Company Incorporator

From £80

Introducing our award-winning

Company Incorporator software

TaxCalc Company Incorporator is the simplest and most complete way to assist you with the incorporation of Private Limited Companies and Limited Liability Partnerships (LLPs).

Key features

What makes our software stand out? It's not just what it does. It's how it does it.

Connected Database

Avoid rekeying by utilising the power of the TaxCalc integrated database.

Availability checker

Find out if your preferred name is available before you start.

Flexible articles

Adopt Companies House model articles or attach your own.

Company Incorporator in action

Find out how Company Incorporator can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Incorporation with the power of integration.

Incorporation

All the entities you need, and more

- Private companies limited by shares

- Private companies limited by guarantee

- Limited liability partnerships

- Same day incorporations

- Company name checker

- SIC code finder

- Companies House progress tracker

- Store and view incorporation documents

Flexibility

Incorporate your way

- Model Memorandum and Articles of Association

- Attach modified or bespoke articles

- Create ordinary, preference and custom share classes

- Create share classes in UK Sterling, Euros and US Dollars

- Templated rights and particulars of share classes

- Simple process to enter officers, shareholders and to identify person(s) of significant control

Integration

The power of the integrated suite

- Newly formed entities automatically appear as clients in the database

- Reuse known directors, secretaries and shareholders in future incorporations

- Global address book to store regularly used addresses

- TaxCalc eSign Centre for fast document approval

- TaxCalc Document Manager for easy document storage and retrieval

- TaxCalc AML Centre for secure internal compliance

Company Incorporator in action

Find out how Company Incorporator can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features in detail

TaxCalc Company Incorporator is complete with features that are designed to help you run your practice.

TaxCalc in action

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below to see how straightforward it is to incorporate your clients' companies using TaxCalc.

