TaxCalc Blog

News and events from TaxCalc

The Digital Tax Account – Public Beta and a New Name

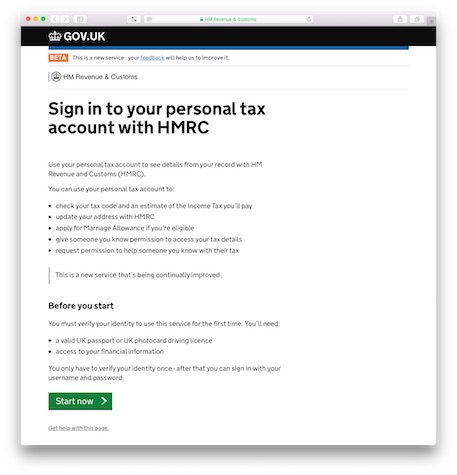

On Tuesday 1 December 2015, HMRC formally launched the public beta of the Digital Tax Account, now renamed the Personal Tax Account (PTA).

The new service, as with all new Government projects, is to be delivered in a piecemeal fashion. In this article, we’ll take a look at what it can do.

The new service, as with all new Government projects, is to be delivered in a piecemeal fashion. In this article, we’ll take a look at what it can do.

Intended for use by taxpayers, rather than accountants, the PTA is fronted by GOV UK Verify. This uses one of several third party companies, such as the Post Office and Experian, to verify the identity of the taxpayer before letting them in.

Having tried it myself, the setting up process was surprisingly lengthy and required me to dig out information that I wouldn’t know off the top of my head. However, the nature of the hoops that I had to jump through would certainly suggest that it could only have been me that was trying to gain access to the account.

It took about half and hour to complete and after this was set up, it was quite easy to gain access to my PTA.

What can the Personal Tax Account do?

Once logged in, this initial release of the PTA allows the taxpayer to do the following:

- view and update their personal address

- see an estimate of their income and tax for the current tax year (appears to be based upon employment income)

- view tax coding information

- complete a couple of online forms such as the Marriage Transfer Allowance and trace them through the submission process

- inform HMRC about changes to a couple of specific employment benefits

- become or offer to be a trusted friend to another taxpayer (a form of agent)

We suggest that everyone tries the sign up process with GOV UK Verify at this early stage and takes a look at their own PTA. You can do this by visiting https://www.tax.service.gov.uk/personal-account/start .