Practice Manager

Included as standard.

With its powerful administration, client information and practice management tools, Practice Manager will become the heartbeat of your practice.

The heart of your practice

Your single source of information

Integrating with the TaxCalc suite, Practice Manager allows you to manage tasks and provides

a single source of client information, sharing data seamlessly with other TaxCalc applications.

Features

Client/Contact Management

- Customisable list of clients/contacts with a selection of default views or create your own

- Add columns for key client information e.g. UTR, Phone number or a clients latest work period/status/deadline

- Quick filter by client type or search or use our powerful data mining tool for advanced filtering

- Access any work module or client record from one central list

Client Records

- Record detailed information about clients and their businesses

- Stay on top of GDPR consent management by recording clients’ marketing preferences

- Track individuals’ trading and property businesses for MTD.

- Pre-populate sets of accounts, tax returns and VAT returns. Data all comes back from these sources and can be used within mail merges and reports.

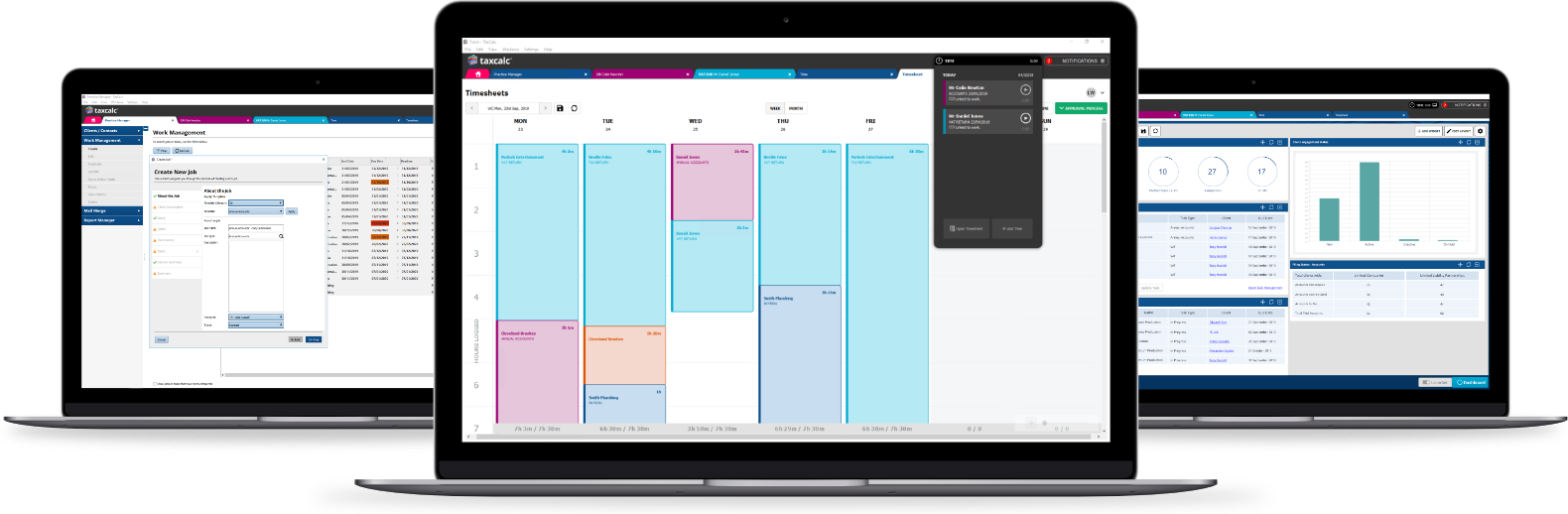

Task management

- Create Tasks to assign work

- Use Work Statuses to keep track of assignments in progress

- Manage your due dates and ensure client deadlines are met.

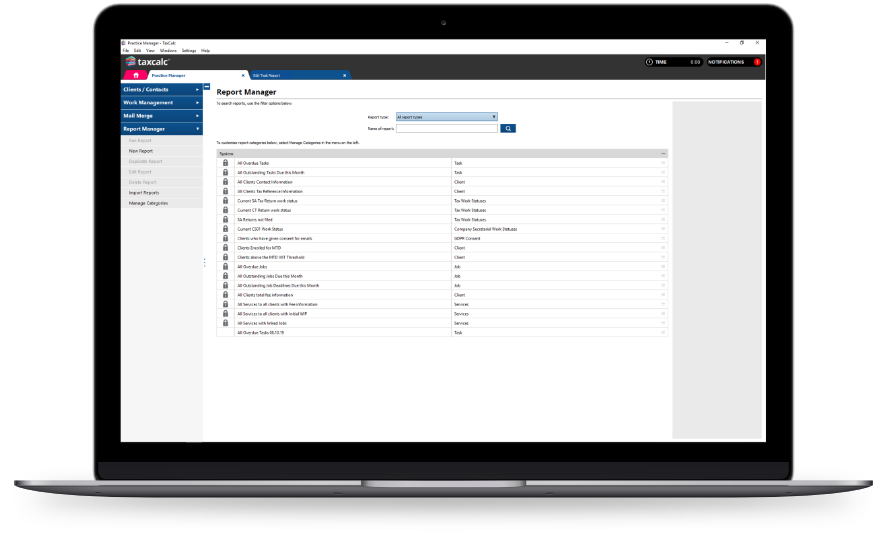

Reports

- Produce detailed, interactive reports

- Export reports to Microsoft Word, Excel and PDF formats.

