office address

- AD02 Notification of single alternative inspection location (SAIL)

- AD03 Change of location of the company records to the single alternative inspection location (SAIL)

- AD04 Change of location of the company records to registered office

- AD05 Notice to change the situation of an England and Wales company or a welsh company

- AP01 Appointment of director

- AP02 Appointment of corporate director

- AP03 Appointment of secretary

- AP04 Appointment of corporate secretary

- CH01 Change of director's details

- CH02 Change of corporate director's details

- CH03 Change of secretary's details

- CH04 Change of corporate secretary's details

- EM01 Change of registered email address

- NM01 Notice to change of name by resolution

- NM02 Notice to change of name by conditional resolution

- NM03 Notice confirming satisfaction of the conditional resolution for change of name

- NM04 Notice of change of name by means provided for in the articles

- SH01 Return of allotment of shares

- TM01 Termination of appointment of director

- TM02 Termination of appointment of secretary

- PSC01 Give notice of individual person with significant control

- PSC02 Give notice of relevant legal entity with significant control

- PSC04 Give notice of change of details for person with significant control

- PSC05 Give notice of change of details for relevant legal entity with significant control

- PSC07 Give notice ceasing to be an individual person with significant control

- PSC08 Give notice of PSC statements

- PSC09 Give notice of update to PSC statements

Companies House Forms in action

Find out how Companies House Forms can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features in detail

TaxCalc Companies House Forms provides everything needed to keepyour limited company clients' affairs up to date

Limited Companies forms supported

- AA01 Change of accounting reference date

- AA03 Notice of resolution removing auditors from office

- AA06 Statement of guarantee by a parent undertaking of a subsidiary company

- AD01 Change of registered office address

- AD02 Notification of single alternative inspection location (SAIL)

- AD03 Change of location of the company records to the single alternative inspection location (SAIL)

- AD04 Change of location of the company records to registered office

- AD05 Notice to change the situation of an England and Wales company or a welsh company

- AP01 Appointment of director

- AP02 Appointment of corporate director

- AP03 Appointment of secretary

- AP04 Appointment of corporate secretary

- CH01 Change of director's details

- CH02 Change of corporate director's details

- CH03 Change of secretary's details

- CH04 Change of corporate secretary's details

- CS01 Confirmation statement

- NM01 Notice to change of name by resolution

- NM02 Notice to change of name by conditional resolution

- NM03 Notice confirming satisfaction of the conditional resolution for change of name

- NM04 Notice of change of name by means provided for in the articles

- SH01 Return of allotment of shares

- TM01 Termination of appointment of director

- TM02 Termination of appointment of secretary

People with significant control (PSC)

- PSC01 Give notice of individual person with significant control

- PSC02 Give notice of relevant legal entity with significant control

- PSC04 Give notice of change of details for person with significant control

- PSC05 Give notice of change of details for relevant legal entity with significant control

- PSC07 Give notice ceasing to be an individual person with significant control

- PSC08 Give notice of PSC statements

- PSC09 Give notice of update to PSC statements

Powerful add-ons to improve functionality

Collecting and maintaining client data can be a long and boring task, but now on-boarding new Limited Company clients is a quick and simple process. Using our ingenious Sync Wizard, Companies House Advanced Integration lets you check and pull even more information from the Public Register directly into Practice Manager. From now on you’ll always be sure your local data and the data held on public record is accurate and up to date at any time.

Add-ons

Companies House

Advanced Integration

Quickly on-board new Limited Company clients and keep company data up to date

and accurate.*

£194 per year

Buy now*This add-on is included with Companies House Forms 150 and above.

