GDPR Centre

£157 per year

Complete peace of mind for your GDPR

TaxCalc GDPR Centre is your fully integrated solution to your GDPR compliance challenges.

Demonstrate your compliance by documenting your firm's personal data policies and procedures; and respond quickly and effectively to any Data Breach or Subject Access Request.

Key features

What makes our software stand out? It's not just what it does. It's how it does it.

Process checklists

Easily record and update all ICO-recommended processes with our Process Checklists.

Data activity registers

Track all your firm's personal data activities in easily actionable sections.

Risk assessments

Conduct thorough and comprehensive risk assessments to mitigate the risk of fines.

GDPR Centre in action

Find out how GDPR Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Manage your firm's GDPR compliance.

Evidencing your compliance

GDPR features baked in.

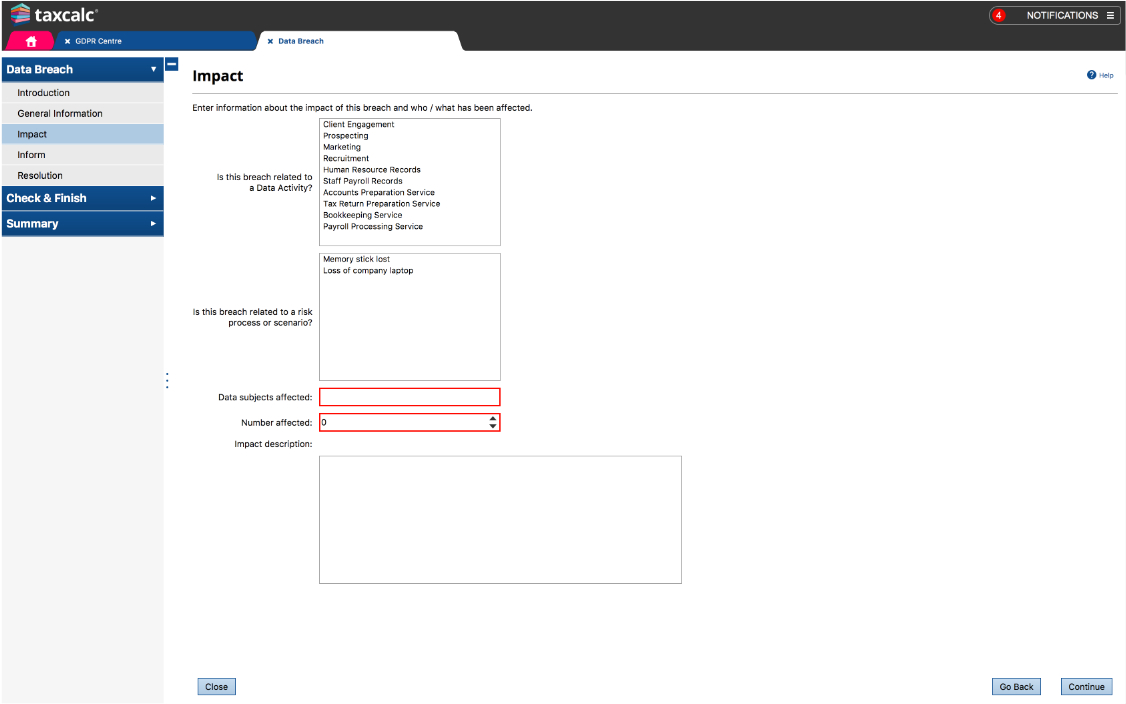

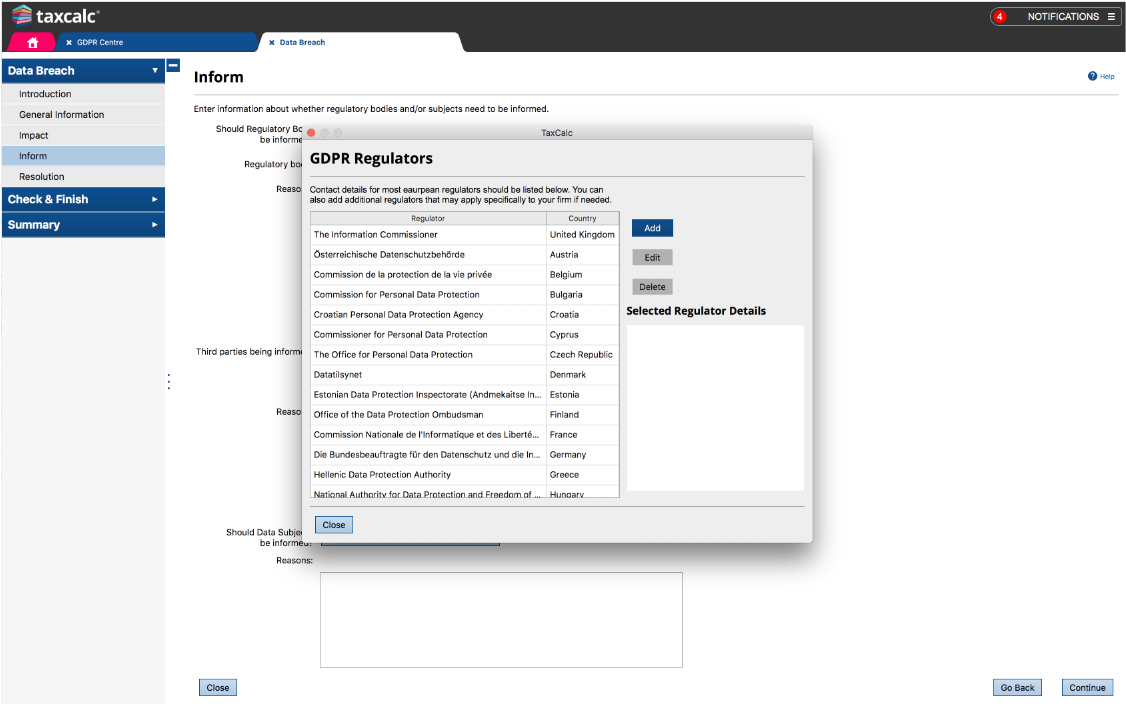

- Record Data Breaches – and help prevent them happening again

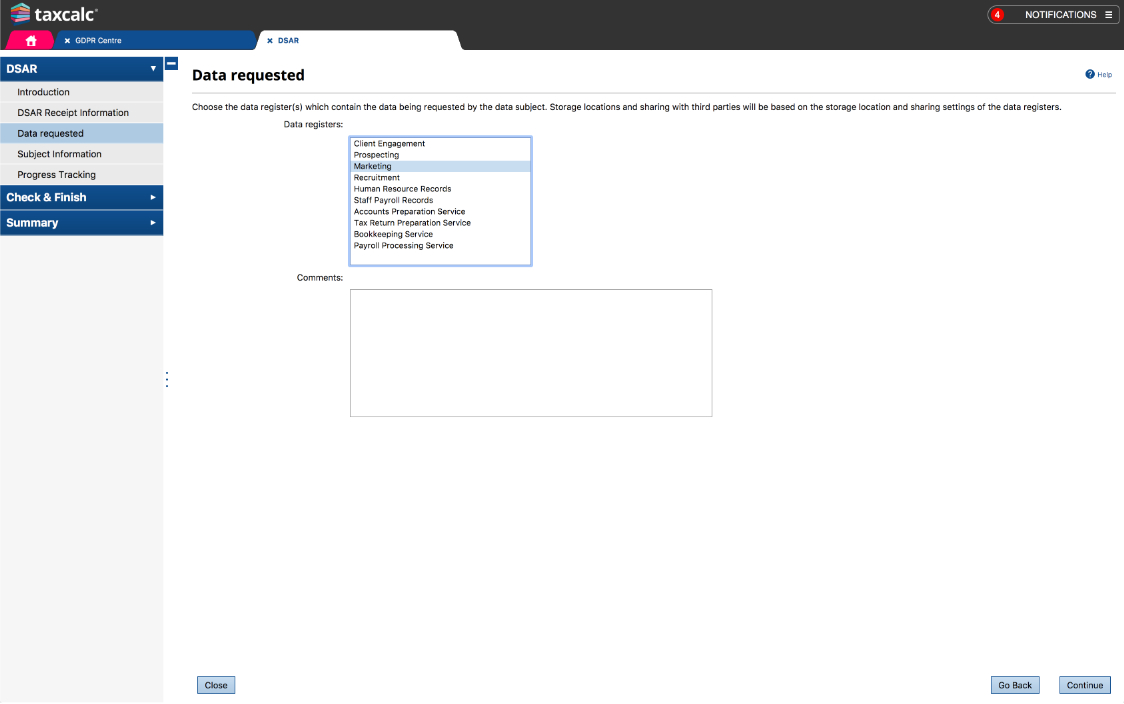

- Fulfil, track and file Data Subject Access Requests

- Create comprehensive checklists of your GDPR-compliant policies and procedures

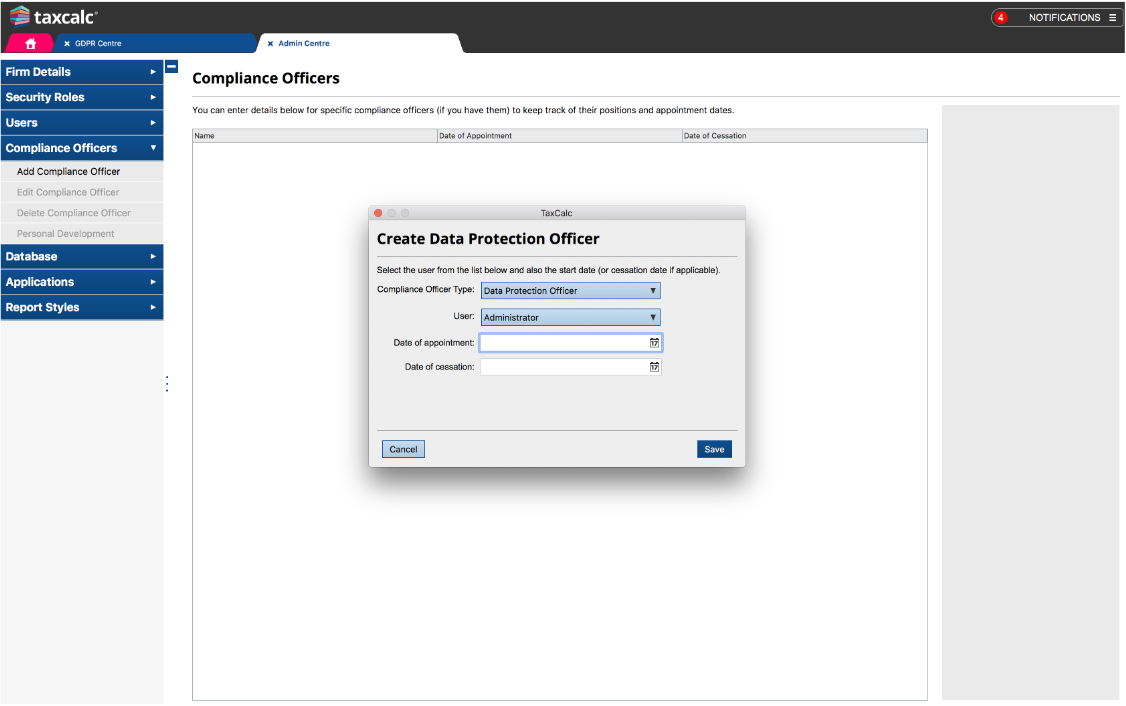

- Log the appointment, training and actions of your nominated Data Protection Officer