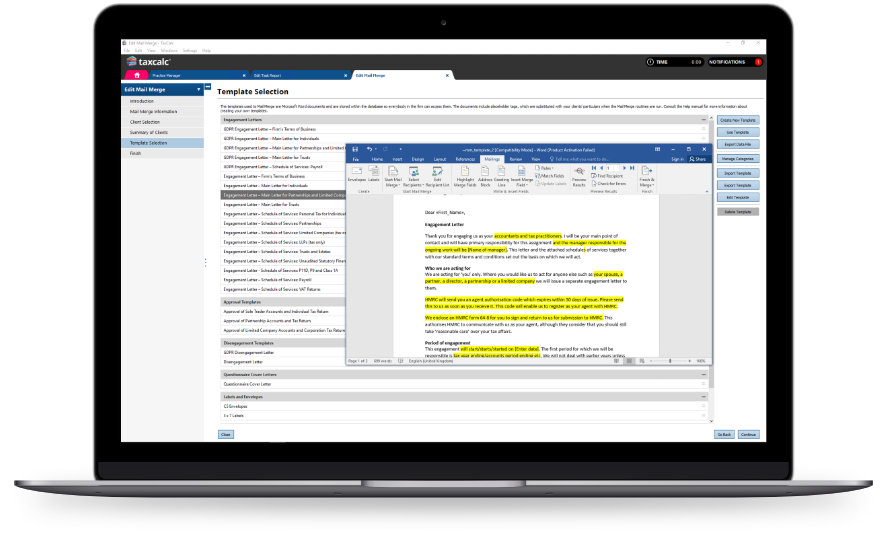

Client Communications

- Send letters (via MS Word) to clients*

- Use mail merge templates for engagements, terms of business, approval of work, and more

- Use tax return data to send a Tax Questionnaire, including the covering letter.

* Mail Merge functionality located within TaxCalc Communications Centre

Part of the practice management suite

Manage clients, communications, tasks and workflow, time and compliance

throughout your practice and across the entire TaxCalc ecosystem.

See TaxCalc in action

Find out how TaxCalc can switch on your digital practice.

Start a free 14-day trial and see for yourself.

Try everything! See for yourself how easy TaxCalc is to use.

Take a trialNo payment card required

Call us about your practice software needs.

Find out more about what TaxCalc can do for your practice.

Speak to our Sales Team

0345 5190 883

Features

Create and manage clients

As well as providing a central client list, Practice Manager can be used to keep records of key information including contact information, services offered, AML events, client notes, GDPR content and much more. If a field isn’t available just add your own.

Tasks, reminders, work tracking and deadline management

Take control of the activity in your practice by creating and scheduling tasks for automatic assignment to staff, with deadline, reminders and completion progress. Accounts, tax, VAT – indeed all work performed in TaxCalc can be tracked according to any of a series of customisable task types and work statuses.

Mail Merge and Tax Questionnaire

Send letters in bulk via Microsoft Word*. Complete with a library of GDPR friendly engagement letters, written to CCAB standards and many more templates to choose from or create your own. Select and send clients a tax questionnaire to collect tax information in advance of starting their tax returns.

* Mail Merge functionality located within TaxCalc Communications Centre

Reports

Practice Manager features a wizard driven report engine, helping you to build reports based upon clients, tasks and work status.

The system comes with a number of pre-built reports to get you going quickly. Reports are powerful too – you can report on any field in your clients’ records. Make reports public or private and import/export templates.

Data Mine (More filters)

As more data is captured, you’ll want to do more with it. Data Mine can be used to check and validate client data. For example, finding all clients without a UTR.

Data Mine can also be used within Mailing Lists, Tax Questionnaires and Reports to help target clients that fit specific criteria.

Dashboard

Dashboard provides a whole new way of working within TaxCalc.

We hold a lot of useful data inside of the TaxCalc Suite including Accounts, Tax Returns, Client’s Details and Tasks.

Dashboard is the platform for improving the way you work day to day.

Your task list becomes interactive, getting you to the work you need to complete without having to select the client or specific period your task relates to.

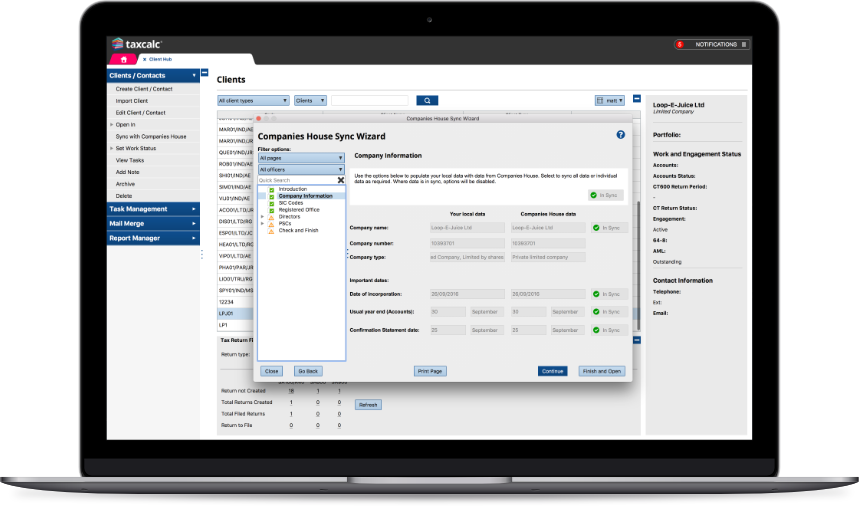

Integration

As the heart of your practice, Practice Manager shares any data entered into TaxCalc’s other applications.

Practice Manager ties together related processes. For example, marking a client as being new to your firm can automatically create a 64-8 and engagement letter.

Useful HMRC Forms

Practice Manager features an updated library of additional HMRC forms:

- SA1 - (Registering for Self Assessment)

- FBI 2 - (Authorise an agent to use PAYE/CIS online services)

- Both online and offline 64-8 - (Authorise your agent)

- SA303 - (Self Assessment claim to reduce payments on account)

- CWF1 - (Registering as a Sole Trader)

- CT41G - (Registering for Corporation tax)

Multiple office support

Manage staff, clients and jobs across multiple offices.