Companies House Forms in action

Find out how Companies House Forms can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

TaxCalc in action

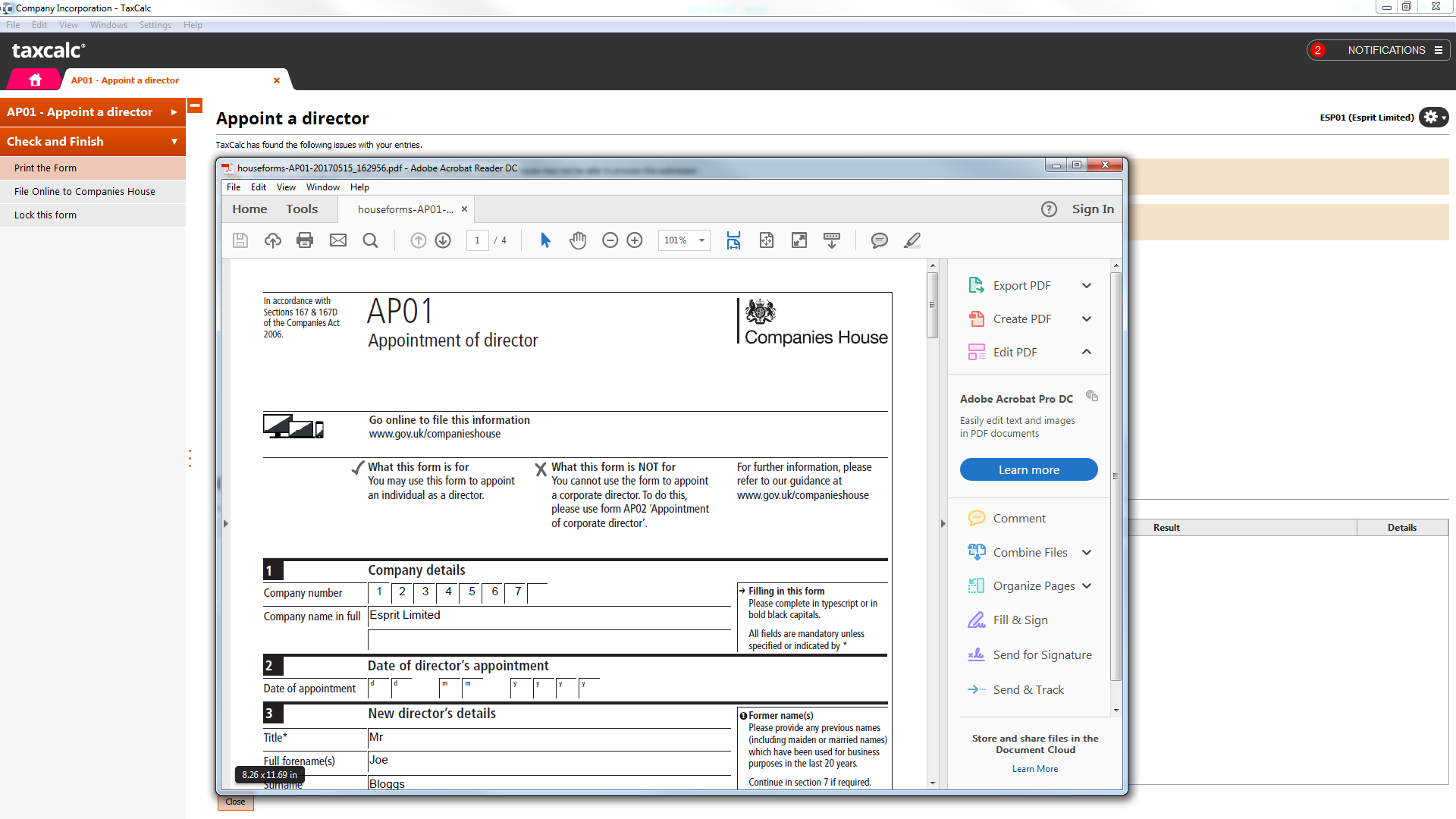

