Tax Return Production

From £172 per year

Power through client tax returns

Preparing and filing Individual, Partnership, Corporation Tax and Trust returns has never been easier. Powerful, affordable and integrated into our accountancy software suite, TaxCalc Tax Return Production is trusted by thousands of firms and finance professionals.

Game-changers

What makes our software stand out? It’s not just what it does. It’s how it does it.

SimpleStep®

Fast forward to the relevant boxes in your client’s return with our intelligent prompting tool.

Check & Finish

Ensure everything tallies and address any potential problems using our unique validation tool.

Multiple returns

Jump effortlessly between clients’ tax returns without the hassle of opening and closing tabs.

Tax Return Production comes on an annual licence. Run it on your computer, over your office network or work in the Cloud using our CloudConnect® service and we'll securely host and back-up your practice data.

Buy now More featuresUpdated and supported

Updated

We work closely with HMRC to ensure that your software always stays updated to meet your compliance obligations. Tax Return Production comes:

- Fully updated to cater for the latest Self-Assessment and Corporation Tax Years and Forms.

- Supporting FY24 and updates to the new CT600 version 3.

- Supporting tax years dating back to 2012-13 with standalone solutions for prior years also available on request.

Our software also includes other useful HMRC forms such as the 64-8 Authorising Your Agent form, the R40 Repayment form and the SA303 Reduction of Payments on Account.

We‘re actively working on solutions, as recognised by HMRC, to make the transition into MTD for Income Tax as seamless as possible. Look out for more news soon.

Supported

Our support is unlimited and provided at no extra charge. Our team has technical know-how and practical accountancy experience, so you know that whatever your problem, we can find a solution.

Tax Return Production in action

Find out how Tax Return Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Seamlessly integrated

We’ve built all of our products on a single platform, so installation is straightforward, with easy deployment and online licensing. With one application and one database, data is shared seamlessly with other products in our range, which means everything works beautifully together.

Need an integrated accounts

solution too? We’ve got you covered.

Find out more about what Accounts Production can do for your practice.

View Accounts ProductionNeed clients to sign electronically?

Check out our eSign Centre.

Find out more about how eSign Centre can speed up your practice.

View eSign CentreFeatures

All the features, supported returns and supplementary pages you need to prepare your tax returns for every client, regardless of their affairs.

Compliance and Filing

Produce tax returns in accordance with the latest legislation, rates and allowances and save time filing electronically.

- Create and file tax returns going back to 2012-13 for Individual, Partnership and Trust Returns, and FY13 for Corporation Tax Returns (earlier years available on request)

- Produce comprehensive Corporation Tax Computations in iXBRL file format for submission to HMRC

- Property business Corporation Tax Computations

- Check and Finish routine to validate entries within the tax returns and to confirm the availability of HMRC online filing service

- Automatic updates for new features and compliance updates throughout the life of your licence

- Password protection of your clients’ returns

Fast and Simple Data Entry

Complete your data entry with ease, taking advantage of our many features to guide you through the returns, providing useful information to ensure nothing is missed.

- Complete your clients’ returns directly using HMRC Forms mode or by using our unique SimpleStep mode (1), a questionnaire format to guide you through the Return, so you only see what you need to

- Bring forward data from earlier years

- Compare the previous year’s tax data with this year’s tax data

Integrations and Sharing

Take advantage of the host of integration features designed to save you time and increase the accuracy of the data entered.

- Integration with HMRC APIs to download individual’s tax data, including employment income and tax deductions, off payroll working arrangements, SEISS claims, Marriage Allowance and National Insurance checks directly from HMRC. A lifesaver for those clients with missing records

- Import Limited Company Accounts data directly from TaxCalc Accounts Production with automatic time apportionment for long periods of account

- Disallow certain expenses when importing from TaxCalc Accounts Production

- Import self-employed and partnership accounts data directly from TaxCalc Accounts Production and also a variety of third party products via the SNF file format

- Post a journal from Corporation Tax period to the associated Accounts Production period

Summaries and Reports

Provide your client’s with summary information or a detailed breakdown of their tax data and calculated liabilities.

