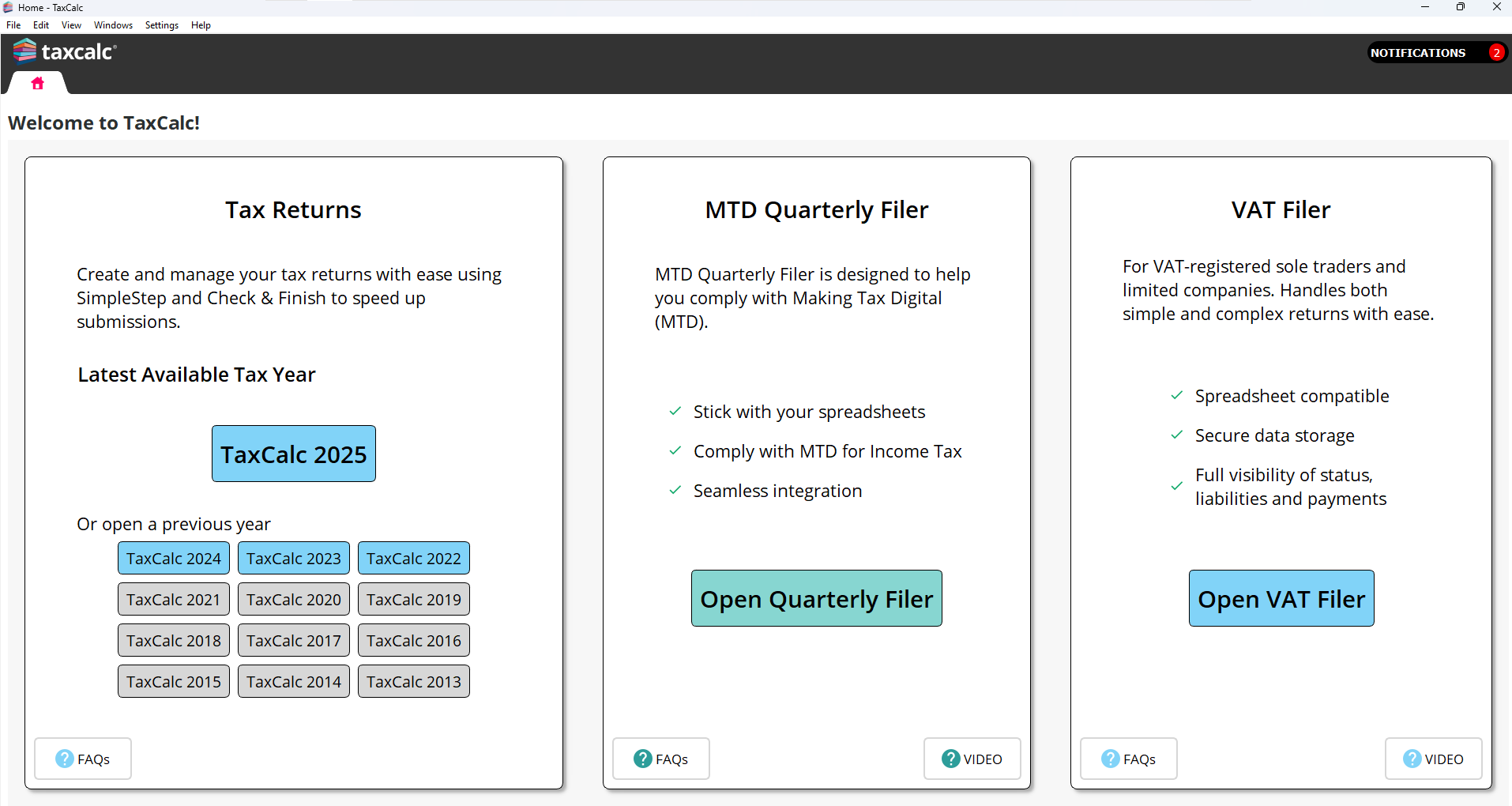

MTD Quarterly Filer

From £24 per year

Ready for MTD for IT, let Quarterly Filer do the hard work.

For sole traders and landlords.

MTD Quarterly Filer is designed to help the self-employed and landlords comply with Making Tax Digital (MTD) for Income Tax.