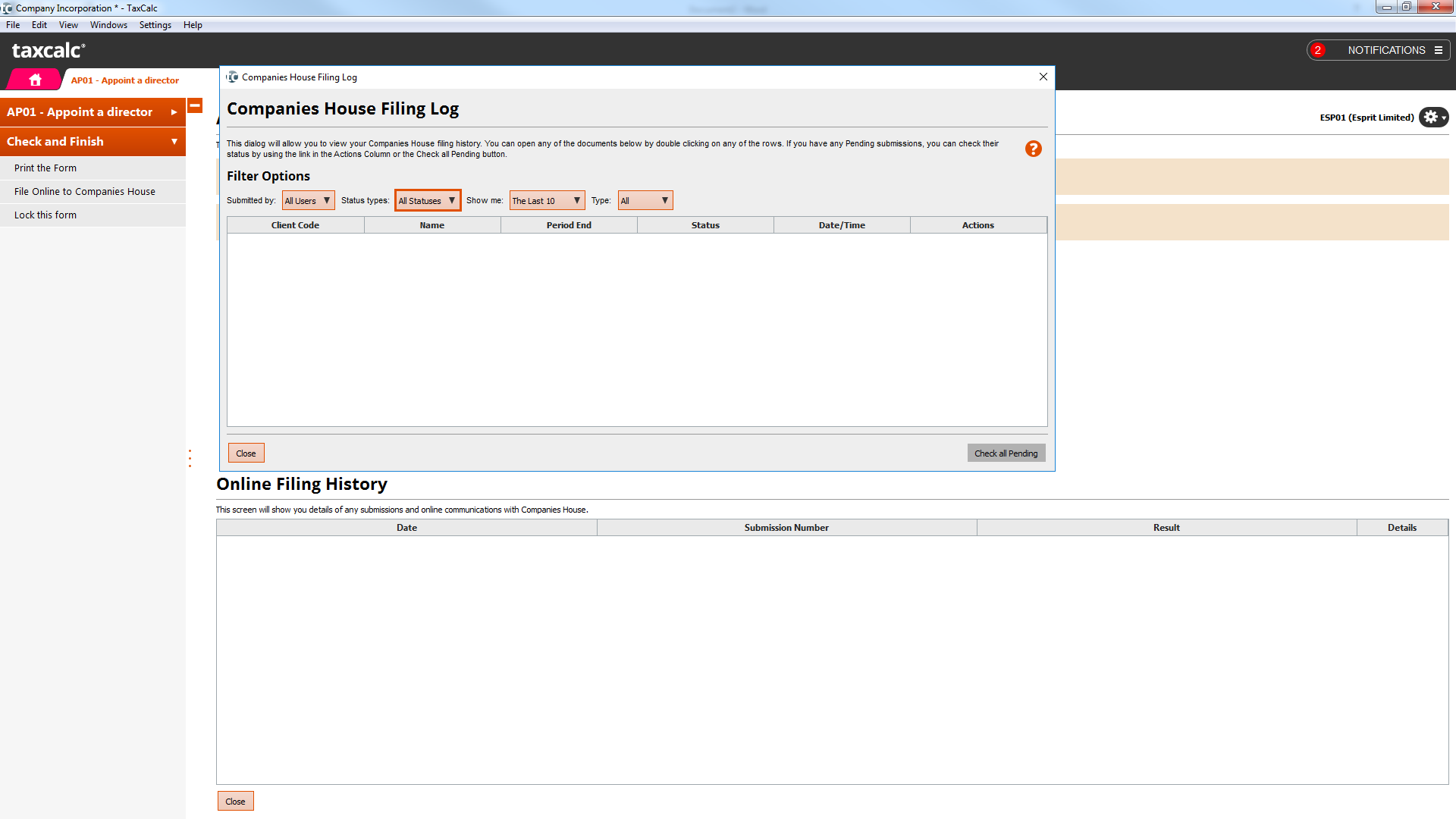

See how easy it is to work with TaxCalc Companies House Forms. Click on a screenshot below to see more detail.

