TaxCalc Blog

News and events from TaxCalc

The much-awaited Making Tax Digital Roadmap is unveiled

It’s been largely radio silence in recent times regarding Making Tax Digital (MTD), with various delays, Brexit and Covid-19 all seemingly taking precedence. All of which has left taxpayers, accountants and software developers in a state of limbo.

Should accountants start discussing the changes with their clients and implementing solutions? How long have they got to prepare? Is it worth spending time on it? Some accountants were not convinced MTD for Income Tax would ever be rolled out, likely fuelled by the lack of clarity provided. So many unanswered questions made planning and implementing change unnecessarily complicated and worrisome.

However, as part of a new 10-year plan to modernise the UK tax administration , issued by the Treasury Department on 21 July 2020, we finally have some answers. The accounting industry can finally start planning with some certainty and to a sensible timeline.

MTD Current Progress

MTD for VAT was launched as the initial phase. In April 2019, VAT registered businesses with a turnover above the registration threshold were mandated to join the MTD for VAT regime. This meant:

- Keeping records digitally (including the use of spreadsheets).

- Using MTD-compatible software to submit the returns to HMRC.

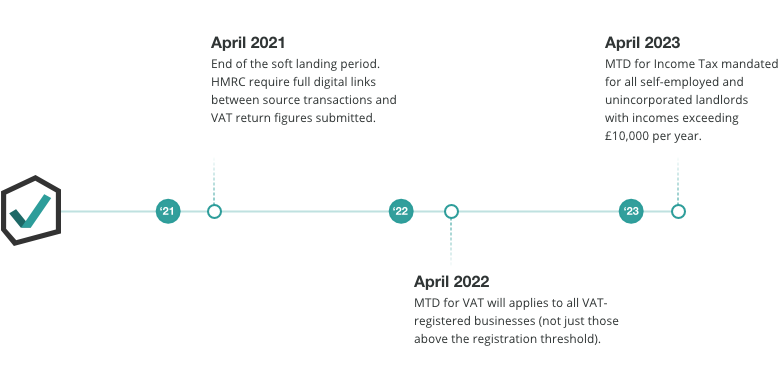

There was an initial relaxation of ‘digital links’ rules with regard to connections between the digital records and the software used to submit the figures to HMRC. This was due to end in March 2020, but was postponed for 12 months to give businesses longer to get ready for the changes. Therefore from April 2021 digital links will have to be in place.

To find out more about digital links, please view our detailed knowledge base article.

Bridging software such as TaxCalc’s VAT Filer meets the requirements for digital links and ensures those businesses that are happy using spreadsheets for their record-keeping can continue to do so in the MTD future.

HMRC published a review on the initial implementation in March 2020. Over 1.4 million businesses have registered for MTD for VAT, which includes over 280,000 business under the VAT threshold, that have voluntarily registered.

What’s Next?

As confirmed in a written statement from the Financial Secretary to the Treasury, Jesse Norman, the next steps are as follows:

MTD for VAT

- From April 2021, the MTD for VAT ‘Soft Landing’ period comes to an end, meaning digital links must be in place for all VAT quarters beginning on or after 1 April 2021.

- From April 2022, MTD for VAT will apply to all VAT-registered businesses (not just those above the registration threshold).

To reiterate, TaxCalc VAT Filer will continue to be a viable solution.

MTD for Income Tax

- From April 2023, MTD for Income Tax will be mandated for all self-employed and unincorporated landlords with incomes exceeding £10,000 per year.

What does this mean for the self-employed and landlords?

MTD for Income Tax mandates that businesses and landlords keep their records digitally and submit business income information at least quarterly to HMRC, using third party MTD-compatible software.

Taxpayers will be mandated to provide the following accounting period information:

- Income and expenses summary for each self-employment and property business, at least every three months.

- Allowances and adjustments for each self-employment and property business, at least once a year, at the end of the accounting period.

- Confirmation of business income sources with an End of Period Statement (EOPS).

- In addition to the business-related obligations above, other sources of income, reliefs and allowance, capital gains etc. will need to be submitted at least annually to HMRC in relation to the tax years and a confirmation process completed.

Other Taxes

HMRC has announced that they plan to begin a consultation on MTD for Corporation Tax in the Autumn.

What’s Next for TaxCalc

We at TaxCalc have been working closely with HMRC to ensure we fully understand the processes and requirements surrounding MTD, in order that we can deliver a range of products and features to ensure you have all you need to continue in the new digital world of MTD.

Now that firm dates have been clarified, we will review our roadmap plans and work with customers to ensure our offerings stay true to our core beliefs and put our customers’ needs first.

For Practice

File your clients' VAT returns to HMRC using both the Government Gateway and the MTD for VAT service for MTD registered clients.

From £78.00

Learn more

For Business

If you’re ready and required to file VAT returns, TaxCalc’s VAT Filer for Business is simple, quick and affordable.

From £17.50

Learn more