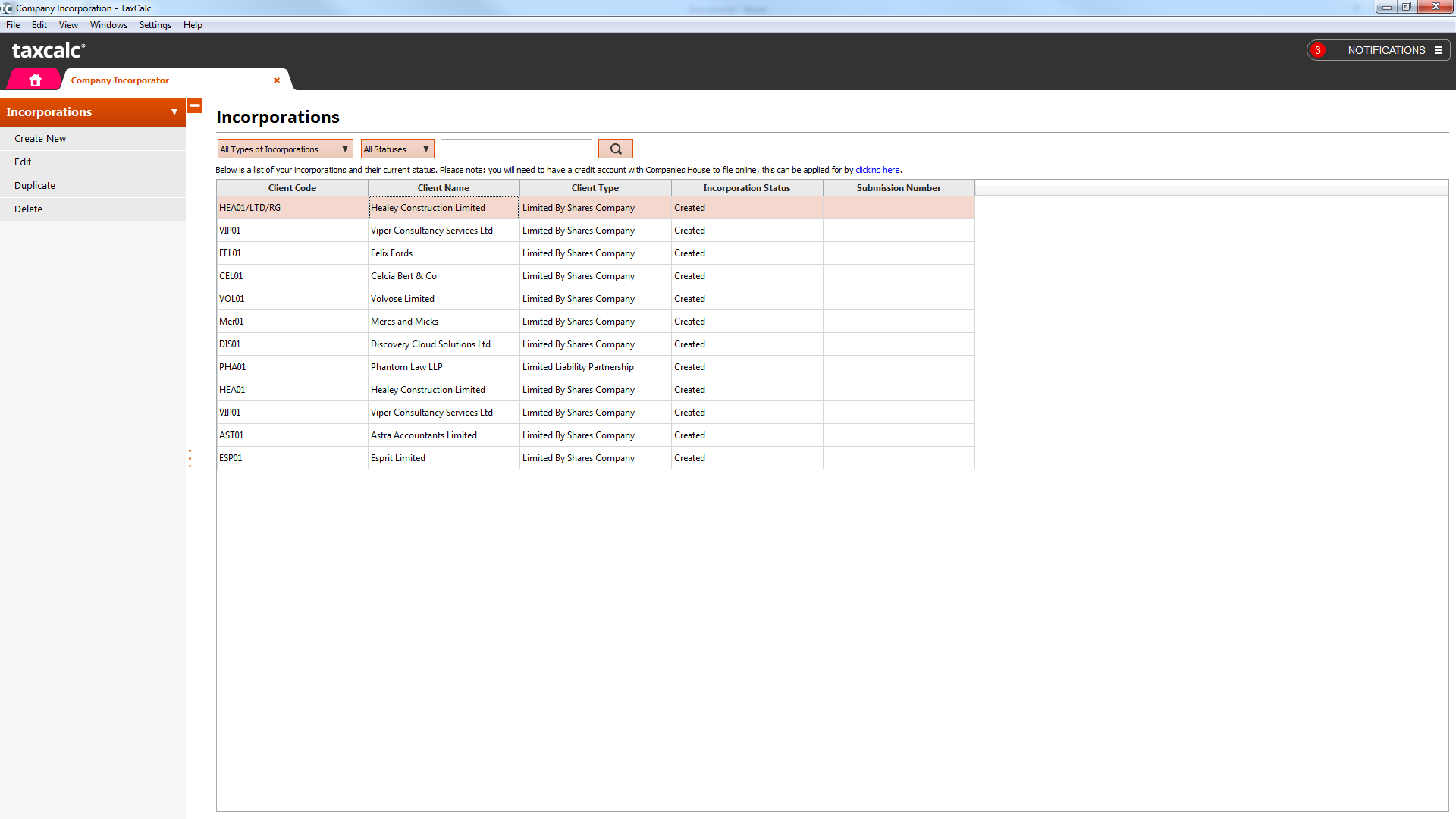

Incorporations in progress and successfully created are located in a central screen for easy access.