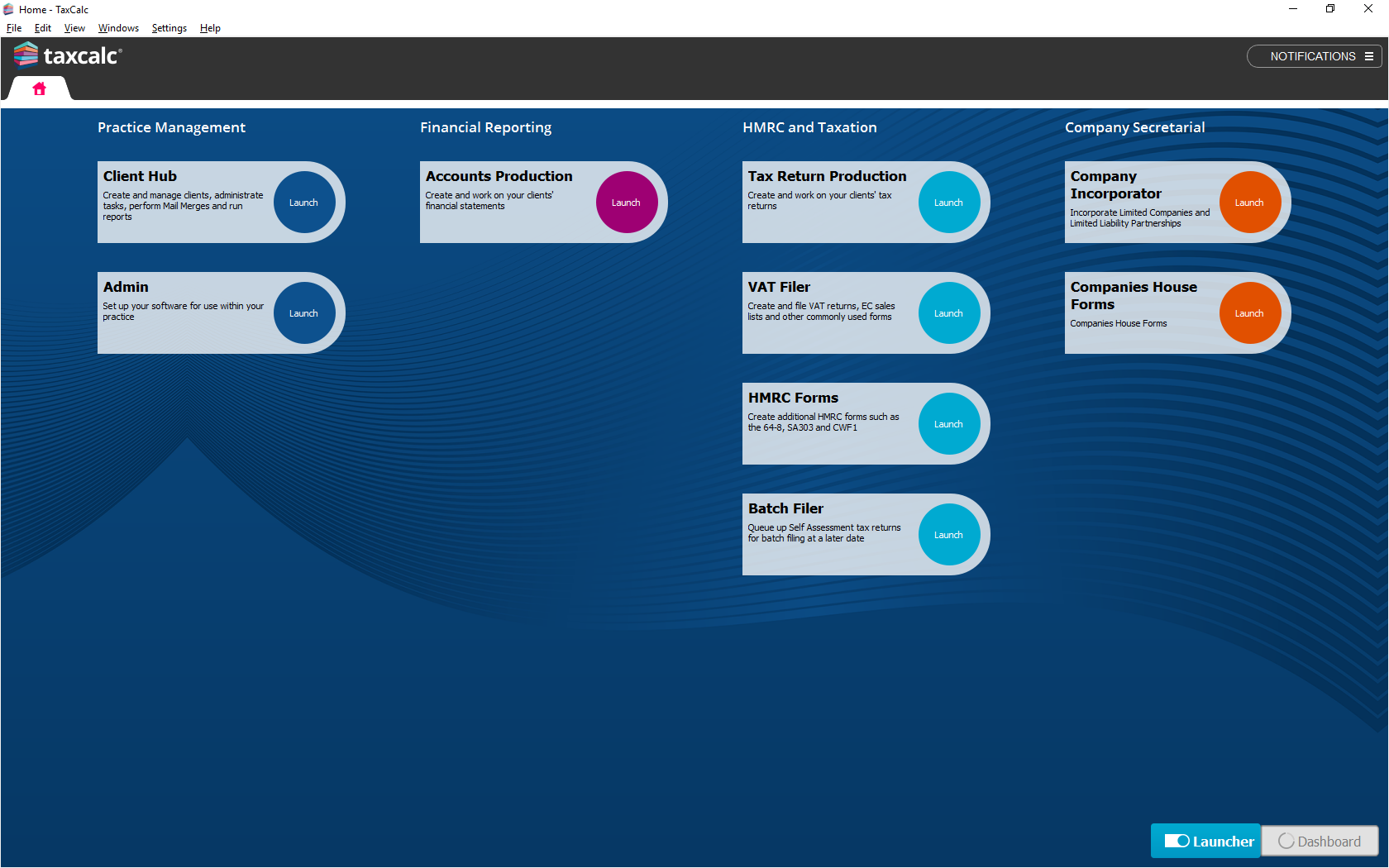

You can create a form to complete in two ways. The first is by clicking on the icon on the TaxCalc Hub Home tab.