As part of the upcoming MTD changes, self-employed and landlords with combined turnover exceeding £50,000 must submit quarterly updates to HMRC from April 2026, with those turning over more than £30,000 joining them in April 2027 and April 2028 for those above £20,000

MTD Quarterly Filer guides you through the process of importing your records and turning them into HMRC compliant quarterly submissions. It's easy to learn, superfast and, starting at just £24.00 per year per individual, exceptionally good value.

Now is the ideal time to prepare. By adopting MTD Quarterly Filer during the 2025/26 tax year, you can participate in HMRC’s testing phase and ensure your processes are ready well ahead of mandation. Early adoption gives you the opportunity to familiarise yourself with quarterly submissions and streamline your workflows.

MTD Quarterly Filer lets you:

- Comply with MTD for Income Tax: Easily submit quarterly updates to HMRC for your sole trade and landlord businesses

- Stick with your spreadsheets: No need to migrate over to complex bookkeeping solutions

- Add adjustments: Add and record disallowables and private use adjustments required to your source data prior to submission

- Be prepared: Receive an HMRC tax estimate/forecast after each submission

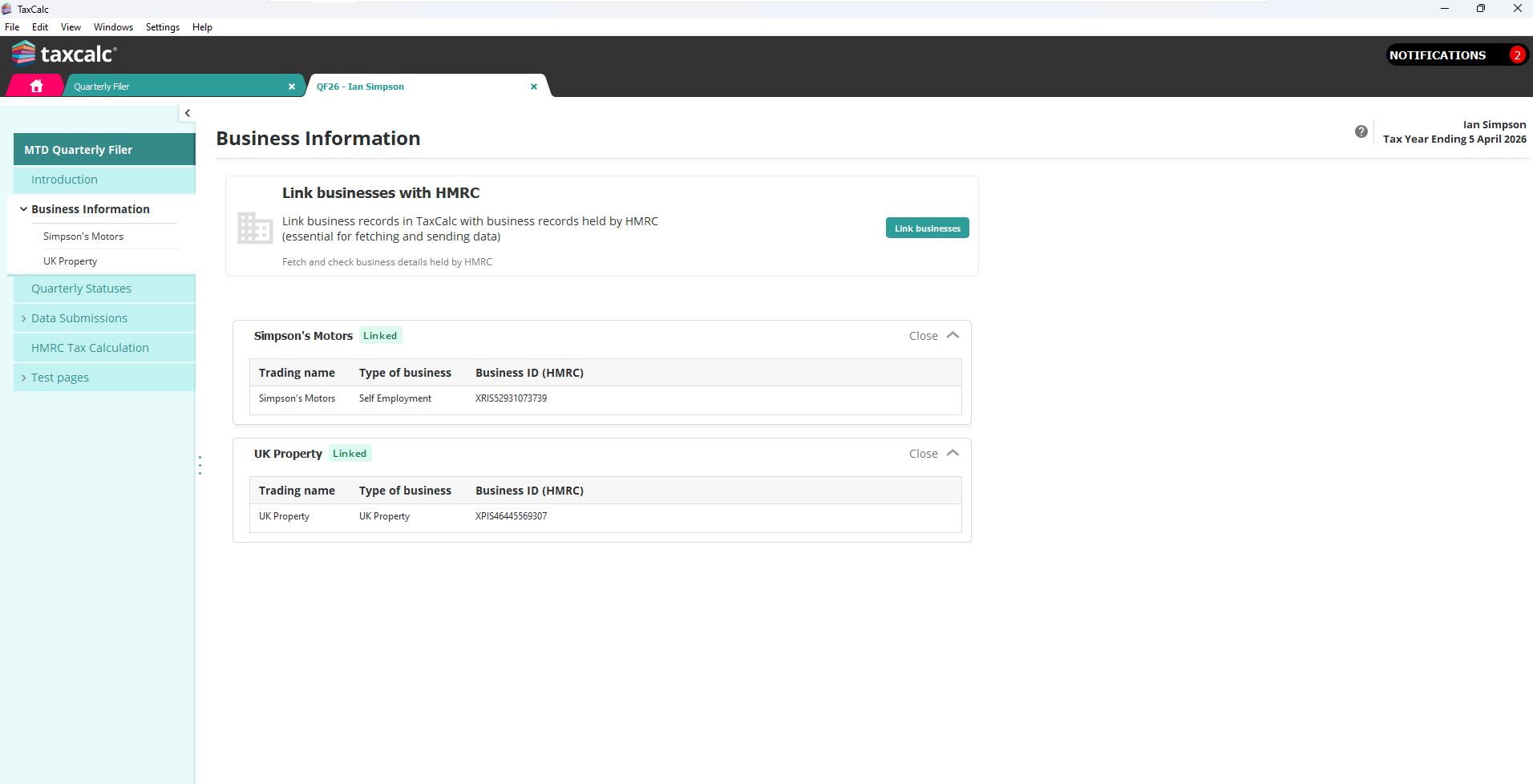

- Simple setup: Retrieve all your obligations and business information direct from HMRC

- Manage effectively: Multiple trades and properties, see them all in one place

Take a tour

See how easy it is to create and submit a Quarterly Update.

Rest assured, you're choosing the best

TaxCalc software is multi-award-winning, trusted by over 12,000 accountancy practices and 60,000 individuals and business owners to submit their tax and accounts.

MTD for IT Compliant

TaxCalc has gained HMRC recognition for MTD for Income Tax.

Features

Just like all our products, MTD Quarterly Filer is simple, intuitive and packed with user-friendly

features to help you keep on top of MTD compliance.

MTD-compatible

MTD Quarterly Filer supports your MTD obligations for keeping digital records and exchanging data digitally with HMRC through the MTD service.