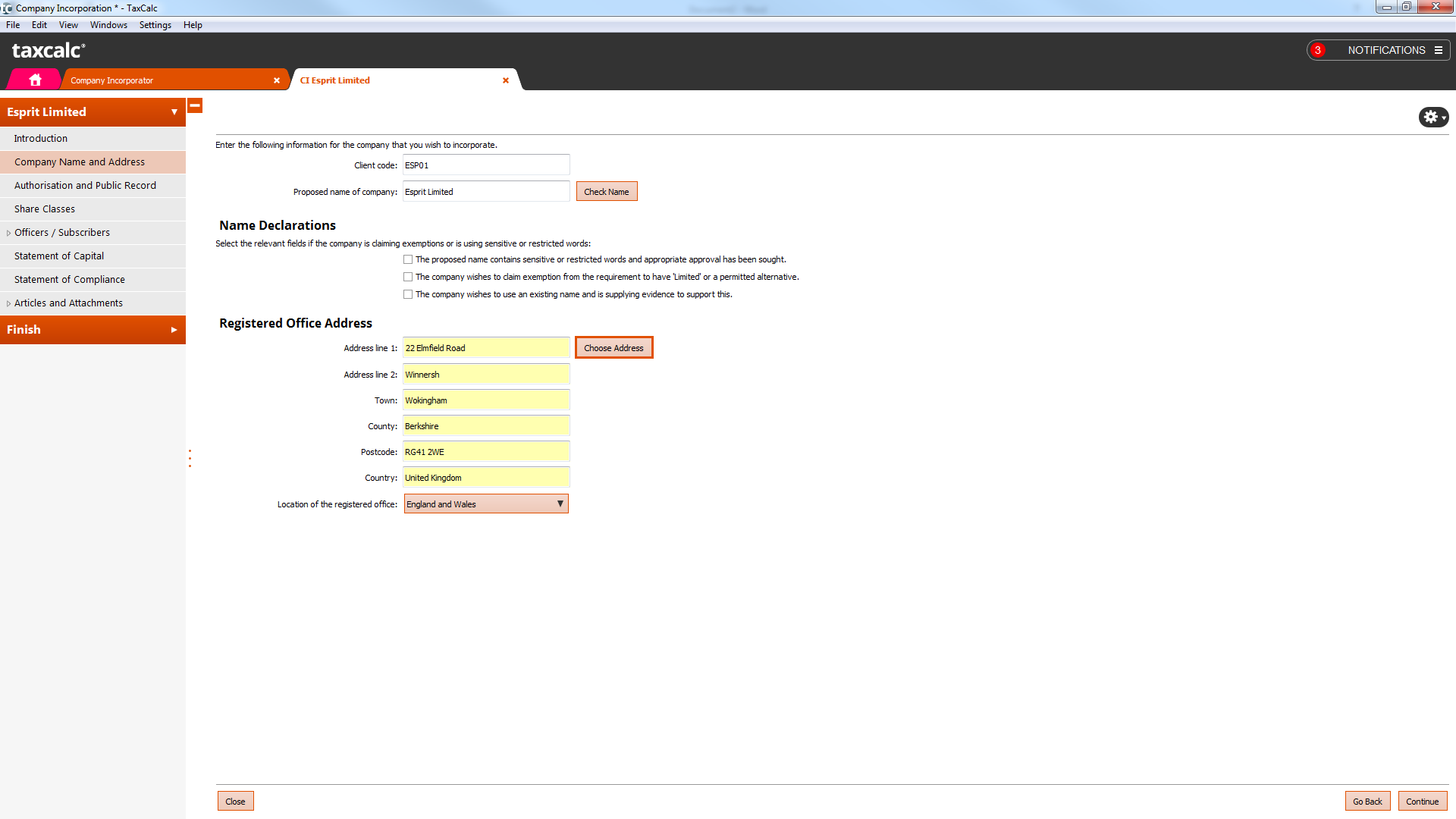

Incorporations are created through a SimpleStep process, which is a questionnaire that gathers all the information needed.

