TaxCalc Blog

News and events from TaxCalc

Fine. Or fine?

HMRC has issued fines for non-compliance to AML regulations. Don’t make the same mistake.

How to protect your firm against an HMRC investigation

With HMRC issuing fines to certain accountants for failing to have proper Anti-Money Laundering (AML) procedures in place Money Laundering is an issue that can’t be ignored.

Anti-Money Laundering Regulations require that firms put effective systems and controls in place, so it’s vital that you and your staff take appropriate actions and carry out the necessary procedures to demonstrate your compliance by assessing the risks to your firm; keeping appropriate records; performing client due diligence; monitoring clients on an ongoing basis and reporting potentially fraudulent activity.

New TaxCalc AML Centre does the hard work for you

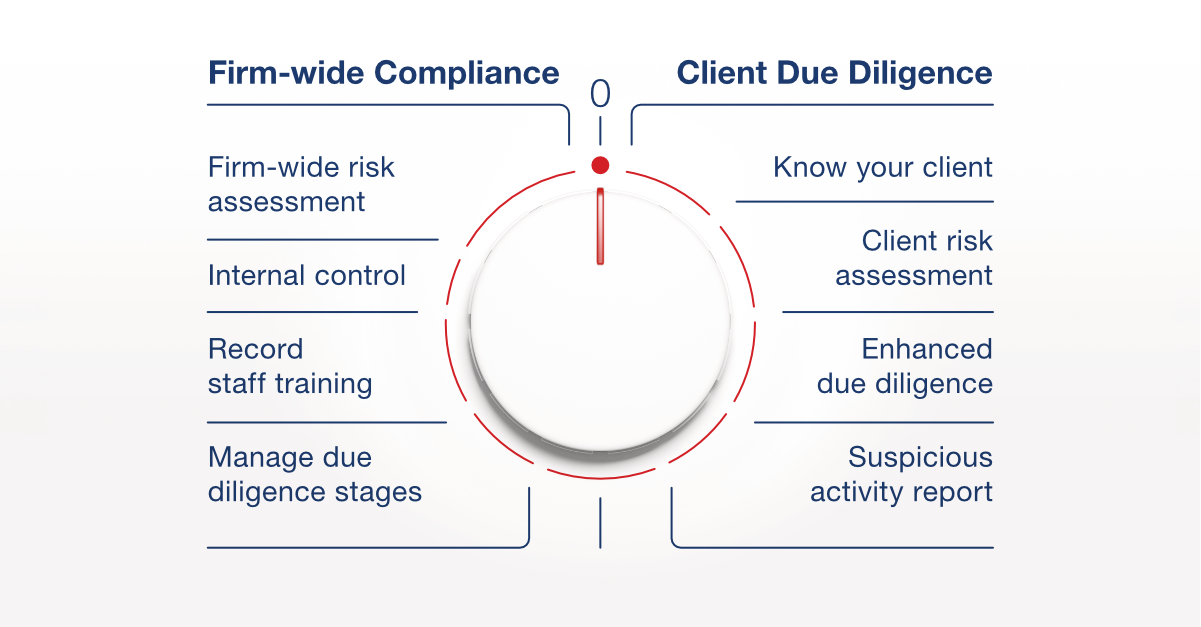

Fortunately, TaxCalc is one step ahead and has introduced AML Centre to help reduce the administrative burden of firm-wide AML compliance and provide a robust and effective way to perform client due diligence, all with one simple solution.

Anti-Money Laundering Centre. Dual Control for accountants, bookkeepers and finance professionals

When it comes to Money Laundering, Your firm needs a clean sheet

Firm-wide compliance. A closer look.

Is your firm taking the right precautions and putting the correct measures in place? Are your employees aware of their obligations? Can you prove that your firm is doing all it can to combat money laundering activities?

Using the firm-wide compliance module in TaxCalc AML Centre it’s easy to make sure you’re ticking all the right boxes, performing the correct procedures, understanding all the risks and keeping everything in order, logged and updated.

Record what internal controls you have in place

AML Centre provides a simple and effective hub for recording, storing and maintaining all the evidence to demonstrate your compliance. For example, you can:

- Appoint and set up details of your Money Laundering Reporting Officer and Money Laundering Compliance Principal

- Record details of your Beneficial Owners, Officers and Managers

- Log staff training and personal development of the MLRO/MLCP

- Link to policies and procedure documents

Complete a firm-wide risk assessment

As part of your AML compliance audit, you’ll need to assess the potential risks to your firm. TaxCalc AML Centre lets you identify and categorise risks across five different factors for quick and easy assessment, providing you with the framework to mitigate and manage risk as and when it arises. You’ll be able to generate reports to gain an overview and implement any necessary interventions.

You receive full use of TaxCalc AML Centre’s firm-wide compliance tools when you purchase any client option.

Friend? or fraud?

Client due diligence made simple.

Can you be sure that a new client, or an existing one for that matter, is really who they say they are? For all you know, they could be handling money earned from illegal activities. Even funding terrorism. It sounds like something you’d only see in the news, but it happens. You and your staff are at the frontline in preventing money laundering. As part of your firm’s AML obligations, you’ll need to perform due diligence for all clients.

But don’t worry, TaxCalc AML Centre covers off all the steps you need to take, allowing you to record data, review the risks posed by a client and report concerns to your nominated Money Laundering Reporting Officer (MLRO).

TaxCalc AML Centre methodically takes you through each of the areas you need to consider when assessing a client’s identity. Simply enter the following data:

- Client information

- Evidence of identity

- Nature of business

- Sources of wealth and funds

- Client relationships and corporate structures

- Politically exposed persons

Once you’re armed with this information you can then:

Complete Client Risk Assessments

Using a risk scoring methodology, you can calculate and assess the potential risk a client poses. If you identify a high-risk client, you can then take the appropriate actions by performing enhanced due diligence and recording your findings.

Conduct Enhanced Due Diligence

If you believe a client represents a high-level risk, AML Centre guides you through enhanced due diligence, recording the additional information you’ve gathered, plus the measures and actions you’ve taken. Should you be investigated, the evidence you’ve logged can be used to prove that you’ve taken the necessary precautions and actions required to fulfil your obligations.

Submit a Suspicious Activity Report (SAR)

AML Centre makes it easy for members of staff to report any suspicions to your MLRO, who can quickly assess the findings and report any suspicions to the National Crime Agency.

Useful features at a glance:

Companies House Integration

Save time by checking and pulling information from Companies House directly into AML Centre for processing and reviewing, using Companies House Advanced Integration.

Works within TaxCalc or standalone

You don’t have to work in the TaxCalc ecosystem to use AML Centre. With TaxCalc Client Hub provided as standard, AML Centre gives you the freedom and flexibility to perform all the necessary functions to perform client due diligence and assess firm-wide compliance, even if you have a different set-up.

Check your client before you onboard them

You can useAML Centre as a portal for retrieving and recording information to assess prospective clients before officially onboarding them. This could prove especially useful if you hold sensitive information on a client that needs verifying before it’s stored in Client Hub.

Sync your data back to Client Hub

Control and store data how you see fit. You can keep sensitive information in AML Centre and then sync it back into Practice Manager, only transferring the relevant information.

So why not find out more about TaxCalc AML Centre for all-round peace of mind?