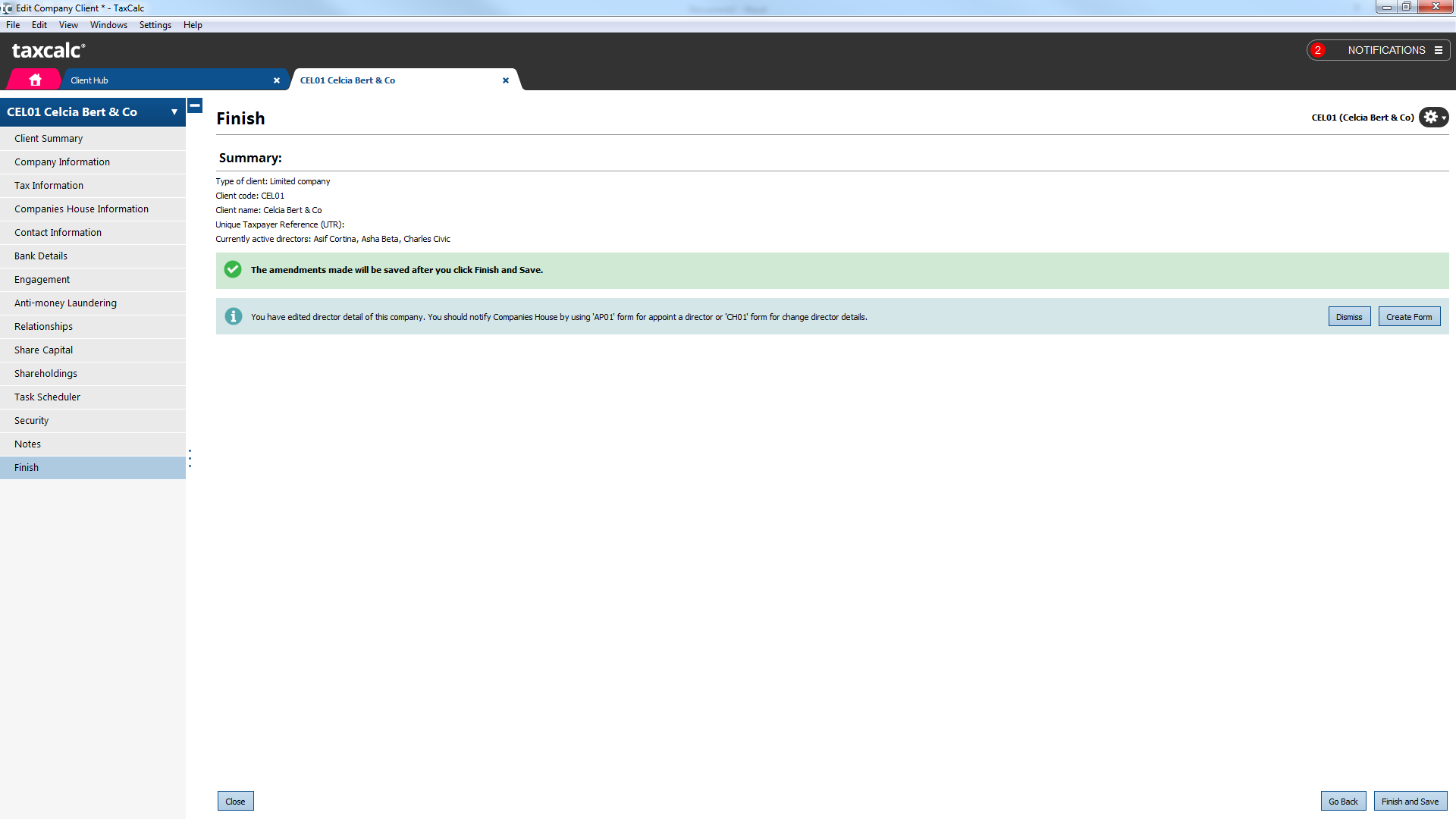

Alternatively, as you use TaxCalc, the software will suggest to you forms that you may wish to file.