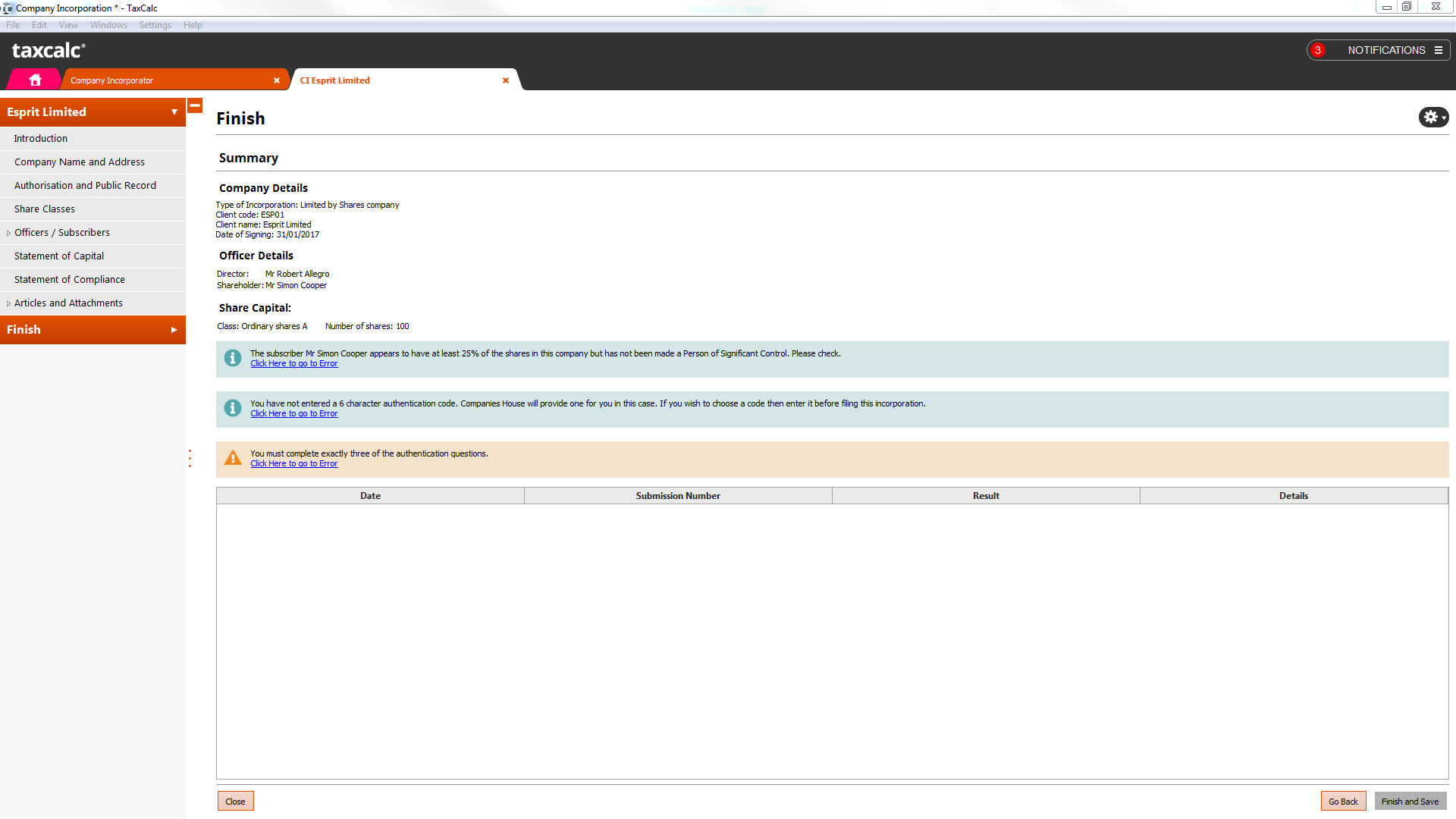

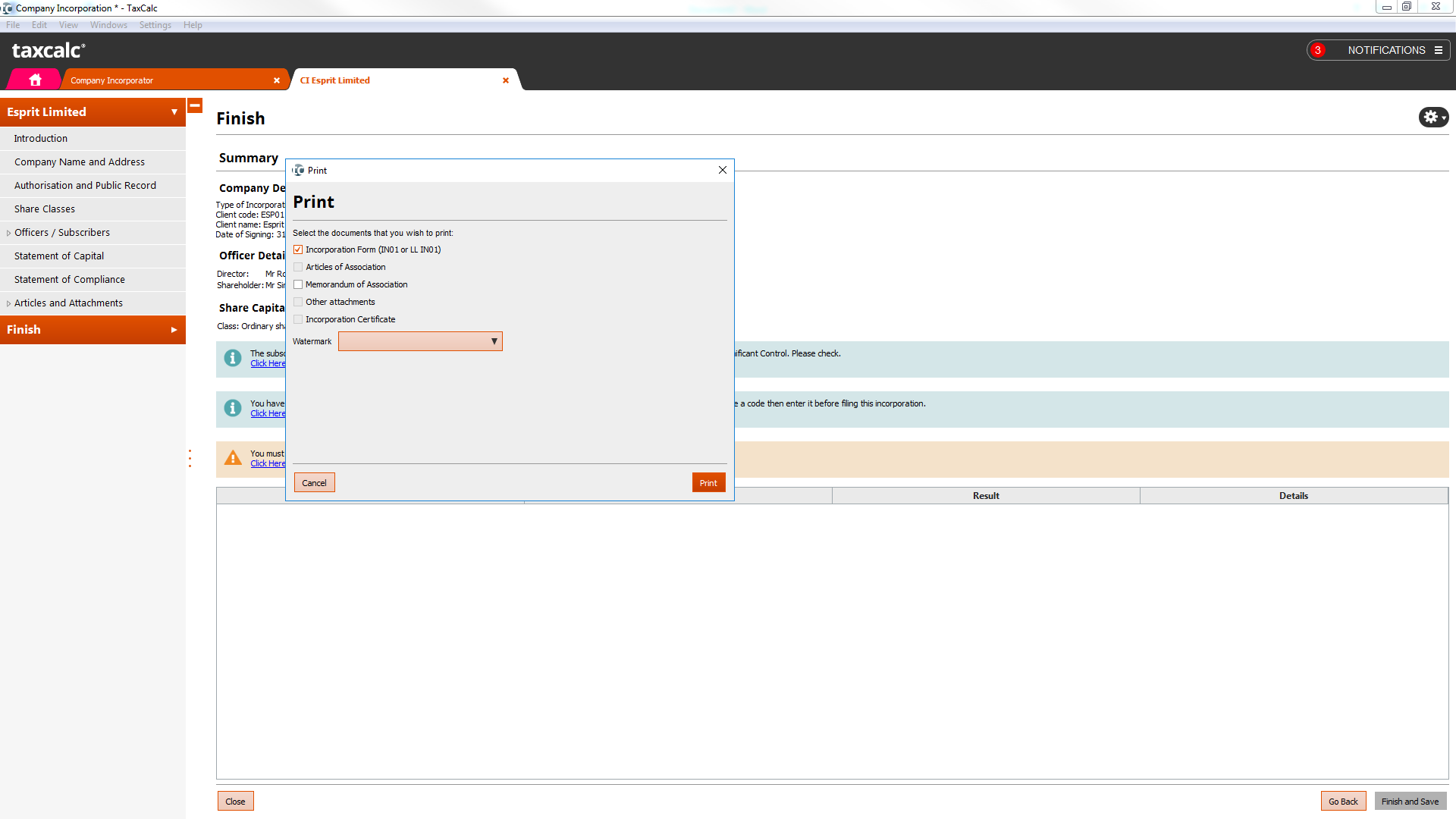

At the end of the data gathering process, Check & Finish reviews and validates the information entered to ensure a successful incorporation.

