TaxCalc Blog

News and events from TaxCalc

Articles containing the tag "Self Assessment"

Making Tax Digital - Consultation Documents

HMRC have now published their consultation documents on the Making Tax Digital (MTD) strategy. Covering six separate documents and totalling 243 pages, together they set out HMRC’s vision for the future for the UK’s tax system.

For some time now, we’ve been taking time to inform our customers of the key concepts behind Making Tax Digital: Digital Tax Accounts, Application Programming Interfaces (APIs) and Quarterly Updates. The consultations not only help explain these plans but introduce some new ideas not previously imagined.

We’ve dissected the first of the six documents and here are our high-level findings…

Read moreHMRC Making Tax Digital Update

It’s been almost two months since we last posted about HMRC’s Making Tax Digital strategy.

Due to matters such as the local elections and the EU Referendum, not an awful lot has happened since then. However, there have been a few matters of note arising…

Read moreNew Addition to HMRC Government Gateway Security

As part of HMRC’s Making Tax Digital strategy, we have been expecting security improvements to be made to taxpayers’ access to their online accounts via the Government Gateway.

On 29 March 2016, HMRC introduced a new optional layer of security that introduces a mobile phone into the logging in process for Individual taxpayers…

Read moreHMRC Making Tax Digital – What You Need To Know

We received a number of emails and calls yesterday and today following a webinar presented by another company in our industry. The webinar purported to be in connection with HMRC’s Making Tax Digital strategy but turned out to be not much more than rouse to sell mobile app development services.

Unfortunately, its content rather unsettled the customers that contacted us, so I’ve written this blog to set out where the industry currently sits with the strategy and how it could affect practitioners and their firms…

Read moreHMRC's New APIs – How They Work in TaxCalc 2016

Hi there. I’m Greg Case and I’m TaxCalc’s Head of Product Development. I’ve recently been reviewing HMRC’s progress with the implementation of their new Application Program Interfaces (APIs) and how we’re going to incorporate this into the forthcoming 2016 version of our software.

In a nutshell it will give TaxCalc the ability to gather information that HMRC hold about a taxpayer and, in time, even update it in real time and outside of the tax return itself.

But only if you want it to. To do this, you need to give your TaxCalc software permission to work with HMRC’s APIs. TaxCalc can’t access any information unless you allow it to.

In this article, we’ll look at how it works…

Read moreDigital Tax Accounts and Quarterly Reporting

The Government today released a new document about Digital Tax Accounts. Entitled Making Tax Digital, it consolidates information that has been released into the public domain since the March Budget and lays out the roadmap by which HMRC will transform from its current regime to the new digital one.

Having read numerous articles in the press these last few days, many reporters have reiterated the fact that Digital Tax Accounts, both for individuals and businesses, will be the norm by 2020. However, what seems to have slipped somewhat under the radar by a few is the requirement for “most” self employed people and landlords to make quarterly returns from April 2018…

Read moreThe Digital Tax Account – Public Beta and a New Name

On Tuesday 1 December 2015, HMRC formally launched the public beta of the Digital Tax Account, now renamed the Personal Tax Account (PTA).

The new service, as with all new Government projects, is to be delivered in a piecemeal fashion. In this article, we’ll take a look at what it can do…

Read moreProtecting Yourself from Phishing Scams

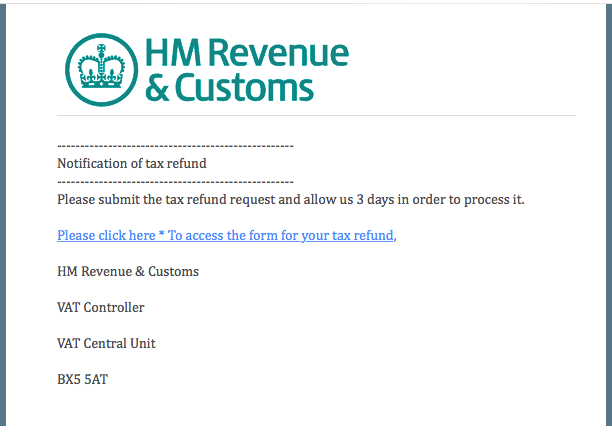

In something of an irony (considering who’s received it), a phishing email beat my spam filter last night and landed in my personal inbox. Purporting to come from HMRC, I apparently have a VAT tax refund waiting for me and need to follow the link to fill out a form to claim it. What excitement for a Thursday evening!

I think that everyone will agree with me that this is really quite a suspicious looking email. However, looking today at the kinds of emails TaxCalc generally receives from HMRC, especially with regard to VAT and VAT MOSS, even official emails from HMRC can appear to be quite generic.

For example, VAT return reminders are addressed to Sir or Madam and VAT MOSS emails to just “VAT MOSS user”. Whilst said emails may quote the name of the company and our VAT number, these can easily be found on our website.

The email prompted me to think about how we can stay safe with phishing scams.

Read more