- Create separate bank details and filing credentials for different offices

- Assign users to a specific or multiple office(s)

- Assign clients to a specific office

- Restrict user access to clients of a specific office

Features in detail

TaxCalc Practice Manager is replete with features that are designed to help you run your practice.Clients

- Customisable client list table with search and filter options

- Add columns to the client list for key client information or latest work status/period/deadline

- Quick setup window to create clients

- Caters for individuals, partnerships, limited company and trust clients

- Handles multiple trades (individual only)

- Create partner or staff portfolios and assign clients to them individually or in bulk

- Record services engaged and indicative fee levels

- Record anti-money laundering events

- Set up relationships between clients and non-clients alike (spouses, partnerships, directorships etc.)

- Captures all necessary core information about your client, including:

- name, address and other contact information

- place notes against phone numbers (e.g. bookkeeper's number, evening only etc.)

- critical dates (birth, incorporation etc.)

- tax references (UTR, NINO, PAYE)

- tax schemes and dispensations

- tax office

- pension auto-enrolment date

- bank account details

- engagement status, 64-8 status

- Create custom fields (inc. text, date, number, dropdown and user) that can be data mined and reported

- Password protect sensitive clients from being opened by staff without correct privileges

- Record and print arbitrary notes against the client's record

- Check & Finish routine to ensure all necessary information to create a client has been entered

- Import client data from csv files

- Set work status for accounts, tax and VAT work

- Archive former clients from views and reports

Tasks

- Single Task viewing screen to see, search and filter tasks both active and completed in the practice

- Task creation wizard for fast setting up of tasks

- Optionally associate tasks with clients and non-clients alike

- Create tasks by reference to key client dates, such as accounts year end or tax filing date

- Enter due dates and reminders

- Get notifications when a task reminds you of its presence or that its deadline approaches

- Assign to staff for tracking around the office or leave unassigned for future allocation

- Set tasks to reoccur

- Customise the types of task that can be created

- Keep an audit trail of task progress as it moved through your practice

- Edit, duplicate, update, assign and delete tasks

- Update, assign and delete multiple tasks at once

- View and update tasks associated with a client from within any TaxCalc application

Mail Merge

- Use default templates or create your own to generate a Mail Merge via MS Word*

- Save Templates and Mailing Lists for future use

- Select all clients, specific clients or build a mailing list using our powerful Data Mine tool to target clients meeting given criteria

- Create templates in Microsoft Word and import into the system for future use

- Create categories of templates to help manage your own template library

- Includes templates for address labels and envelopes

* Mail Merge functionality located within TaxCalc Communications Centre

- Choose a letter template from the library provided (written to CCAB guidelines):

- engagement letters for various types of clients

- engagement letters for various types of services provided

- standard terms of business

- presentation of accounts and tax computations

- disengagement letter

- questionnaire cover letter

- Mail Merge tokens include:

- name and address components

- pre-built formal and informal name blocks (e.g. Dear Mr R Smith or Dear Bob)

- tax references, liabilities and balancing payments

- custom fields (inc. text, date, number and dropdown)

- Set a principal contact for Partnership and Limited Companies

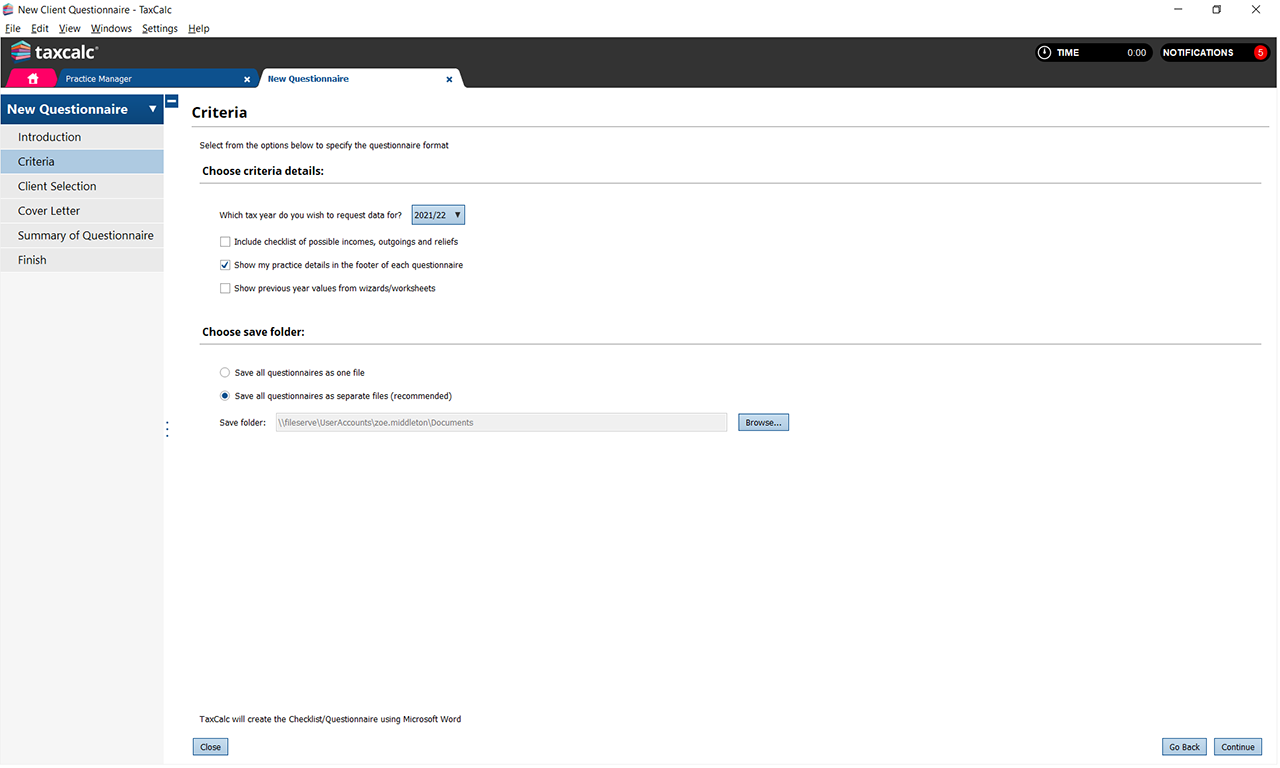

Tax Questionnaire

- Send a tax questionnaire to clients to gather information prior to starting their return