- Carry out annual reviews of your data processes

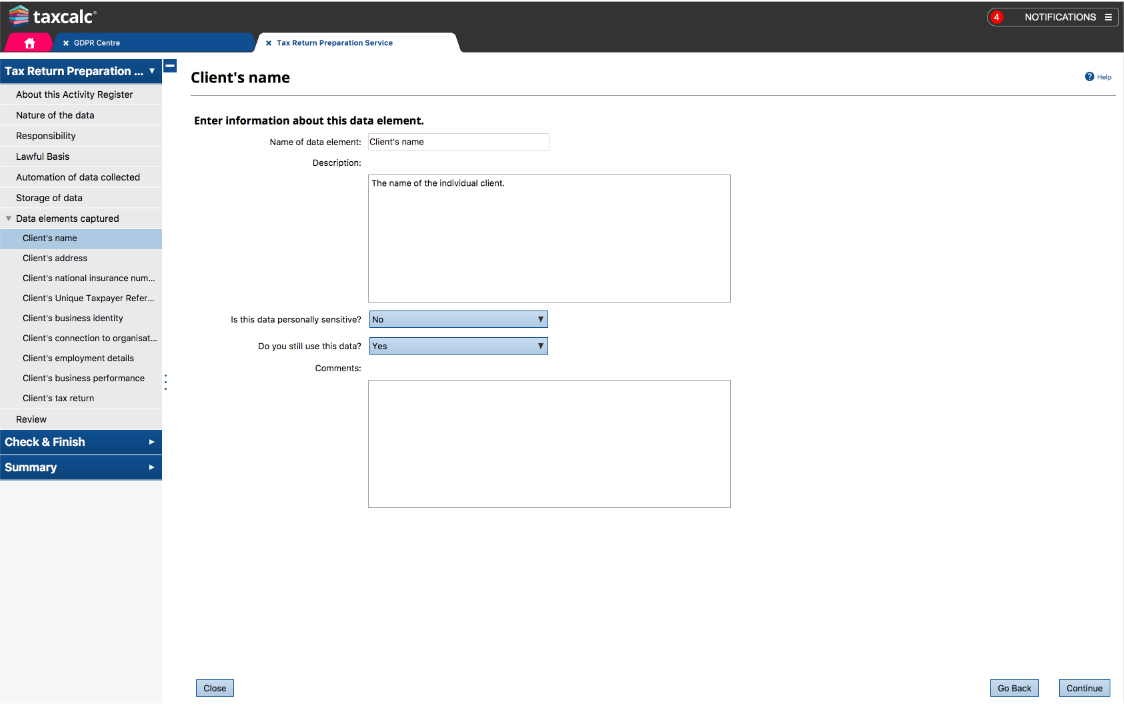

- Record what kinds of personal data you hold (and why)

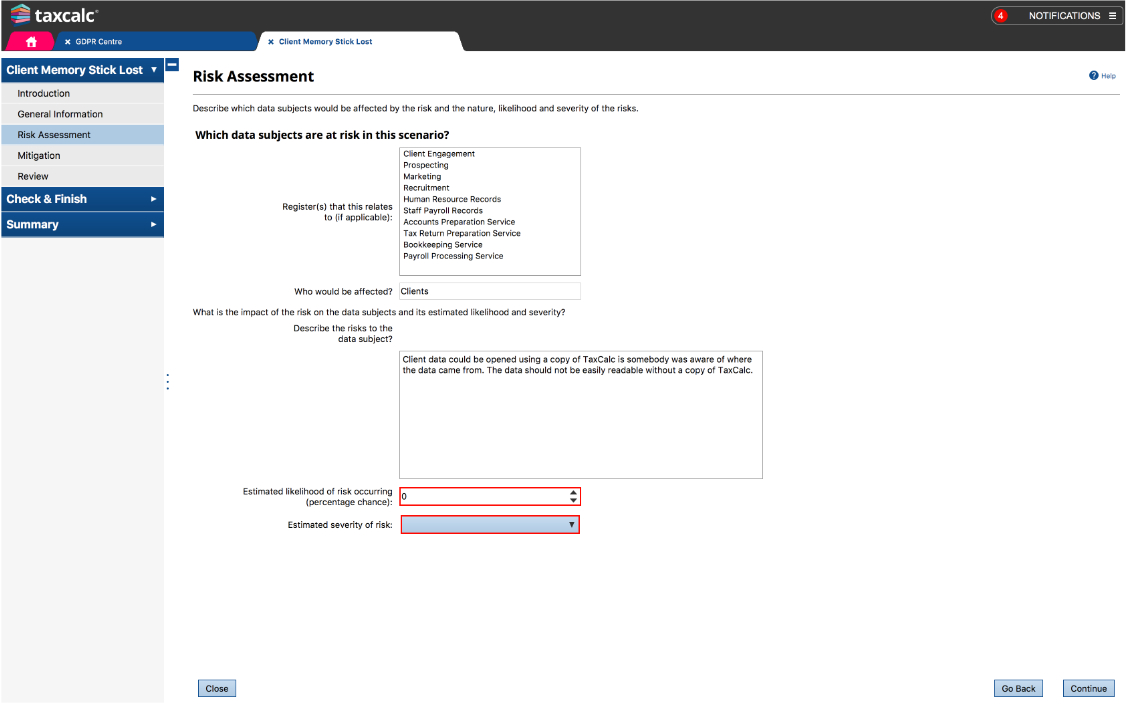

- Create risk scenarios to test how your firm will react to a variety of situations