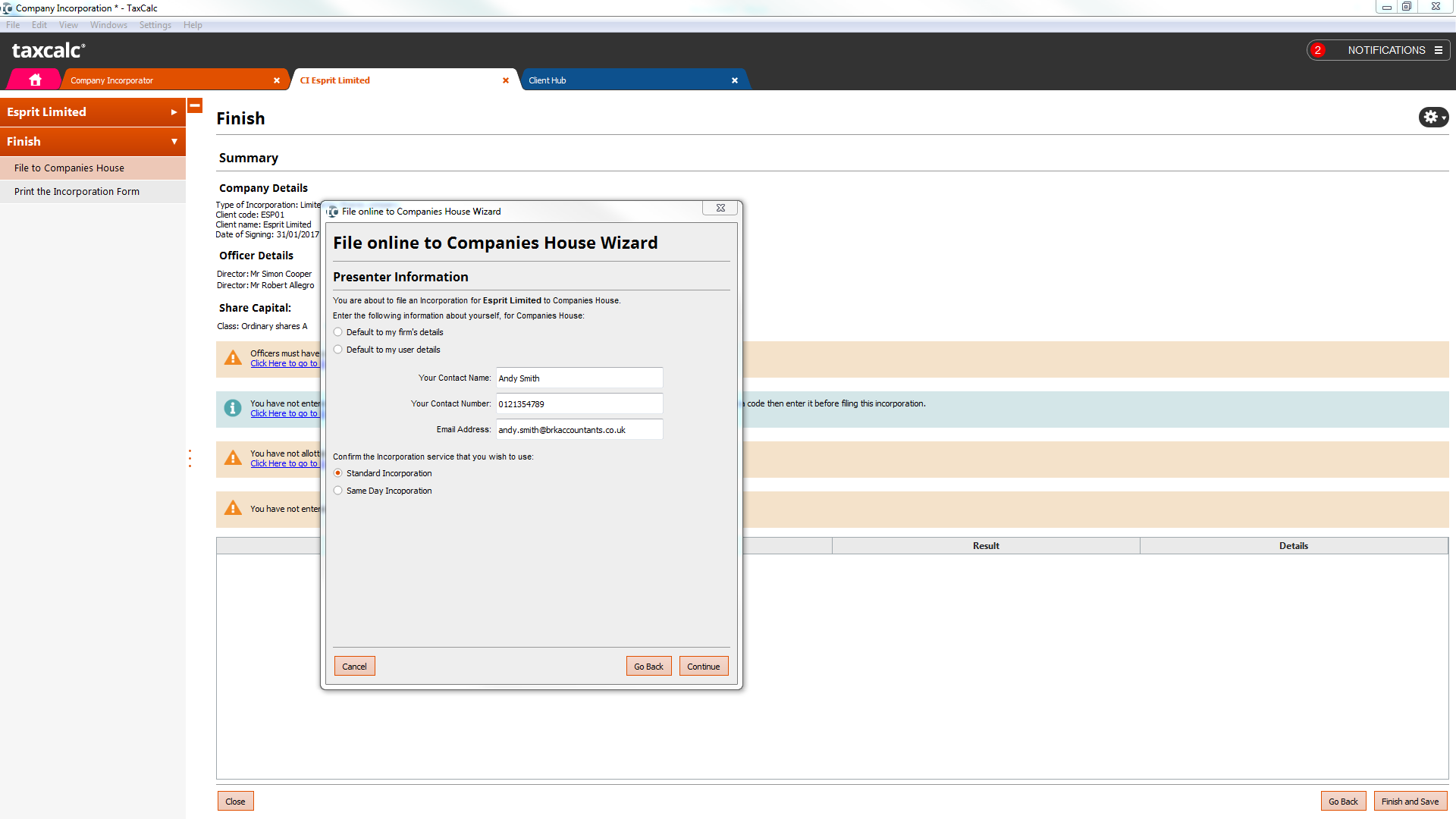

When ready, all information is sent to Companies House online via an easy to use wizard. You can track progress of the incorporation.

TaxCalc Company Incorporator stores the incorporation documents that can be viewed at any time.