- Detailed calculations and summary reports

- Tax Payment / Repayments summaries (including due dates)

- Supporting Schedules

- R185 included

- Integrations between R185s and SA900 Tax Return

- Display the full SA951 tax calculation

- Add your own PDF attachments

- Export reports to PDF, Microsoft Word and Microsoft Excel

Computations and Calculations

All you need in one place, reduce the need for manual calculations outside of your tax software. TaxCalc comes with many additional calculators and computations to simplify the completion of your client’s returns.

- Real time tax liability calculation

- Capital Allowances Calculator (1)

- Basis Period Adjustments (2)

- Maximum Class 1 national insurance contribution calculations (2)

- Capital/Chargeable Gains calculations (including supporting schedules)

- Annual Pension Allowance Charge (2)

- Foreign Tax Credit Relief calculations (2)

- Statutory Residence Tests (2)

- Calculation of Trust Tax Pool computation

- Management Expenses record (3)

- Trading profit and loss adjustments worksheet for CT computations (3)

- Research and Development relief (3)

- Patent Box relief (3)

- Loans to participators record (3)

- Corporation Tax loss handling record (3)

(1) Excludes SA900 Trust and Estates Return

(2) Applies to SA100 only

(3) Applies to CT600 only

Guidance, Help and Support

Should you need assistance in the completion of the returns or use of the software, TaxCalc is full of useful features, but should you need further assistance our free UK based support team will be happy to help.

- Context Sensitive Help – No trawling through guides

- Guidance and useful links (including HMRC helpsheets, worksheets and tax return guides)

- Anonymous “send return to TaxCalc” function to get help from our Support team

Supported Returns and Supplementary Pages

SA100 and R40 Individual Returns

- SA100

- SA101

- SA102

- SA102M

- SA102MP

- SA103S

- SA103F

- SA103L

- SA104S

- SA104F

- SA105

- SA106

- SA107

- SA108

- SA109

- SA110

- R40

- Core Return

- Additional Information

- Employment

- Minister of Religion

- All Parliamentary Pages

- Self-Employment (Short)

- Self-Employment (Full)

- Lloyd’s

- Partnership (Short)

- Partnership (Full)

- UK Property

- Foreign

- Trusts & Estates

- Capital Gains

- Residence, remittance basis etc.

- Tax Calculation Summary

- Claim for repayment of tax deducted from savings and investments

SA800 Partnership Returns

- SA800

- SA800 (PS)

- SA800 (TP)

- SA801

- SA802

- SA803

- SA804

- Core Return

- Partnership Statement (Full)

- Partnership Trading and Professional Income

- UK Property

- Foreign Income

- Disposal of Chargeable Assets

- Savings, Investments and Other income

SA900 Trust Returns

- SA900

- SA901

- SA901L

- SA902

- SA903

- SA904

- SA905

- SA906

- SA907

- SA923

- Trust Return

- Trade

- Lloyd’s Underwriters

- Partnerships

- Property

- Foreign Income

- Capital Gains

- Non-residence

- Charities

- Estate Pension Charges etc

CT600 Corporation Tax Returns

- CT600

- CT600A

- CT600B

- CT600C

- CT600D

- CT600E

- CT600F

- CT600G

- CT600H

- CT600I

- CT600J

- CT600K

- CT600L

- CT600M

- CT600N

- Corporation Tax

- Loans to participators by close Companies

- Controlled foreign companies

- Group and Consortium

- Insurance

- Amateur Sports Club (CASCs)

- Tonnage Tax

- Northern Ireland

- Cross-border Royalties

- Supplementary charges in respect of ring fenced trades

- Disclosure of tax avoidance schemes

- Restitution Tax

- Research and Development

- Freeports

- Residential Property Developer Tax

Tax Return Production in action

Find out how Tax Return Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

TaxCalc for all firms

We recognise that practices in the UK come in all shapes and sizes.That's why we offer a wide range of Unlimited and smaller pre-built packages to suit your client base.

Whether you opt for your TaxCalc software to be supplied in standalone or server versions,

they both cost the same and come with free, unlimited support.

Standalone

Suitable for startups and those working on their own:

- Local database with option to store tax returns in your own file system or cloud storage (e.g. DropBox)*.

- Designed for a single installation. For multiple standalone machines please contact our team on 0345 5190 883.