Spreadsheet import

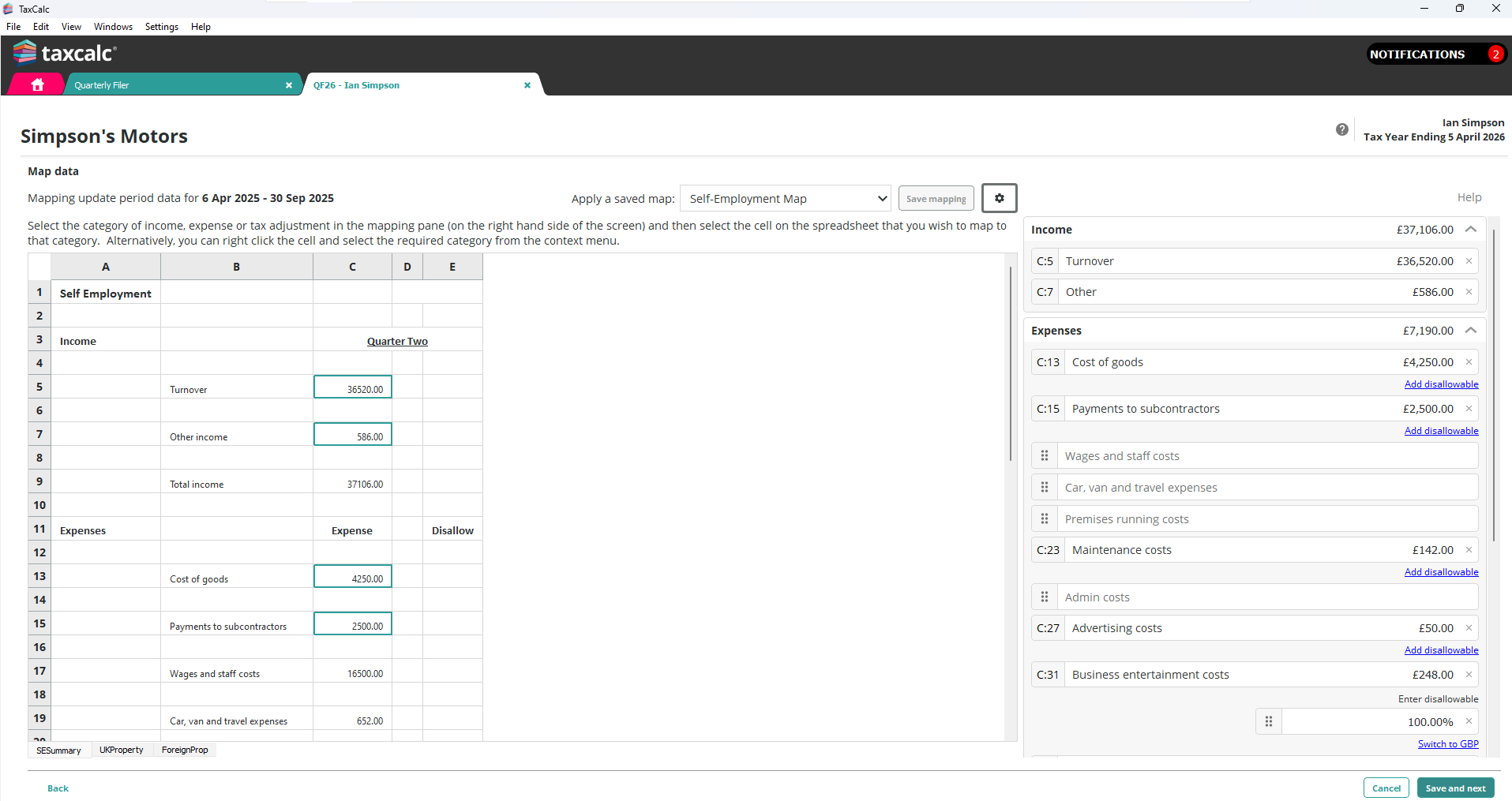

Quickly and easily import any spreadsheet directly into your Quarterly updates (as required by MTD) using an on-screen cell selector.

Taxable adjustments

Enter your add-backs, disallowables and private use adjustments to ensure a more accurate tax estimate from HMRC

Attach supporting data

Keep an electronic copy of your supporting documents within easy reach by adding attachments directly against the submissions.

Auto create Quarterly obligations (periods)

Reduce errors and automatically create the standard periods by retrieving MTD for IT obligations directly from HMRC (as required by MTD).

Retrieve HMRC tax forecasts

Keep on top of your income tax position by retrieving a tax estimate/forecast direct from HMRC.

System requirements:

An internet connection is needed in order to license your product and to file online to HMRC.Minimum screen resolution: 1024 × 768

Windows

- One of the following versions of Windows:

- Microsoft Windows 10

- Microsoft Windows 8.1

- Microsoft Windows 8

- Microsoft Windows 7

- Appropriate hardware to run the above operating system

- Adobe Reader version 9.0 or higher

- Microsoft Office 2010 or higher (for export to Word and Excel)

Macintosh

- Intel Macintosh running Mac OS 10.12 (Sierra) or higher

- Microsoft Office 2010 (for export to Word and Excel)

Linux

- 64 bit kernel 3.10 (or higher), Debian (e.g. Ubuntu) or Redhat distributions

- GUI

- Office productivity software (for Word and Excel exports)