- Base the return on previous year data or start afresh

- Create one Microsoft Word file for all chosen clients or individual files for emailing later

- Select all clients, specific clients or build a Data Mine to target clients meeting given criteria

- Add a cover letter to each questionnaire (templates stored within Mail Merge)

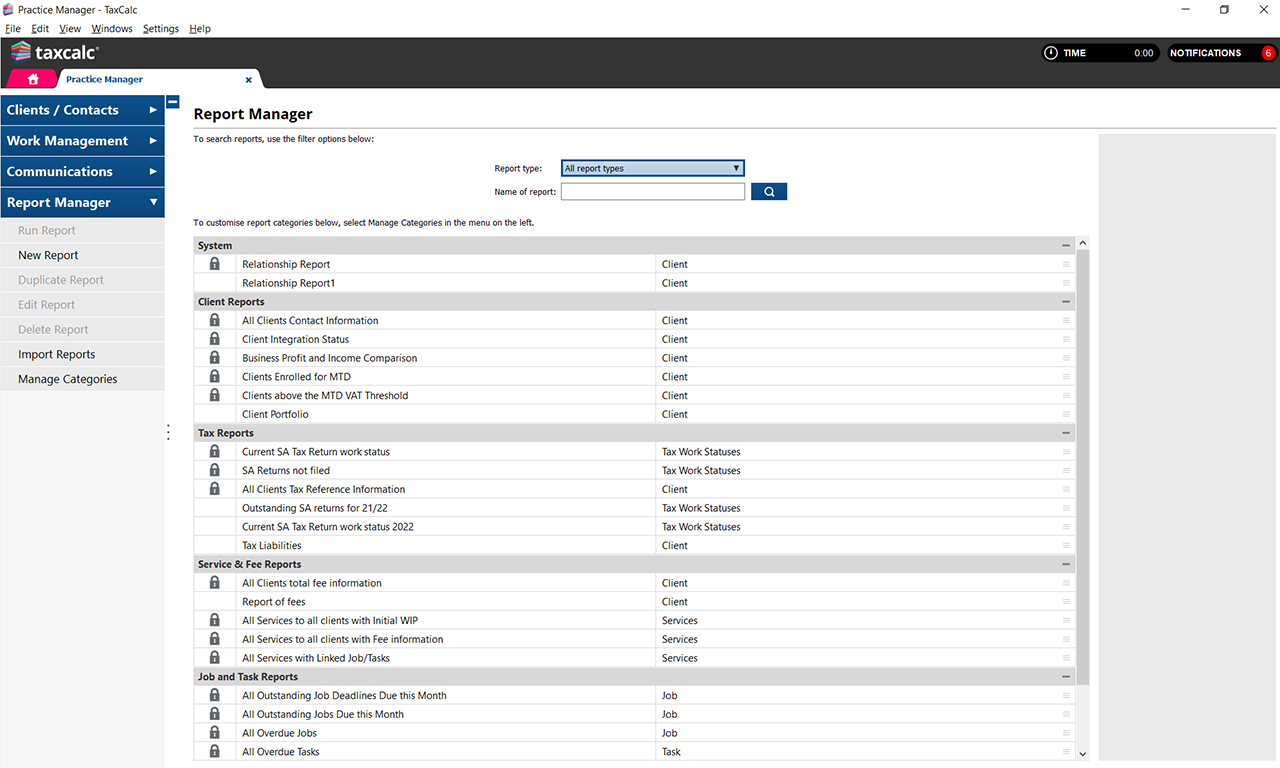

Reports

- Create interactive reports based on client data (inc. relationships), tasks or work statuses (accounts, tax, VAT)

- Select all clients, specific clients or build a Data Mine to target clients meeting given criteria (inc. archived clients)

- Choose from a long list of column titles, including custom fields

- Variety of filter options based upon the type of report being built

- Customise report output to choose columns presented, order sorted by and page orientation

- Private report function (other users cannot see them)

- Save reports for future re-use and share with other users

- Import and export report templates

- Export report output to Microsoft Word, Microsoft Excel and PDF file formats

Data Mine (More filters)

- Build a Data Mine to target clients that meet specific criteria

- Use the wizard to build complex expressions in a simple fashion

- Include or exclude archived clients

- Save Data Mines for reuse elsewhere in the software

- Variety of conditions available, including:

- Client type, gender, marital status, age, engagement status, portfolio etc.

- Relationships

- AML status

- Types of incomes, tax events (e.g. gift aid) and values

- Tax flags (P11D dispensation, VAT scheme, CIS)

System

- First run wizard to help get set up and running quickly and easily

- Set up multiple user accounts, with passwords to prevent unauthorised access

- Create security roles with access privileges and assign each to staff members

- Single point to set up name of firm, qualification, office addresses

- Database backup facility with custom reminder notifications

- Restrict access to clients by subcontractors, outsourcers and other external workers

- Enhance users' login security by enabling two-factor authentication

- See which users are logged in and when they last logged in

Deployment

- Standalone version, ideal for single user practices

- Client/server version for running over an office network

- Performance optimised for running over remote connections, such as VPN

Powerful add-ons to improve functionality

Increase Practice Manager's functionality with these helpful add-ons.