- Available for Windows, Mac, and Linux

* Note that tax returns stored outside of the database will not be included in backups. If you move a tax return file, you will be required to help TaxCalc relocate it.

Server

Suitable for multi-staff offices at one or more locations:

- Central database to store and coordinate all your practice data in your office.

- Easy to use installer. One option for the server (which will auto-configure itself to run as a service on your network) and another option for each of the computers on your network.

- TaxCalc's server software is designed to run over modest, lightweight hardware. You don't even need a dedicated server. In simple setups, you just need to bless one computer on your network with the database and TaxCalc takes care of the rest.

- TaxCalc's software is optimised to run over VPN, so connecting in from remote locations provides superb performance.

- Concurrent user model means that you can install software on as many computers as you like.

- Two concurrent users allowed out of the box with additional users available to buy at just £110 per user.

- Back up all of your clients' accounts, tax returns and other practice records in one go.

If your practice's circumstances change, we can migrate you from the standalone version to the server version. Please call us on 0345 5190 883 to discuss.

TaxCalc and Your Practice - A Short Guide

There's no need to be daunted at the prospect of change: hundreds of practices are moving to TaxCalc and are enjoying the benefit of one integrated software provider.

To learn more about how your practice can install, license and maintain TaxCalc, we've written a detailed guide about this, together with an insight into the technology and user interface design of the software.

DownloadPowerful add-ons to improve functionality

We provide a number of helpful add-ons. Choose one or more add-on modules and review pricing when you come to buy your software.

Client planning

What If? Planner

Use your client’s current year data to

project the following year’s tax liabilities.

£78 per year

Buy nowDividend Database

Bring forward your clients’ shareholdings

from previous returns and let the dividend database complete this year’s entries.

£70 per year

Buy nowAdd-ons

Tax Return Production in action

Find out how Tax Return Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

TaxCalc in action

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below to see how you use TaxCalc and see how easy it is to complete your tax return.