- Record any international data organisations you work with

Simplifying the complex

It's in our DNA

- Easy-to-understand, jargon-free language

- Explanations of technical terms, with reference to official guidelines and advice

- Pre-populated sections with scenarios specific to practices to save you time form-filling from scratch

- SimpleStep® workflow to guide you as you go

- Check & Finish® intelligent validation to cross-check your entries

Complementary GDPR tools

Within the wider TaxCalc suite

- Consent management in Practice Manager – helps you keep track, manage and report on the consent to specific types of communications channel for each client

- PDF Encryption add-on modules for complete data security

- Updated engagement letters for GDPR Compliance within TaxCalc Communications Centre

GDPR Centre in action

Find out how GDPR Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

System requirements:

TaxCalc is optimised to work on the specified versions of the operating systems listed below and all software releases are tested on them. An internet connection is required to receive updates and use certain parts of the software (e.g. file online to HMRC).

Mobile devices, tablets and Chromebooks are not currently supported.

Server installation:

Microsoft Windows (64-bit)

- Windows Server 2019

- Windows Server 2016

- Windows Server 2012

- Windows 11

- Windows 10 (All versions)

- Windows 8.1

Information about hosted desktop environments.

Standalone / Client installation

Microsoft Windows (64-bit)

- Windows 11

- Windows 10

- Windows 8.1

Apple Mac (64-bit only)

- 13.00 Ventura

(v13.1.006 onwards) - 12.00 Monterey

- 11.00 Big Sur

Linux (64-bit Kernel)

- 3.10 or higher, Debian (e.g. Ubuntu) or Redhat based distributions

- Graphical User Interface (GUI)

- Office productivity software (export to Word / Excel)

Additional requirements

- Appropriate hardware is required

- Adobe Acrobat Reader 9.0 or higher

- Microsoft Office 2010 or later (export to Word / Excel)

Information on partially supported systems and others which are no longer supported.

GDPR Centre in action

Along with GDPR consent management and contact administration features baked into TaxCalc Client Hub, you can use GDPR Centre to:

Log the appointment, training and actions of your nominated Data Protection Officer.

Record what kinds of personal data you hold (and why).

Track and file Data Subject Access Requests.

Create scenarios to test how your firm will react to a variety of situations.

Register data breaches - and help prevent them happening again.

Record any international data organisations you work with.

Frequently asked questions

The questions below provide immediate answers to many aspects of TaxCalc GDPR Centre. If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

What is GDPR Centre?

At it's core, TaxCalc GDPR Centre is a series of questionnaires and areas for you to populate and keep your practice fully compliant to the latest GDPR recommendations issued by the Information Commissioner's Office (ICO).

How can TaxCalc GDPR Centre help my practice keep track of how personal data is processed and stored?

The Data Activity Registers area in TaxCalc GDPR Centre helps you keep track of all your personal data activities in easily actionable sections. Simply click on the drop down menu and choose from one of ten key areas relating to personal data in your business and describe the activity.

How do I keep track of Data Subject Access Requests (DSARs) I receive?

In GDPR Centre, logging any data breach is a straightforward process. In the Data Breach area, simply complete the relevant fields to document all relevant aspects and actions. You can assign tasks, monitor progress and resolutions, print and share management reports and link the breach to a Risk Assessment if necessary.

Can the software help analyse the risk to personal data held by my firm?

The Risk Assessments area of TaxCalc GDPR Centre allows you to identify processes that carry a risk as well as any unplanned scenarios that might occur. You can record the potential impact of each risk and define your plan of action if such a scenario arises.

Do you include the ICO data protection assurance checklists within GDPR Centre?

Yes. The ICO data protection assurance checklists cover a number of key areas of data compliance and help you review and take action where it matters most. Currently there are seven checklists covering everything from Information Security to Direct Marketing to usage of CCTV footage and we will continue to update the software as the ICO revise or issue new checklists.

Do I need to renew my software licence annually?

Yes. GDPR is not a one-time process. Continuous assessments and reviews are required and any changes to processed data or procedures that you perform must be updated and documented. You will also need to keep registers of subject access requests and breach notifications. Also, should the GDPR receive any amendments going forward, we will update the software to include the changes.

GDPR Centre in action

Find out how GDPR Centre can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883