Companies House Advanced Integration

Quickly on-board new Limited Company clients and keep company data up to date and accurate with Companies House Advanced Integration.*

*This add-on is included with Companies House Forms 150 and above.

Find out more

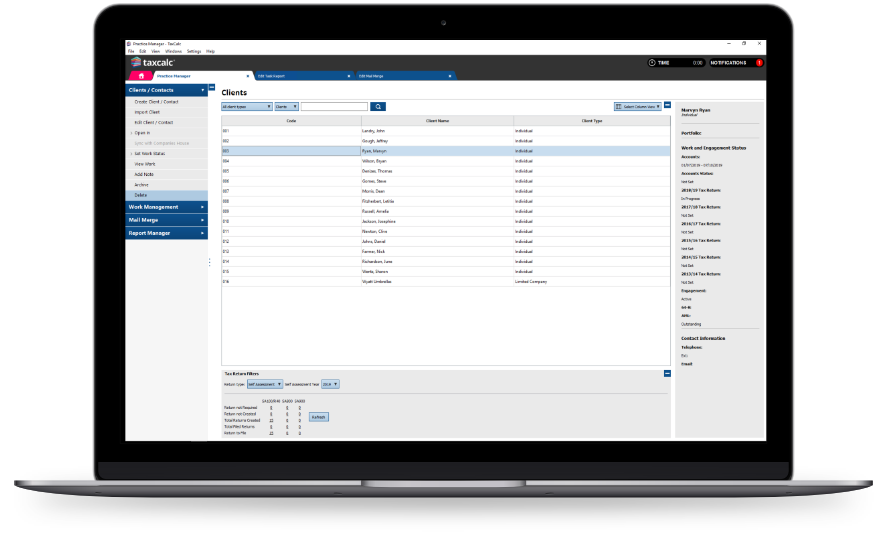

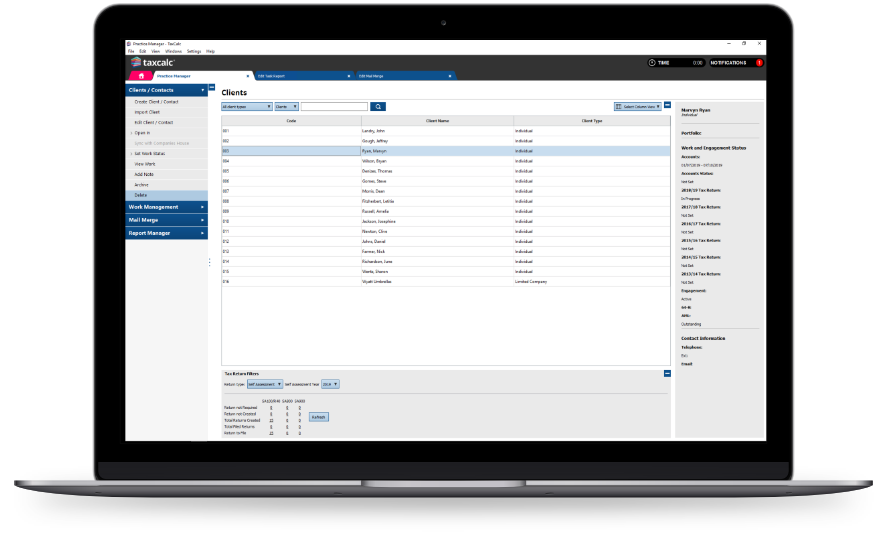

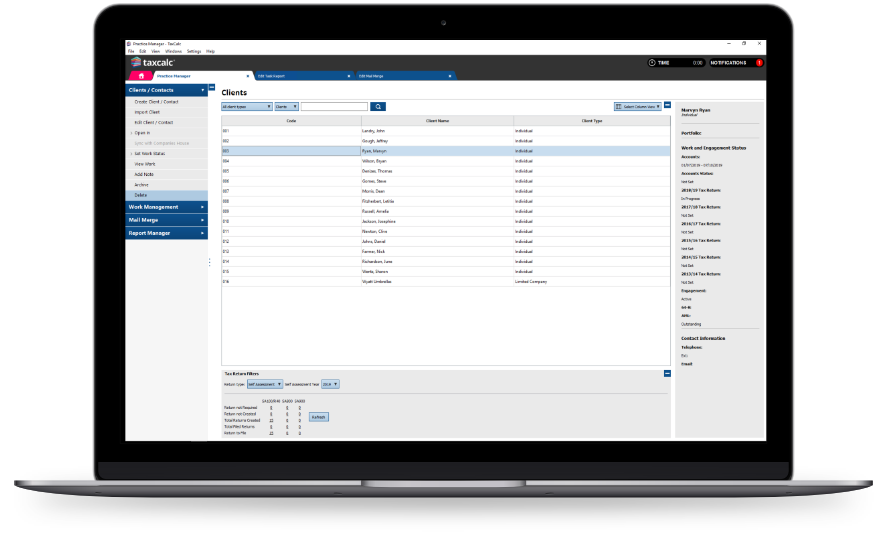

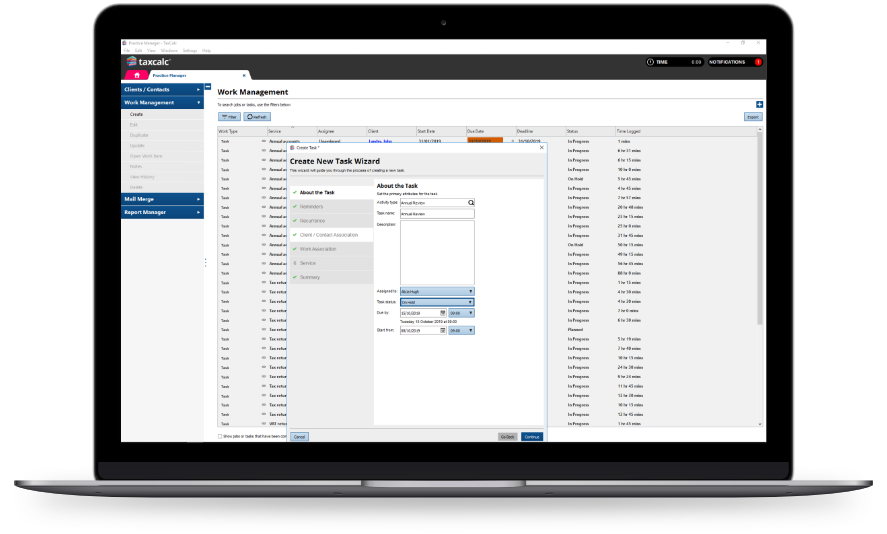