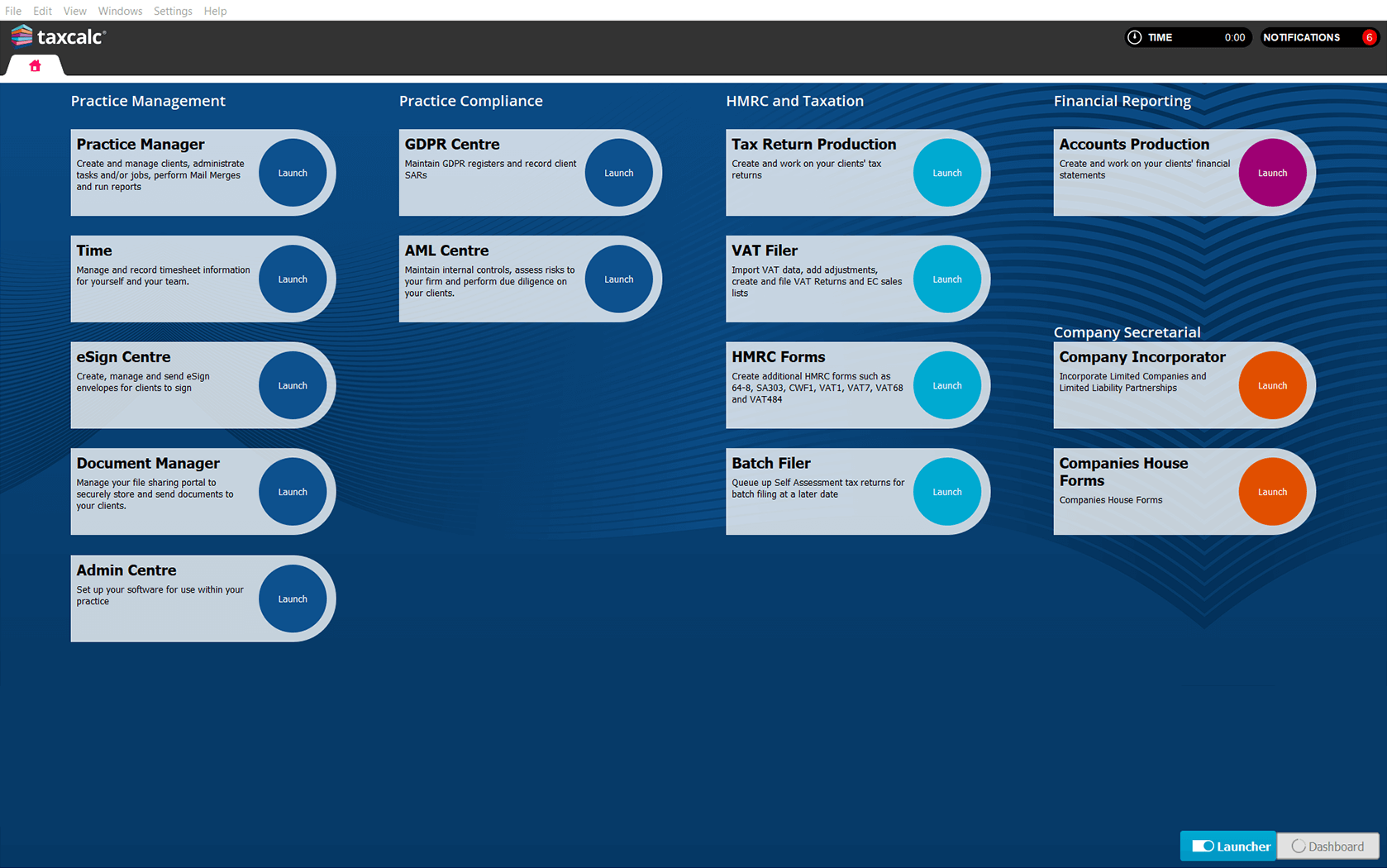

You can launch TaxCalc Tax Return Production in two ways.

The first is to click on its icon on the Hub Home screen, choose a client and then a tax return period.

Alternatively, you can open a tax return from within TaxCalc Practice Manager.

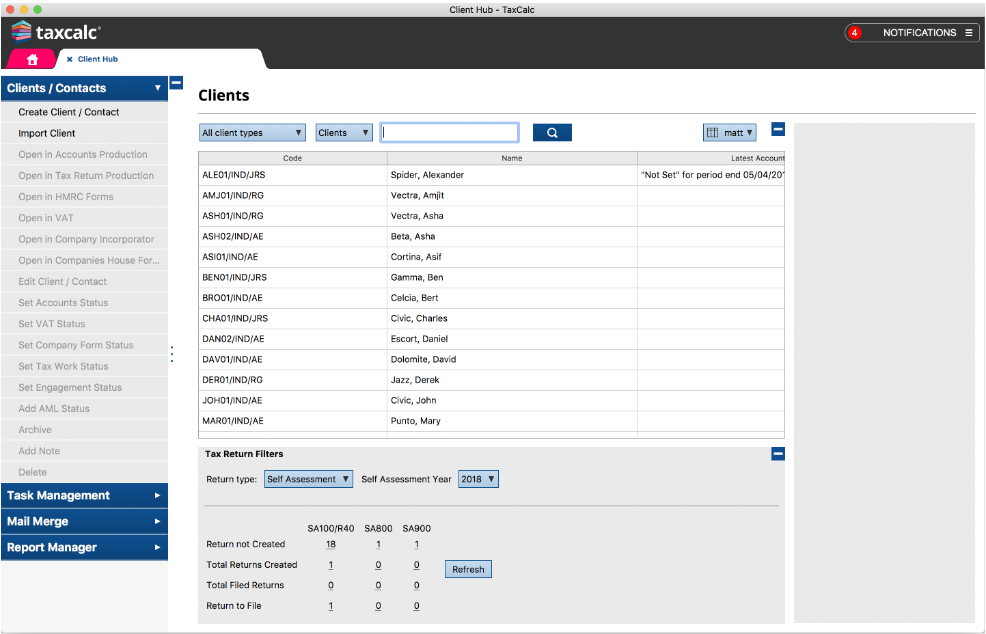

Use TaxCalc Practice Manager to monitor progress, set work reminders and keep on track of your workload.

