TaxCalc Blog

News and events from TaxCalc

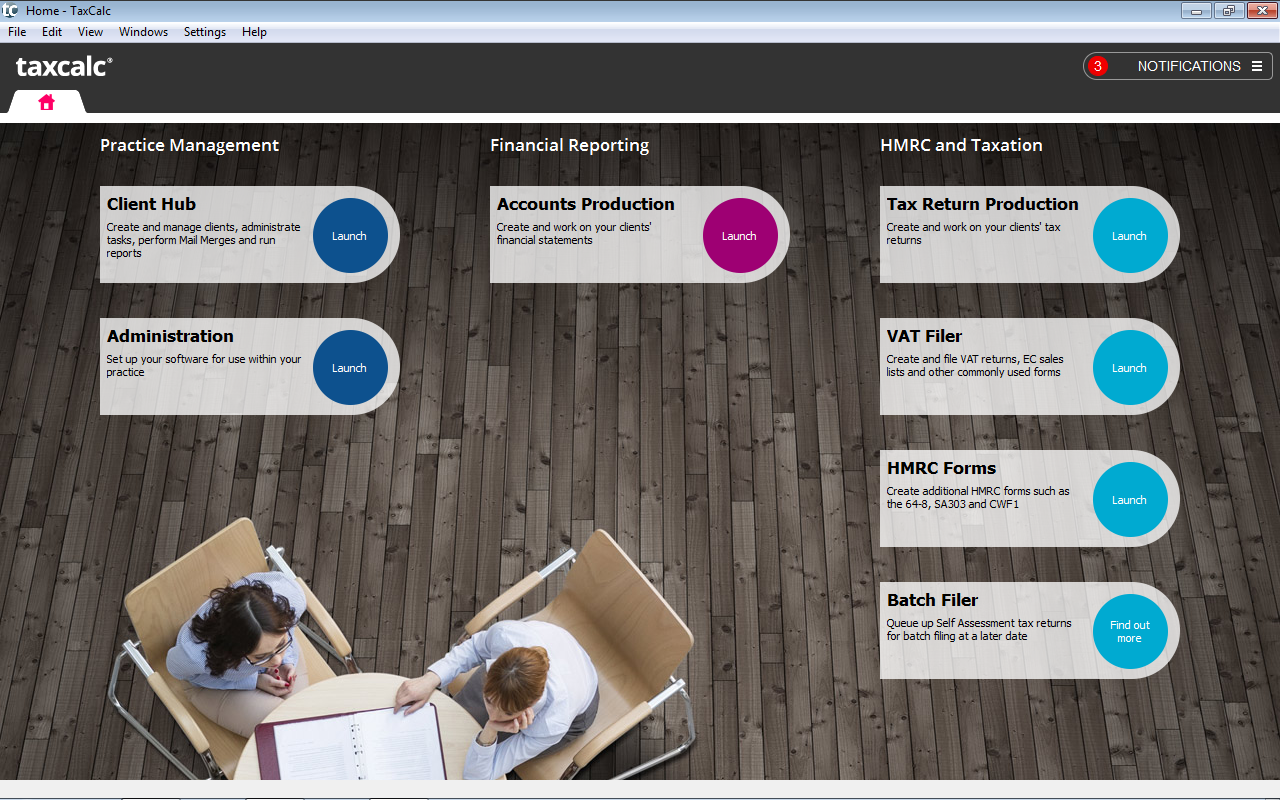

HMRC Opens Up New Possibilities to Make TaxCalc Even Better

As well as carrying out the usual duties you’d expect of a Commercial Director, part of my role at TaxCalc is to engage with various Government bodies and help them to shape various future strategies.

Over the last six months, I’ve been invited to London several times to discuss matters concerning HMRC’s digital tax strategy and all that it entails. We see it as being very important to represent not just ourselves but also the accountancy and taxpaying communities. We use our voice to ensure that proposals don’t just suit HMRC but also our customers and where those customers are accountants, their clients too.

I’m pleased to report that one such strategy that we’ve been contributing towards was announced by HMRC on Tuesday 1 September. It concerns something called Application Programming Interfaces, or APIs for short, which are used whenever our software needs to communicate over the Internet with HMRC or another Government body, such as Companies House.

APIs are nothing new and quite a few exist already, mainly to send data, such as a tax return or a set of accounts. However, having been designed quite some time ago, they aren’t capable of receiving information back.

So, for example, whilst it’s perfectly possible to check whether HMRC have received a tax return, there are absolutely no APIs to check whether they have received a payment of tax to go with it – you can only do this online.

HMRC’s new strategy is to begin building new APIs that will enable our software products to do a lot more with their systems. This is great news for all concerned since we’ll be able to make future versions of TaxCalc much more capable and therefore more efficient to use.

Within the announcement, HMRC has stated that APIs will be created to enable the pre-population of data within the tax return and to provide access to their risk rules.

The former builds upon the concept of the digital tax account. One of the key ideas behind this is that HMRC will be able to collect information about a taxpayer from different sources. In this case, information about payroll and pension income spring to mind since these have to be sent to HMRC as they are paid.

The API that is to be created will enable the sharing of this information with software like TaxCalc, populating parts of the return for you that you would then simply need to check for correctness. Of course, appropriate security standards to authorise the software to do this will be put in place, necessitating the creation of more APIs.

The second set of APIs announced provides us with access to HMRC’s risk rules, which is a suite of checks performed upon tax return data to highlight any potential discrepancies. It’s rather like our Check and Finish, only a lot more secretive since only HMRC gets to see it!

However, the API being suggested here would enable a tax return to be passed through the risk rules prior to submission and return to TaxCalc any potential issues for your attention. Thus any bona fide errors can be caught prior to the actual submission and should hopefully avoid HMRC inspectors being sent on wild goose chases, hunting down honest mistakes.

Of course, despite our input, we don’t get to set the overall strategy nor is it up to us to set the timetable or order for the development of the APIs. That being said, over the coming months, I expect we’ll be visiting HMRC a lot more to discuss how the strategy is developing and, through this blog, we’ll be able to update you and set your expectation as to how a future incarnation of TaxCalc might look.