TaxCalc in action

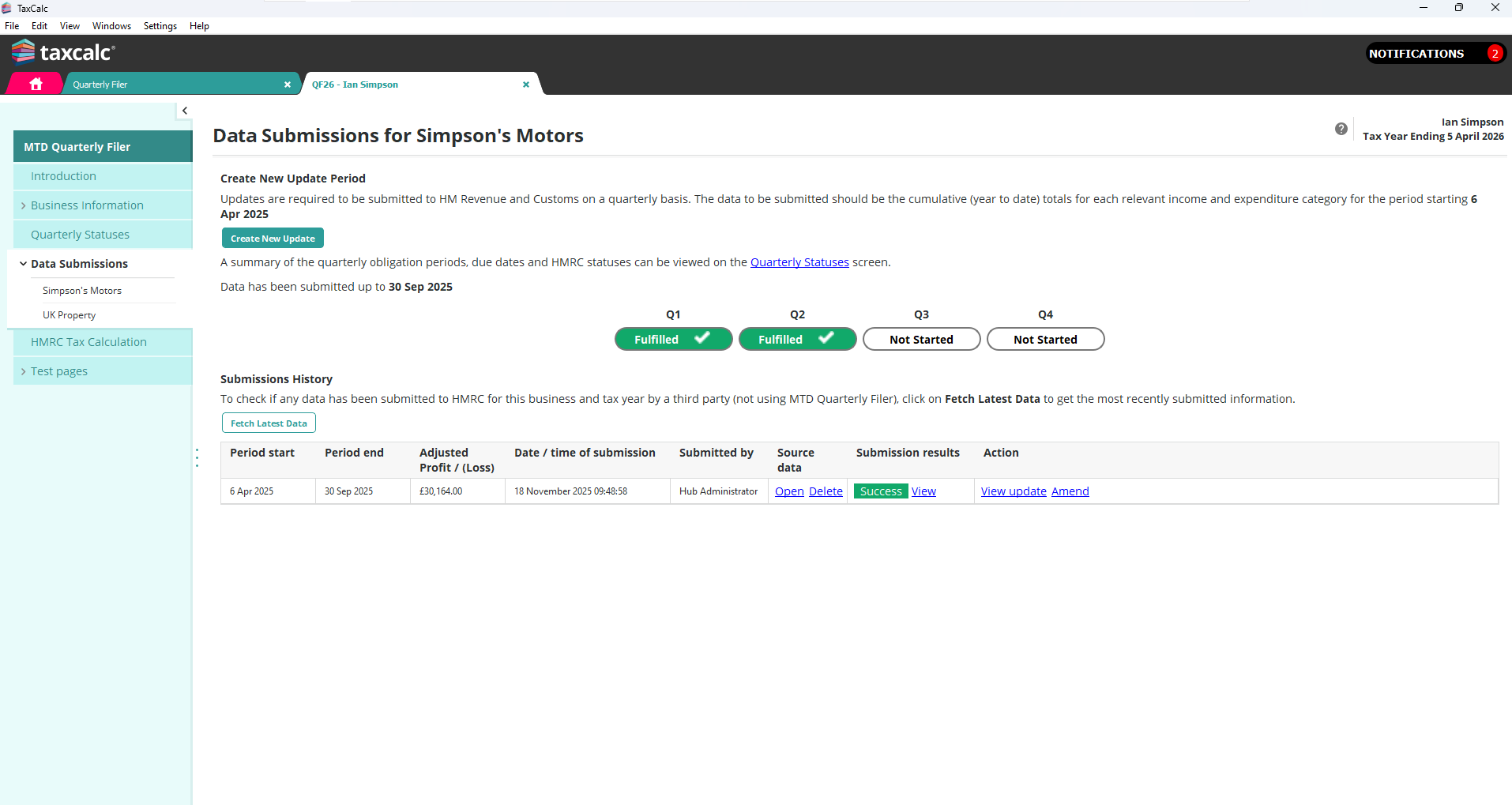

We pride ourselves on delivering high quality and easy to use software. Please click on a screenshot below tosee how you use TaxCalc and see how easy it is to complete your MTD Quarterly Updates.

See an overview of all your businesses and sync with HMRC records.

All your Quarterly Obligations can be easily accessed and their online status determined, all on one screen.

Use the simple import routine to quickly import source data from a spreadsheet and add adjustments.