Practice Manager Screenshots

Practice Manager lets you organise clients, manage your tasks, workload and staff. Best of all it is included free, as standard, with every TaxCalc software product.

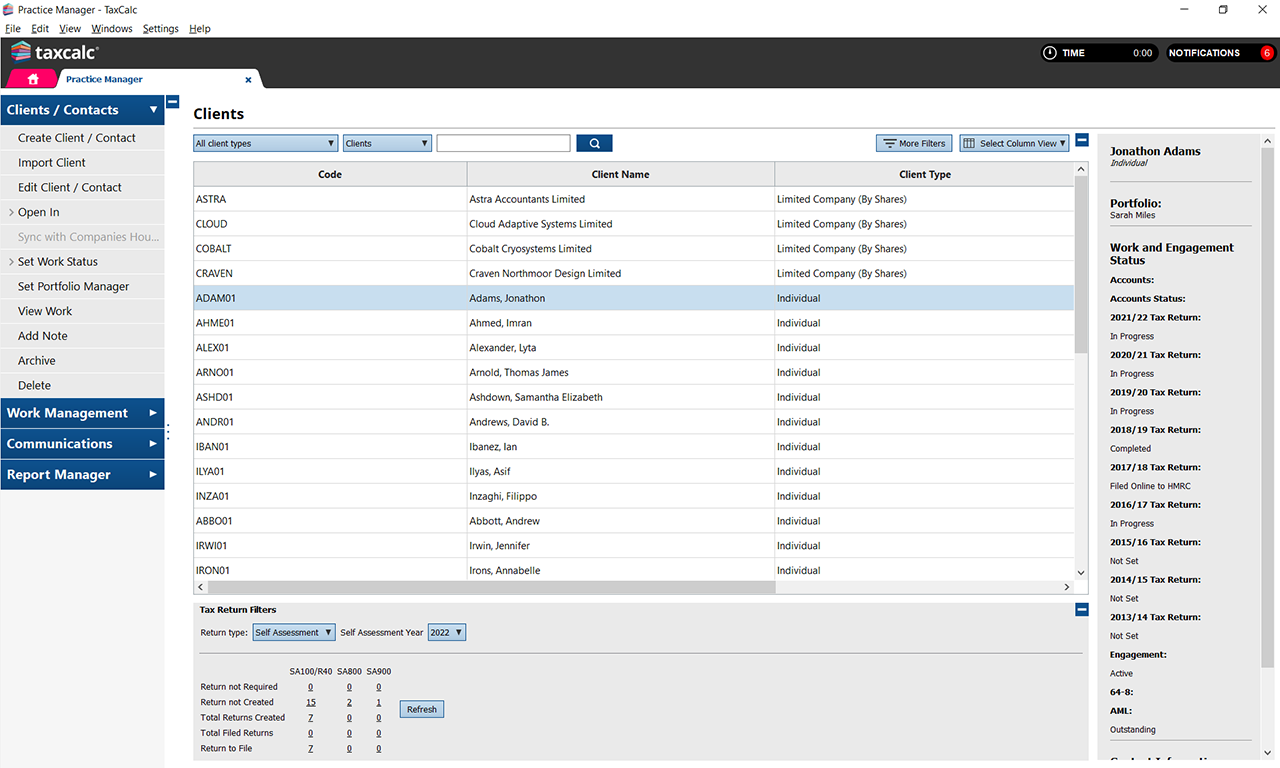

Your clients are accessed from the main Client screen.

You can customise the client table, showing columns of information (such as work status). Use the tax dashboard to keep track of tax return progress.