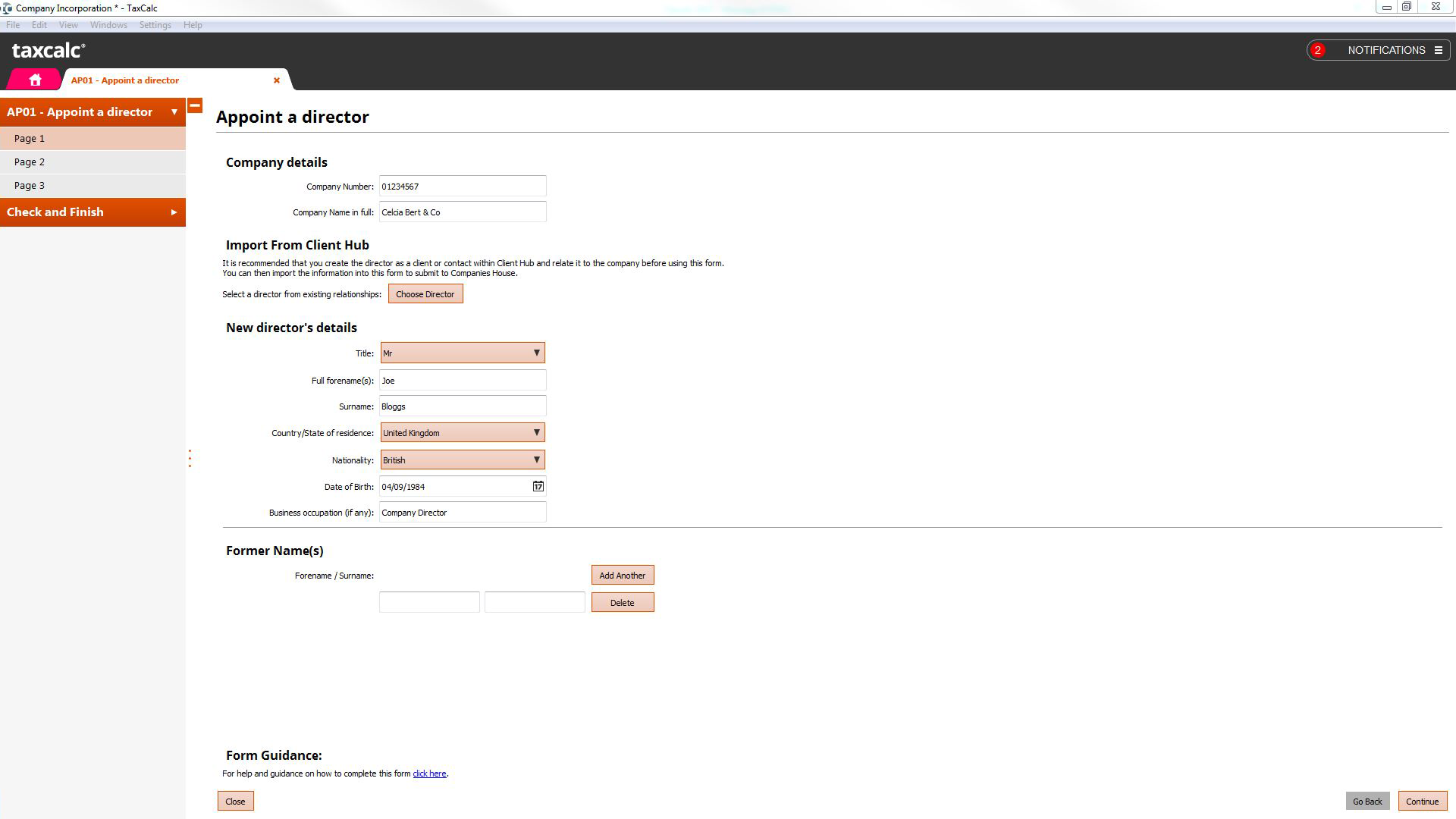

Completing a form is easy. As with other TaxCalc software, the SimpleStep guides you through the data collection…