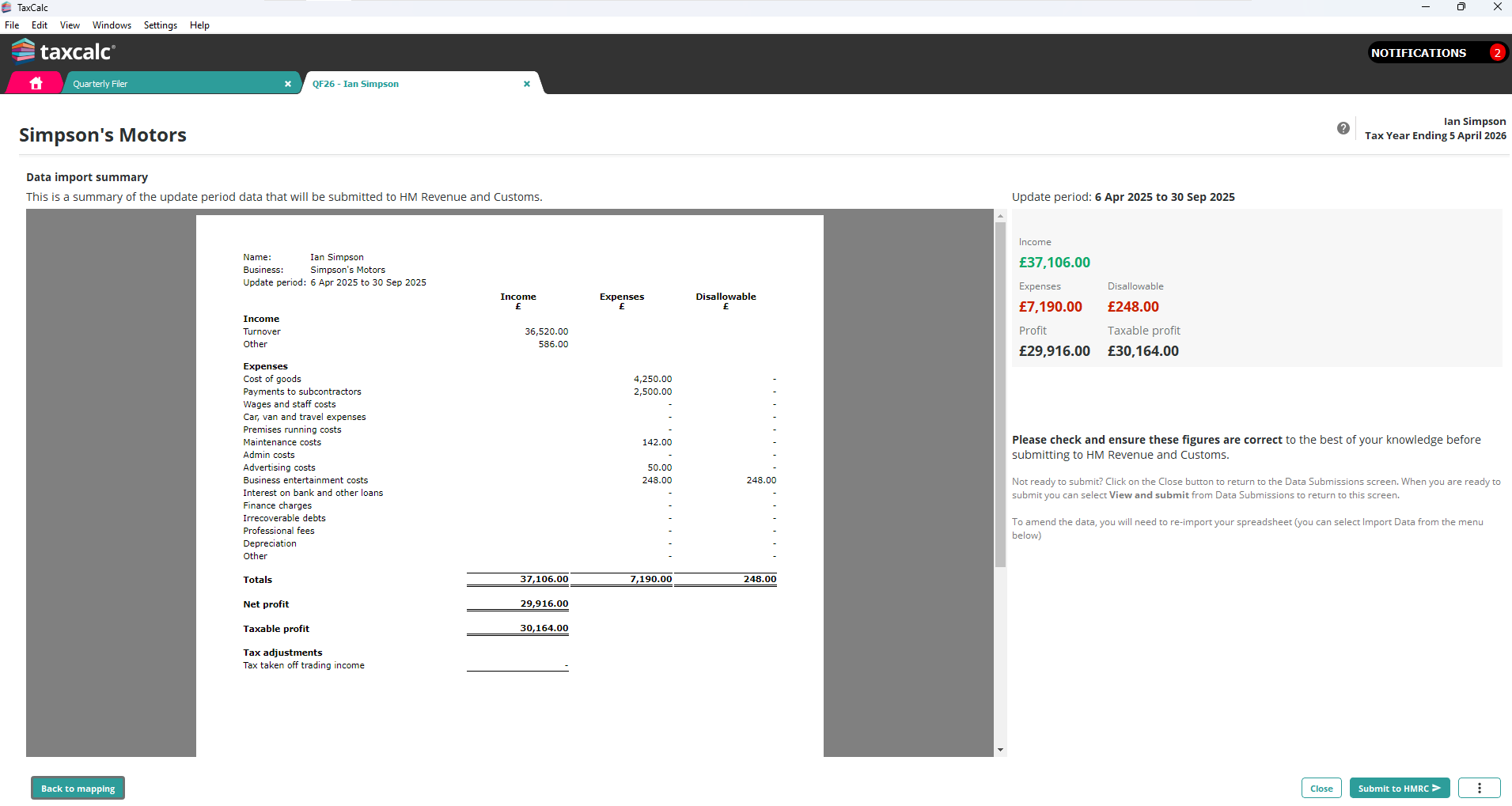

Clean and simple reports to see exactly what you are sending to HMRC.

Use the data submissions screen to easily view your current position and all submission history.

View HMRC provided Tax estimates based on your submissions and other data they hold.

Frequently asked questions

The questions below provide immediate answers to many aspects of TaxCalc MTD Quarterly Filer.If you have any further questions, please call 0345 5190 882 or email sales@taxcalc.com

What is TaxCalc MTD Quarterly Filer?

TaxCalc MTD Quarterly Filer is a HMRC-recognised spreadsheet bridging solution that allows users to submit quarterly updates to HMRC under the Making Tax Digital (MTD) for Income Tax rules.

How do register for MTD with HMRC?

Signing up for MTD for Income Tax is via HMRC’s website. Once registered, you will be able to authorise TaxCalc to connect digitally to your HMRC account.

Can I submit updates for more than one business or property type?

Yes. TaxCalc supports multiple sources of income, including multiple businesses or property portfolios including UK and overseas property. It allows you to file updates for each separately.

Does the bookkeeping spreadsheet get submitted to HMRC?

No. Only the summary totals extracted form the spreadsheet. No transactional data is sent to HMRC.

Does TaxCalc calculate the tax position after each quarterly update?

The software returns the HMRC generated tax calculation based on the data entered and this may change with each subsequent update. The final tax position will be calculated by TaxCalc within Tax Return Production prior to submission to HMRC.

Are the quarterly updates cumulative?

Yes. Each quarter should include all figures from the start of the tax year to the end of the update period.

Can I make a calendar quarter election in the software?

Yes, but you must do so before filing your first quarterly update. HMRC will not accept any change to the basis once the first update has been submitted.

Can I amend a submitted quarterly update?

Yes, although HMRC's expectation is that minor discrepancies will be corrected in the next update or final tax submission.

Do I need to submit an annual tax return as well?

Yes. Whilst quarterly updates are mandatory under MTD, you will still be required to submit a final tax return at year-end.