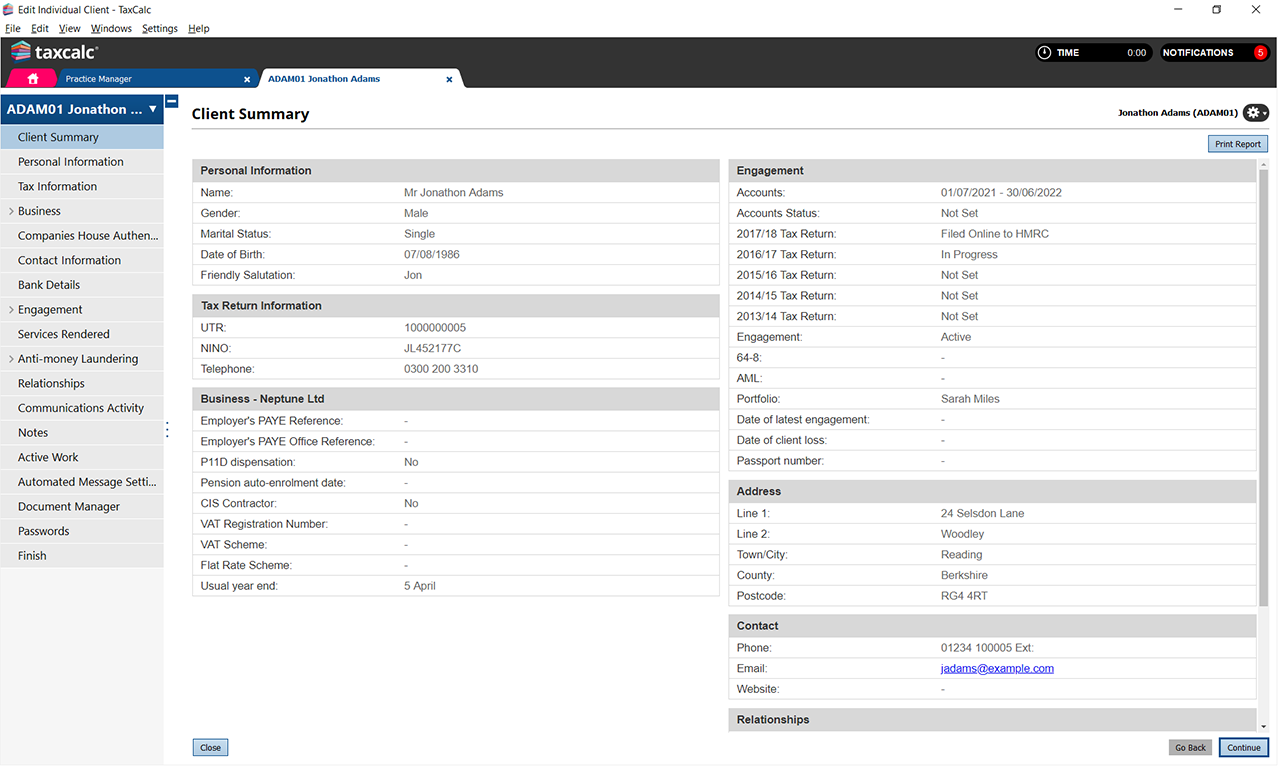

Whenever you open a client in Practice Manager, you will see a summary of key information about them.

This screen can be customised on a per client basis and printed for your paper records.

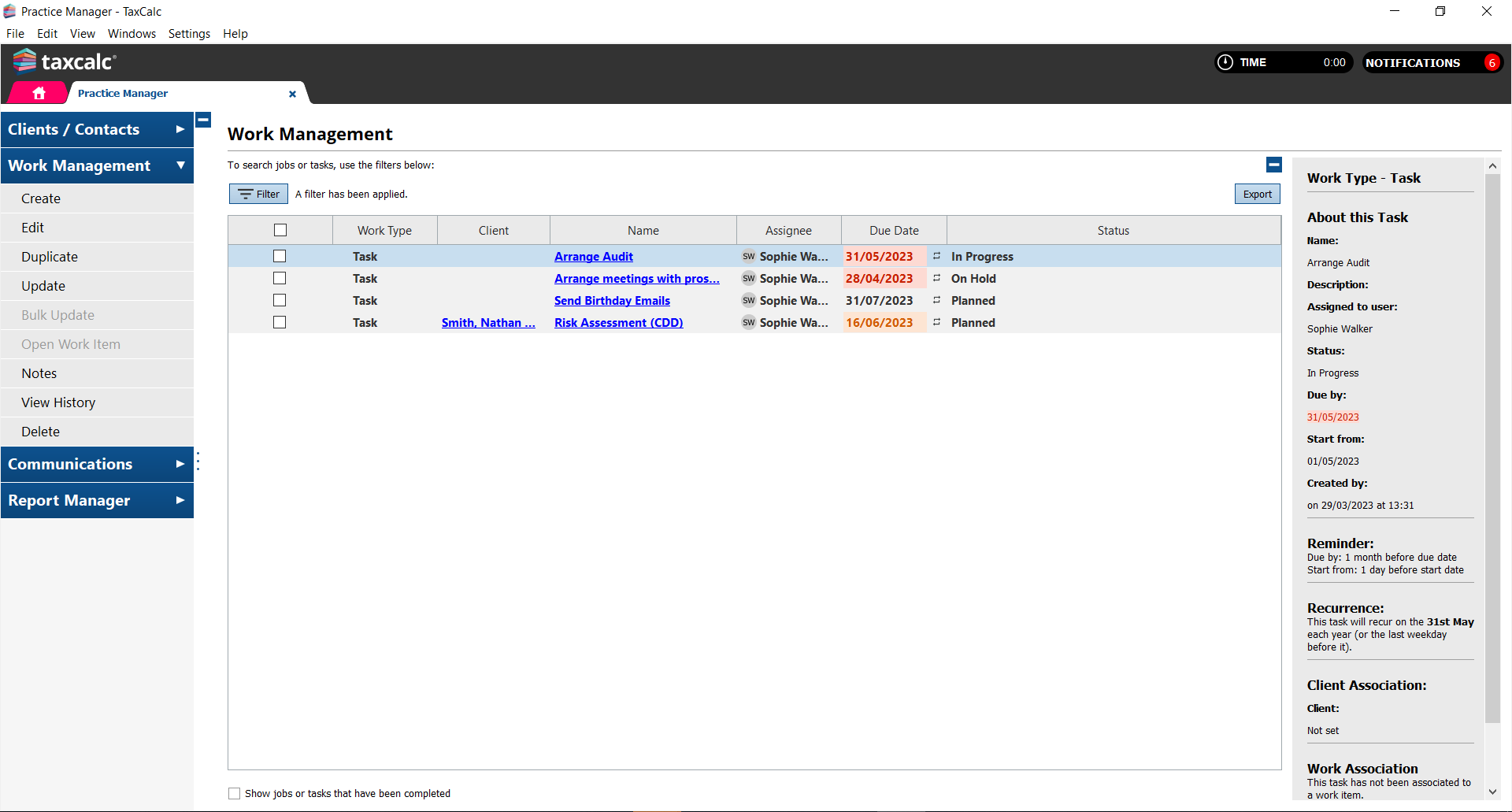

Setting up tasks is easy with TaxCalc's wizard.

