TaxCalc Blog

News and events from TaxCalc

How TaxCalc is hand-crafting the perfect product

An interview with Pauline Smith, Product Director, TaxCalc

As TaxCalc’s Product Director, Pauline Smith oversees the continued improvement of existing products, and coordinates the launch of new ones. It’s a tough job that’s dictated by a variety of compliance guidelines, evolving customer requirements and the wider goal of a future-proof business.

Pauline is constantly on the move, and rarely has much free time on her hands. When a spare moment does arise, she enjoys a spot of handicrafts, be it knitting, crocheting or embroidering. It is a delicate practice that takes skill, creativity, attention to detail and a love for the end product. In some respects, this translates nicely into her role at TaxCalc.

Indeed, Pauline often finds herself spinning plates and tying up loose ends, be it dashing between meetings and scheduling product releases, or keeping customers up to date with industry trends and everything TaxCalc.

A self-proclaimed workaholic and with two young children to look after, Pauline essentially has two full time jobs. As she explains, both require constant awareness, the nous to react to changing demands, and the ability to keep everyone happy.

How would you describe your role?

“We are constantly trying to keep an eye on what is happening in the marketplace, and keeping the product up to date. The most important elements of my job centre around product releases and making sure they fulfil compliance guidelines, as well as ensuring we make appropriate decisions to meet set launch dates. It is also important to coordinate the content that we produce alongside our releases to let our customers know what is going on in the industry and what we are launching.”

What kind of talent do you have within your team?

“I am currently responsible for 11 other team members, and we are actively looking to expand. There is a variety of expertise within the team, from people who have formal tax and accounting qualifications to experienced business analysts. It is a healthy mix of industry knowledge and technical skills, which complement each other quite nicely.”

What’s on your product roadmap?

“Currently MTD is our primary focus and keeping our existing product updated and relevant. We have released many different products, which makes it challenging to ensure that each individual product is maintained and updated. Over the past few years we have been trying to bridge any gaps that are perceived within the existing product set that we have. Efforts have really been taken to ensure that our products give the flexibility that our customers require; and while there is core functionality that needs to be delivered, there are also different customer preferences to cater for.”

How have things changed since moving to home working?

“I never had any concerns moving into remote working as I already have experience working from home. However, I wasn’t naïve enough to think it would be without its challenges. For example, we have had to change the way information is shared throughout the team to ensure that everyone is still involved—things just aren’t as visible. It requires a bit more of an effort to ensure that everyone is communicating, as opposed to casually becoming aware of something like you might do in an office environment. That being said, I do find that people can get hold of each other better by scheduling short catch ups.”

Has the lockdown changed your team’s approach at all?

“We’ve introduced different price points to make the product more accessible for different sizes of practice. We care deeply about our customers and given the challenges everyone is currently facing, we feel it’s more important than ever to provide solutions which are appropriate to practice size and therefore more affordable. Most recently we’ve introduced Individual and Partnerships 30-2, which offers 30 individual tax returns and two partnership returns. It represents excellent value for small practices.”

Many of your customers will have been forced to work from home as well. Have you seen an increased demand for CloudConnect?

“A large number of our customers have embraced remote working—including those who hadn’t considered it previously—and have looked to leverage CloudConnect. It takes all the hassle away from using VPNs and worrying about the maintenance of physical servers.

CloudConnect has certainly been embraced by customers during lockdown, but there was a natural trend toward Cloud solutions anyway. COVID-19 has just prompted that decision to be made earlier by many practices and businesses.”

What has the Making Tax Digital (MTD) bill meant for you from a product perspective?

“We have recently had a bit more clarity around specific deadlines and requirements for MTD, which has certainly helped in terms of our product planning.

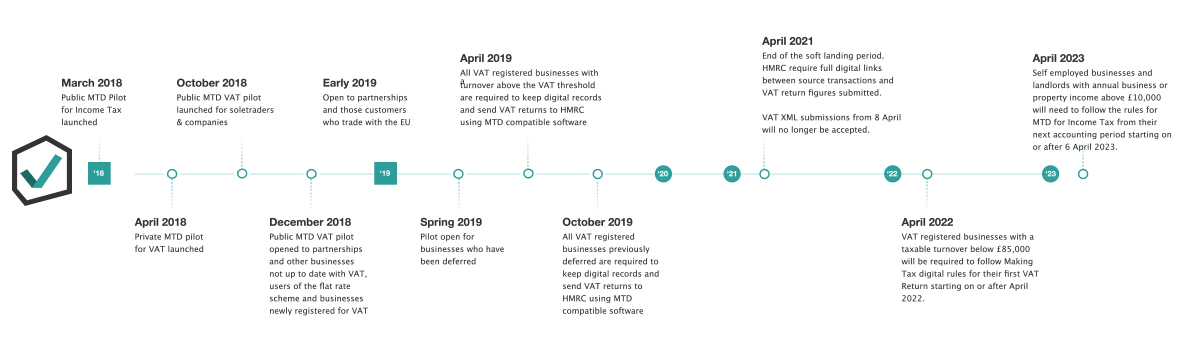

MTD is a massive journey and is a term that encompasses so many facets of change that HMRC is introducing. The first stage tackled VAT, and we’ve already delivered a solution that meant people could file VAT under MTD rules. This will follow with MTD for Income Tax, Corporation Tax and all other forms of tax. This will all be dealt with under the umbrella term of MTD. It’s a huge transformation affecting our industry. We are committed to ensure we help practitioners transition seamlessly as the process is overhauled and have solutions at hand to help achieve compliance.

The next step on our journey is MTD for Income Tax, and we are actively working to provide solutions that comply with these new MTD requirements. We have already passed HMRC’s quite rigid and extensive requirements just to get this into development and appear on the HMRC list of providers for MTD for Income Tax solutions, which is a massive achievement for us. Having worked hard on the technical side, we are now turning our attention to how customers will be able to interact with the product and look forward to announcing more details soon.”

TaxCalc is built on family values. Would you say that filters through to the way you shape your products?

“I would say so. One of the things that attracted me to work at TaxCalc was the fact that it nurtures and cares not only for the customer but also its employees. My previous work life was a bit more cut throat.

Here, we are genuinely trying to produce products that benefit the customer, help them to achieve what they need to do, and generally make their lives easier. That is the result of a family values approach. We are of course building a sustainable business, but we also care about our customers and team members.”

We’re always keen to hear what key features and recommendations you have for new features and product enhancements and would love to hear from you. Please email us at support@taxcalc.com with any suggestions or thoughts promoted by this blog.