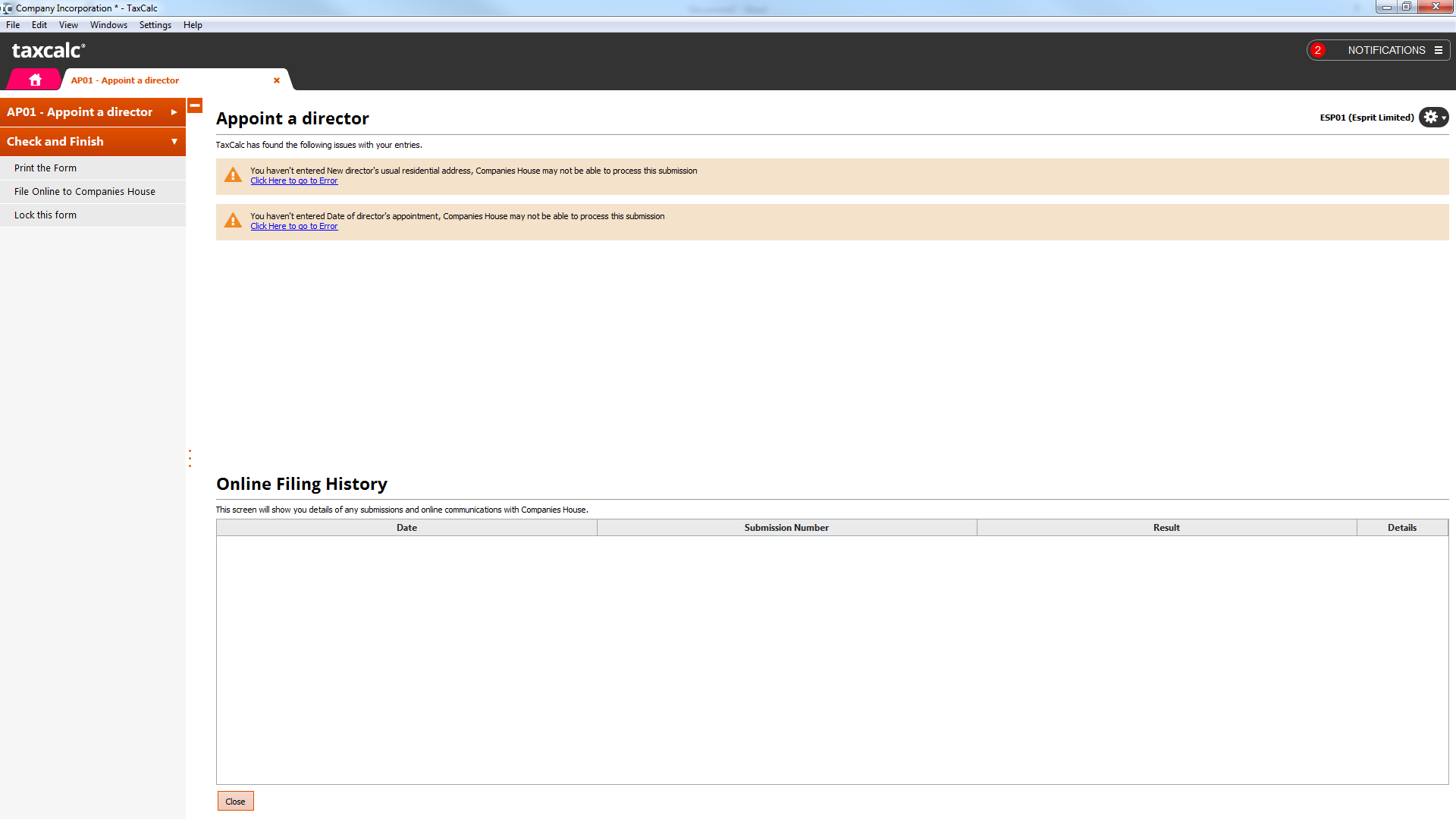

… and the Check & Finish process at the end validates your entries to ensure a successful submission to Companies House.

Each form has a paper version for clients to authorise and most can be submitted by post. Alternatively, you can file online.

For forms filed online, you can track the progress of the submissions and confirm Companies House acceptance.

Frequently asked questions

The questions below provide immediate answers to many aspects of Companies House Forms. If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

Can I file Confirmation Statements (CS01) online?

Yes, TaxCalc Companies House Forms includes the capability to file online Confirmation Statements (CS01).

Do the prices displayed include the Confirmation Statement filing fee?

The prices displayed do not include any associated Companies House charges such as the Confirmation Statement filing fee of £50.

Do I need a credit account with Companies House to file a Confirmation Statement?

Yes, you will need to have a created a credit account with Companies House in order to file a Confirmation Statement. This can be applied for here.

Do I need Companies House Forms to file accounts from TaxCalc Accounts Production?

No. Unlike some software providers, you do not need this software to file company accounts. In fact, we designed TaxCalc Accounts Production to file accounts directly to Companies House as one of its key features.

How does the licensing model work?

The software is licensed on an annual basis for 12, 50, 150, 250, 500 or 1,000 clients. Whenever you create a form for a client, you will allocate one of your client licences to it.

The number of clients allocated to your licence is reset in each licence period, which means that when clients no longer need forms filing in future, they do not continue utilising a licence.

Companies House Forms in action

Find out how Companies House Forms can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883