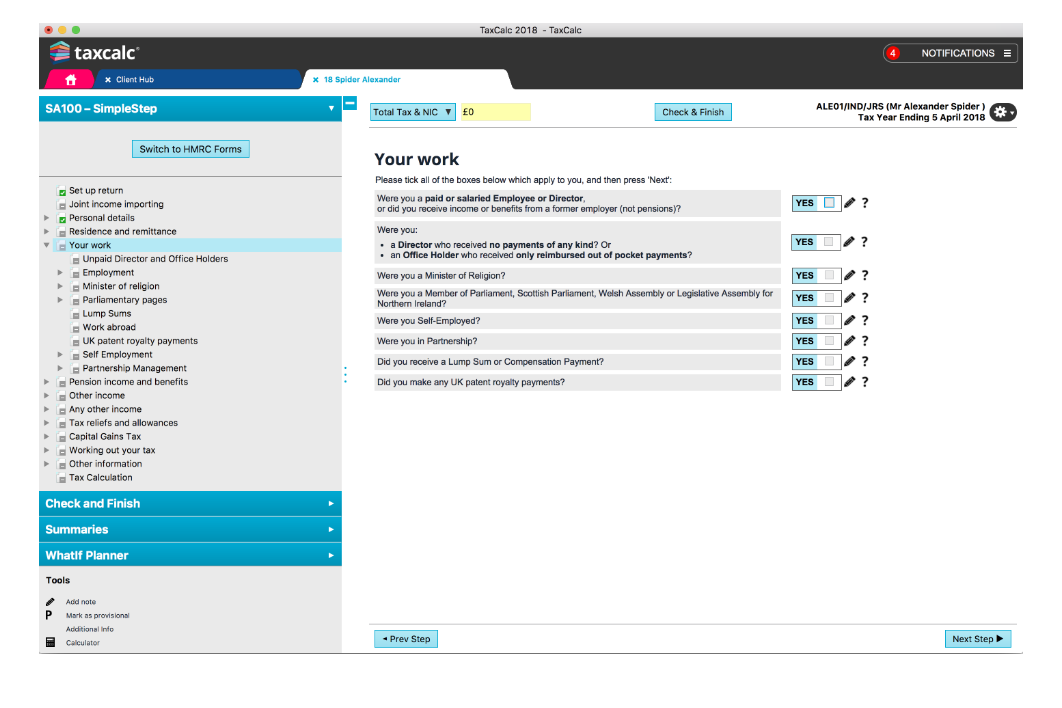

TaxCalc contains two modes of entry. SimpleStep is our unique questionnaire mode, which guides you through the return, asking questions based upon answers given and data entered.

