TaxCalc Blog

News and events from TaxCalc

TaxCalc Tax Return Production 2018. Released and ready for action!

We know you trust us to keep you efficient and compliant. Which is why we’re continually improving our software in line with HMRC legislation, taking as much of the complexity out of preparing tax returns as we can. And in doing so, providing you with the best possible user experience.

This year, the TaxCalc team’s been working hard to bring you fully-compliant software for the 2017/18 tax year BEFORE the start of the compliance year. We know how you like to be organised!

So what’s new for 2018?

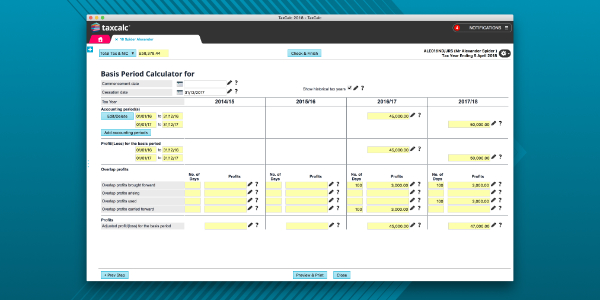

Basis period and overlap profits

One of our new features this year is the calculation of the basis period applicable to the Self- Employed.

What’s different?

TaxCalc will calculate the basis period and any adjustment arising for the commencement of new businesses. This includes the overlap period and resulting overlap profits.

Historical periods can be added to the 2017/18 year, including brought forward overlap profits. Provide TaxCalc with the number of days relating to a previous overlap period and it will use those overlap profits and apply the necessary relief on a change of accounting date - or when the business ceases.

This will be a handy time-saving device for any practice. Invaluable if you’re considering moving clients onto a 31 March year end ahead of the introduction of MTD.

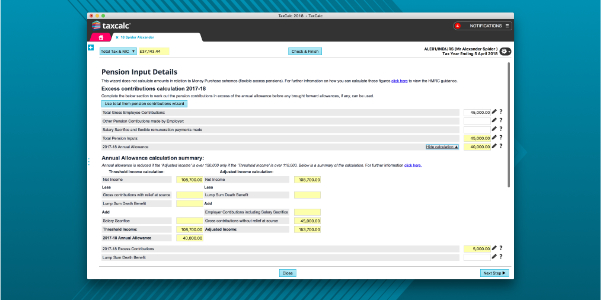

Annual Pension Allowance

As you know, TaxCalc already calculates the amount of Annual Pension Allowance relevant to Pension Contributions paid - and the resulting excess contributions that may be taxable. Without question, it’s a complex area of the tax system! Never fear, TaxCalc has improved the wizard you use to complete these tasks, providing additional automation by using Pension Contributions paid information in the calculation - removing the need to manually enter these details again.

The wizard also displays the Adjusted and Threshold income calculations which is vital to the evaluation of the amount of the annual allowance for the year. No more trying to work out how the software has calculated the result. It’s all there on the screen!

Foreign Dividends and Interest

Foreign Dividends and Interest wizards have been improved and now display the foreign tax credit relief being applied under the Double Taxation Treaties applicable to each country. Select the country from the list and the percentage relevant to that country will appear on screen.

This makes understanding the relief of foreign tax given in the HMRC ForeignTax Credit relief working sheet a little bit easier.

Should there be any changes to percentage allowed under the Double Taxation Treaties during a tax year, you can simply override the rate being applied by TaxCalc, for greater flexibility.

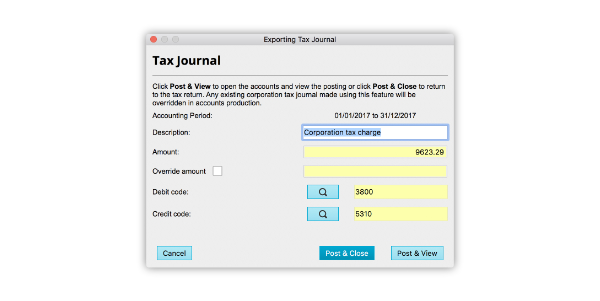

Improved integration within the TaxCalc suite

The mitigation of risk during the compliance process is key. In the 2018 release we’ve enhanced integration between Accounts Production and Corporation Tax.

Now you can send a journal to Accounts Production for the Corporation Tax liability. This means that manual journal posting is no longer necessary. Any changes in the Corporation Tax liability will be recognised and a correct additional journal is automatically calculated. All journals made are recorded so a full trail of changes can be easily seen.

Also, our useful Check & Finish warnings are now displayed within Corporation Tax when:

- Asset additions in Capital Allowances pools do not match the Fixed Asset additions within Accounts Production

- Directors loans made in the period but no CT600A entries completed.

These reminders support the correct completion of CT600s.

Want to know more?

Visit our Tax Return Production or Accounts Production 'What's new' pages or view our Knowledge Base article.

Unlike others, we update our software throughout the year to keep up with HMRC’s ever-changing world. Look out for further updates throughout the year!

Love Tax Return Production? Have you tried Accounts Production? Or our Company Secretarial products?

Why not take a Trial of our award-winning Practice Suite right now and discover how all of our practice products work in perfect harmony?

Enjoy the power of your desktop and the freedom of the Cloud

TaxCalc CloudConnect’s revolutionary cloud-based solution lets and your staff work flexibly and remotely with complete data security. Find out more.