Tasks can also be scheduled from within the client's record and referenced with key dates, such as the accounting year end.

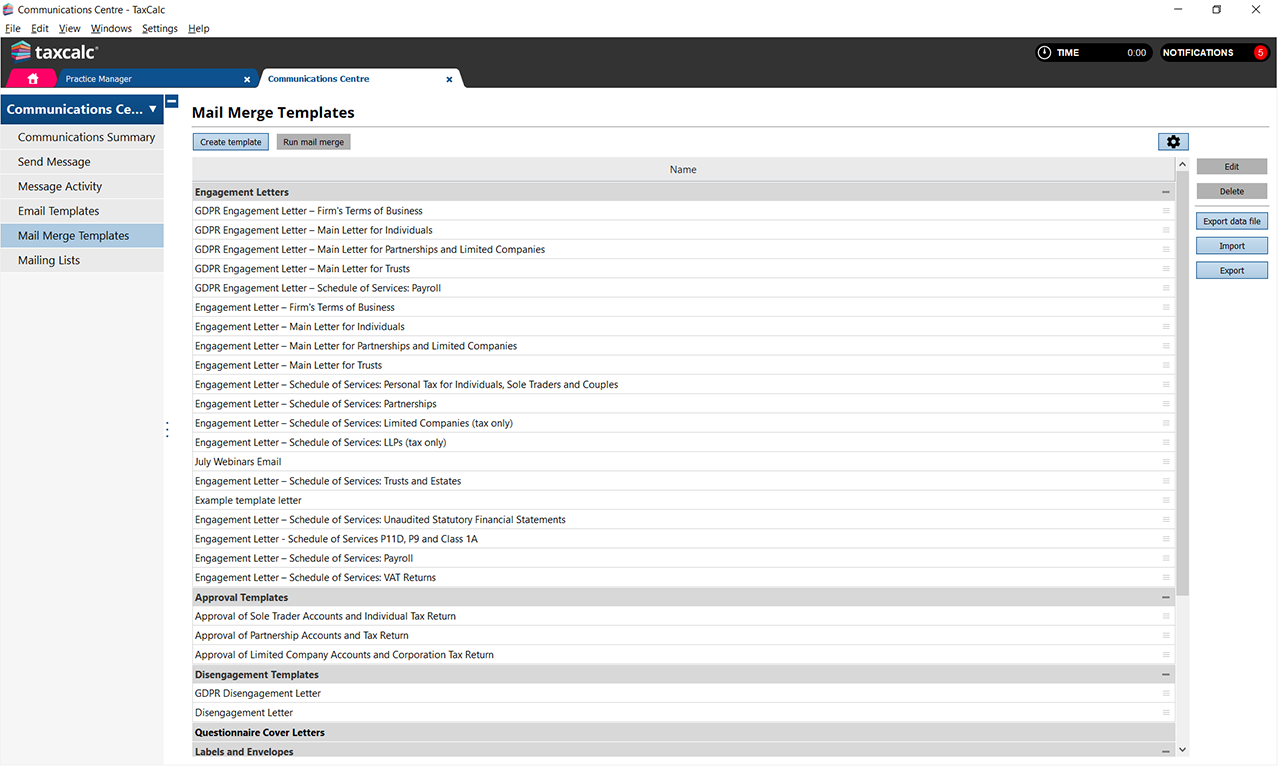

TaxCalc Practice Manager is provided with a range of template letters, neatly organised by type.

You can easily add to the range of templates provided, each written to CCAB standards.

Help your clients to organise their records prior to starting their tax return by sending them a questionnaire.

New clients can be sent a blank questionnaire whilst existing clients can be based upon last year's return.

As well as using the Clients screen to keep on top of work progress, Practice Manager features a comprehensive reporting function to create a variety of reports.

Frequently asked questions

Below you'll find answers to questions you may have about Practice Manager.

If you'd like to know more, please call us on 0345 5190 883 or email sales@taxcalc.com.

What does Practice Manager include?

Practice Manager allows you to record and store your clients information, create and assign tasks to your team and create reports on your work. Please see our feature comparison for more details.

Can I buy Practice Manager on its own?

No. Practice Manager is included at no additional cost when you buy one of our practice products.

If you cannot find the product you are looking for, please call us on 0345 5190 883 or email sales@taxcalc.com.

How many clients can be stored in Practice Manager?

The database can store as many clients as you need. TaxCalc Practice Manager is not limited by restrictions placed on other products, so, your database could hold 80 clients whilst you have an Accounts Production licence for 50.

How many users can use Practice Manager?

Use of Practice Manager is unlimited.

Practice Manager

Included at no additional cost when you purchase any of our

professional products, and includes:

- Work management

- Standalone tasksCreate a single task for one assignee with one due dateSee WorkFlow for advanced work management.

- Client management

- Client records

- Client relationships

- Client notes

- Client engagement

- Custom fields

- HMRC Forms

- Client tax questionnaire

- Communications management

- Mail merge letter templatesincl. cover letters and engagement letters

- Mail merge tokensincl. client and tax data

- See Communications Centre for automated email communications.

- Reporting

- Reports, customisable and interactive

- Private or public reports

- Data mining

- Dashboard

- Multiple DashboardsDashboards can be private or public

- Dashboard Widgets

- General

- User accounts for secure access

- Multiple offices

- Advanced multiple office controlAllows for different filing credentials and bank details for each office. Clients and colleagues can also be allocated to different offices