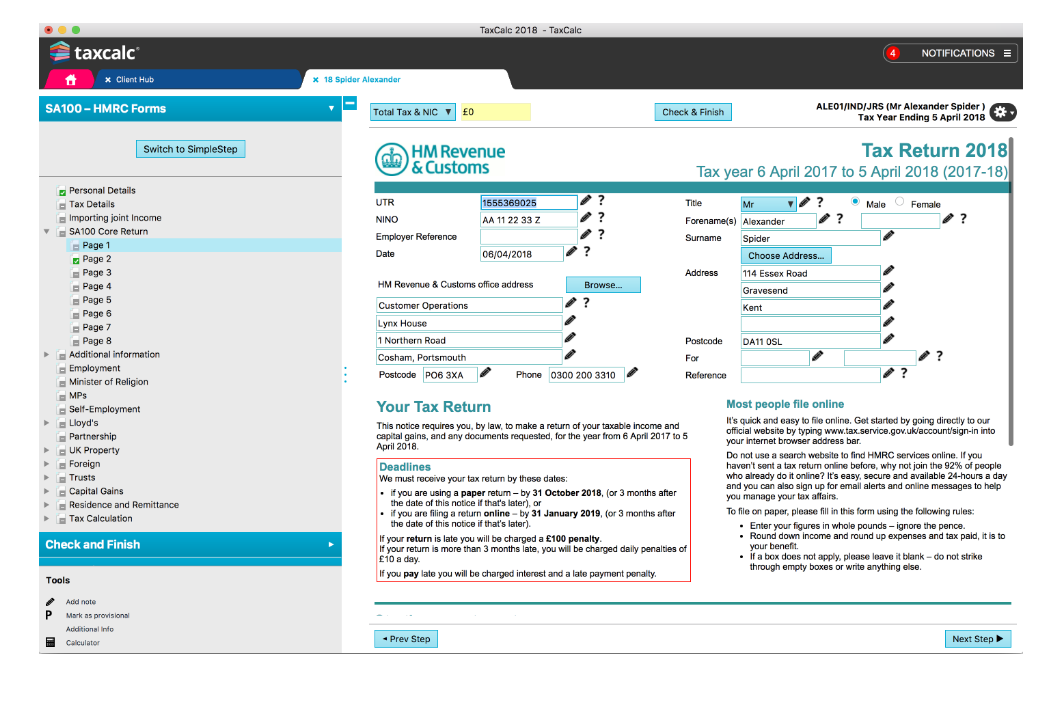

HMRC Forms mode displays a facsimile form for fast direct entry.

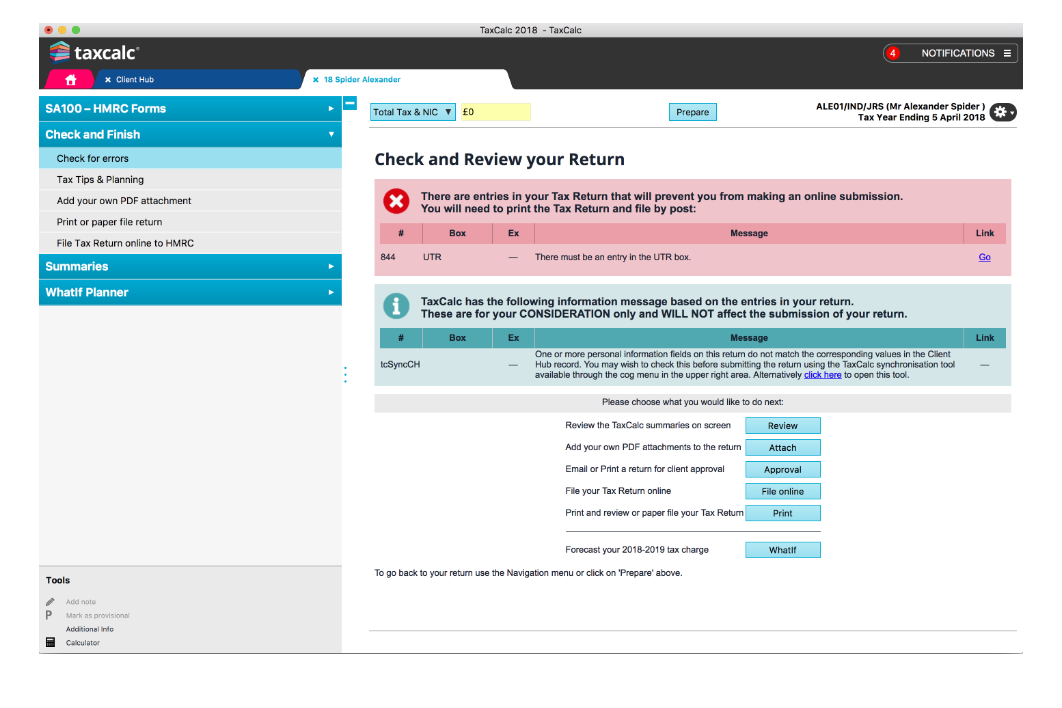

When you get to the end of your return, Check and Finish validates the entries you've made and highlights any potential issues before you file.