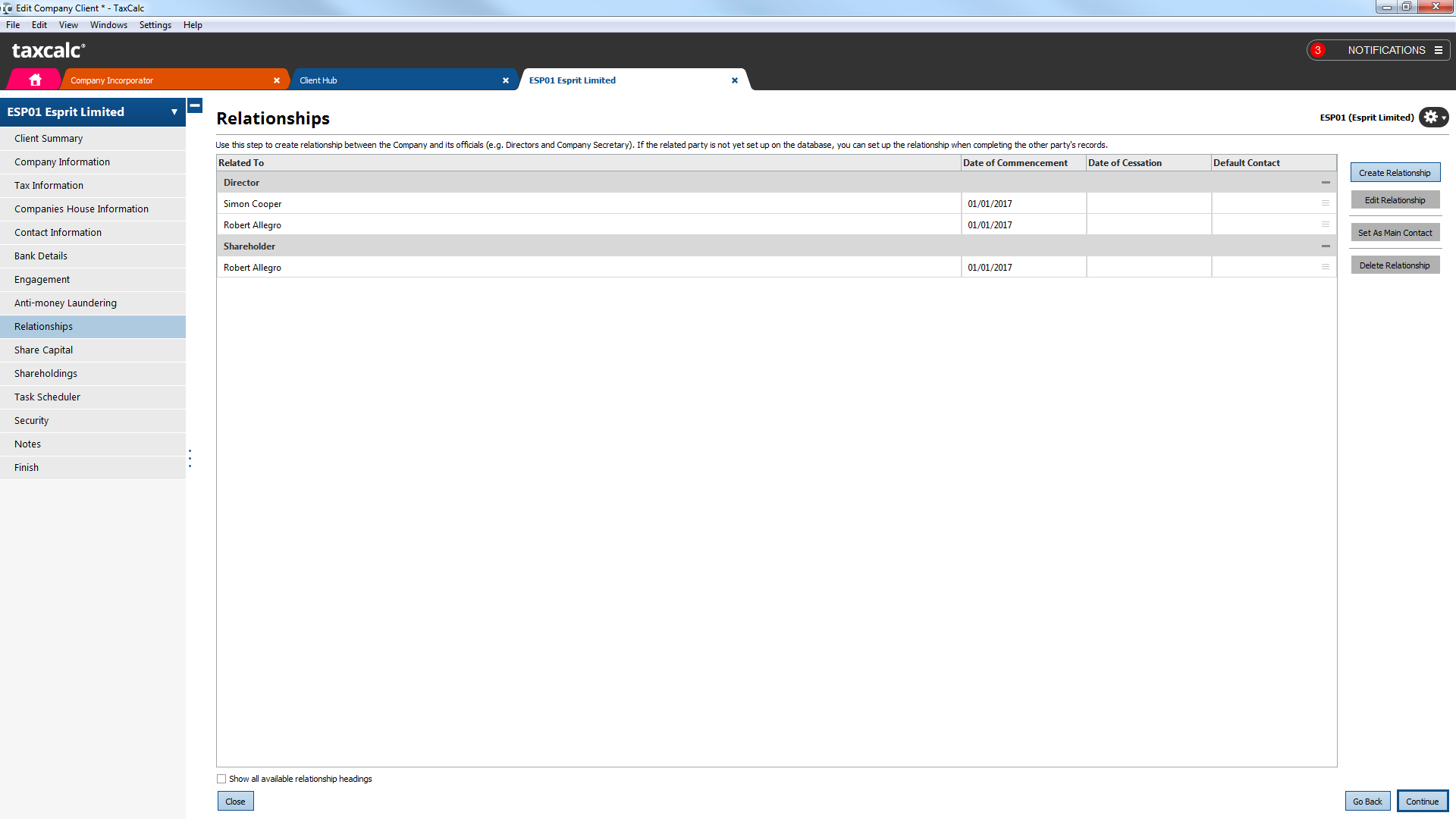

Information entered into TaxCalc Company Incorporator is shared with other TaxCalc products including officers, share captial and shareholders.

Frequently asked questions

The questions below provide immediate answers to many aspects of Company Incorporator. If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

Do the prices displayed include the Companies House incorporation fees?

The prices displayed do not include Companies House fees. These will be charged by Companies House at the following rates:

- Standard incorporation £100

- same-day incorporation £156

- paper incorporation £124

Do I need a credit account with Companies House to form companies?

Yes, you will need to have a created a credit account with Companies House in order to use Company Incorporator. This can be applied for here.

How do assisted incorporation credits work?

A credit will be allocated to a client incorporation at the point that you print or file it. If you receive a failure from Companies House when filing, you will be able to re-file until it is successful without using an additional credit.

Do assisted incorporation credits expire?

No, assisted incorporation credits do not expire and will remain on your account during the life of the service. Please see our Terms and Conditions of Sale for more information.

Can assisted incorporation credits be refunded?

Once assisted incorporation licences have been purchased, it is not possible to request a refund. We may, under some circumstances, provide you with a credit note to be used against the purchase of other products. Please see our Terms and Conditions of Sale for more information.

Can I attach my own articles?

Yes, you can attach your own articles. TaxCalc Company Incorporator has options to adopt the standard Companies House model articles or attach your own bespoke articles.

Can I incorporate companies with multiple share classes?

Yes, TaxCalc Company Incorporator caters for companies with multiple share classes.

When a company is incorporated, can it be turned into a client?

Yes, data entered during the incorporation is shared with TaxCalc Practice Manager after a successful incorporation has been made.

Company Incorporator in action

Find out how Company Incorporator can help transform the way you work.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883