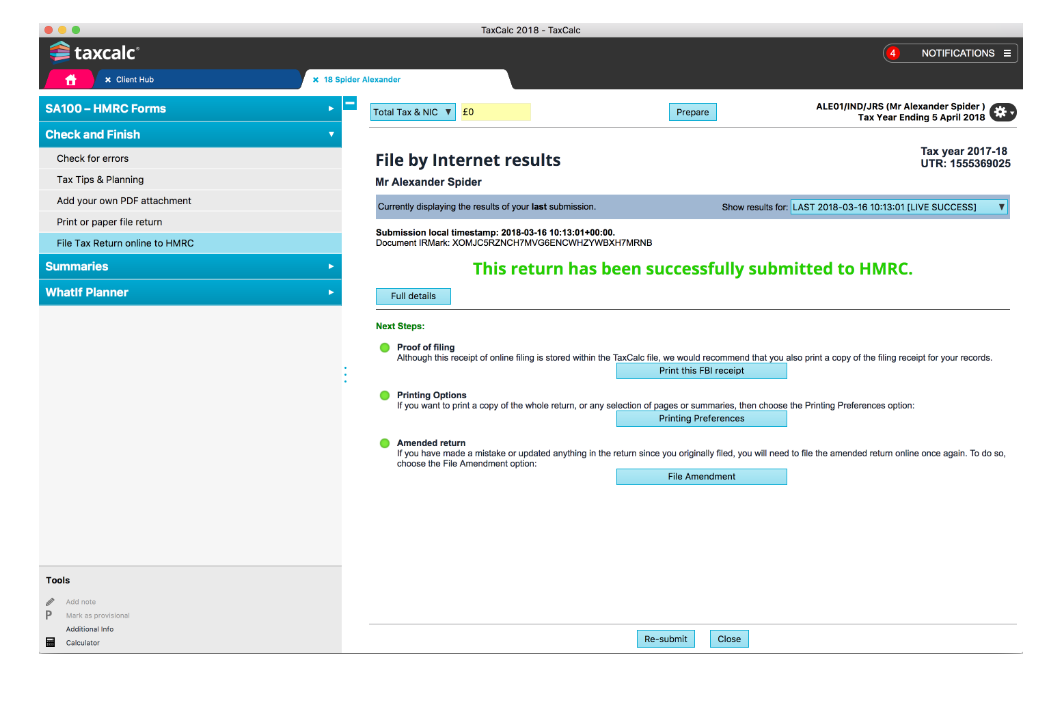

TaxCalc files your client's return online and tells you when it has been successfully received by HMRC.

Frequently asked questions

Below you'll find answers to questions you may have about Tax Return Production.

If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

How do I setup TaxCalc for my firm?

We offer three deployment options to suit different situations. For multi-users working in the same office, our network version allows you to install TaxCalc to a server and connect workstations to the central database. For single users, our standalone version offers a simple installation process for a single computer – all data is stored locally. The first time you install TaxCalc, you will be asked which version you would like to install.

Alternatively for those wishing to work anywhere, we have CloudConnect which allows you to download TaxCalc to any computer and access your data via the Internet. Perfect for firms who need staff to access from the office or from home/client’s premises.

How many computers can I install TaxCalc Tax Return Production onto?

TaxCalc Tax Return Production may be installed on a single computer if you have chosen to use the standalone version. For network and cloud customers, there is no limit, although the number of concurrent users will be limited by the licence you purchased.

Can I upgrade or add additional returns?

Yes. You can start off working with one version of TaxCalc Tax Return Production and later upgrade or buy a version that provides additional returns. We will provide you with a credit for any unused portion of your annual licence.

If you cannot find the product you are looking for, please call our Sales Team on 0345 5190 883 or email sales@taxcalc.com.

Is Tax Return Production ready for MTD for income tax?

We are currently developing our MTD for Income Tax solution for the annual submission to ensure that our users can comply with the requirements of the new service. MTD Quarterly Filer is available for submitting the Quarterly Updates under MTD.

Can I buy previous years' returns?

All TaxCalc Tax Return Production products create tax returns for tax years from 2011-12. We have a range of standalone products for tax years prior to this. Please call us on 0345 5190 883 or email sales@taxcalc.com to discuss your requirements.

How many users can use Tax Return Production?

If you are using a networked or Cloud version of TaxCalc you can have multiple users accessing the software at the same time. Product versions for under 50 clients come with 1 concurrent user as standard, versions for 50 clients and above come with 2 concurrent users as standard. If you need to increase the number of users permitted to access a module at any one time you can simply purchase additional concurrent users.

Can I submit amended Tax Returns?

Yes, on submission, you can specify whether the Tax Return is an amended version.

Will I need to reinstall if I upgrade?

We make it easy for you. All you need to do is pay for your upgrade and restart TaxCalc on your computer. Your software will be updated automatically.

Tax Return Production in action

Find out how Tax Return Production can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883