TaxCalc Blog

News and events from TaxCalc

MTD for ITSA Notices: HMRC’s Atomic Kitten

HMRC recently released the much-anticipated MTD for ITSA Notices , a document that TaxCalc has long been campaigning for and were promised early sight of six months ago – a promise that never quite came to fruition. When first published back in July 2018, the clarity provided by the equivalent MTD for VAT Notice 700/22 was a welcome breath of fresh air, clarifying many outstanding points in relation to functional compatible software, digital links and the use of spreadsheets. It contained examples, diagrams and clear explanations of what was legislative, and hence came with the force of law, and what was HMRC guidance or recommendation.

Never have I been so disappointed by a late arrival since only ⅔rds of early 2000s pop starlets, Atomic Kitten, bothered to turn up for their headline gig at my University’s Summer Ball. When they did eventually show, there was at least some entertainment value in their 20-minute performance. In contrast, there were no crowd-pleasers to be found in the MTD for ITSA Notices , which could be read in their entirety in less time than it took the Kittens to butcher Blondie’s timeless cover 'The Tide is High'.

There are four notices in total, each made under powers conferred to HMRC by the Income Tax (Digital Requirements) Regulations 2021 .

Software Notice

At only a single sentence in length, this notice may be the shortest tertiary legislation on record and is therefore worthy of reproduction in full:

Functional compatible software must comply with the following condition: once a digital record has been entered into a software program that forms part of the functional compatible software, any transfer, recapture, or modification of that digital record within the functional compatible software must happen digitally and not manually.

This statement tells us nothing we didn't already know and fails to provide any sort of clarity on HMRC's expectations. The MTD regulations empower HMRC to specify conditions with which functional compatible software must comply and specify different conditions for different cases or purposes. The notice falls short on both accounts.

We still don't know whether digital links are to be preserved from the bookkeeping right through to the End Of Period Statement, as inferred by regulation 3 para 1 (d) . I do not envy any accountant maintaining a digital link, for even the simplest of client types – from the bookkeeping, through a myriad of working papers and into the final accounts and End Of Period Statement without transposing any figure manually. As has oft been said, this is not nine boxes of a VAT return.

Update Notice

Without reproducing the full contents, this notice once again confirms what we already knew. The information to be submitted quarterly uses the same income and expense categories as those seen on today's supplementary tax return pages for self-employment and property income.

What is attracting perhaps misguided attention, is the reference to the concession for those trading below the VAT threshold:

A relevant person with an annual turnover below the VAT registration threshold, as amended from time to time, may choose to provide the total of all income and the total of all expenses instead of the totals of the amounts falling within each category of transaction listed in this Update Notice.

Oft referred to as 'three line accounts', this replicates the existing concession whereby taxpayers need not report a breakdown of their income and expense figures when returning their Self Assessment.

Some commentators suggest that this negates the need for the taxpayer to record the applicable category of each income and expense transaction – and simply list 'em, total 'em and submit 'em. Unfortunately, anyone doing so will likely fall foul of regulation 6 of the MTD for ITSA Regulations which states that a 'digital record' must comprise the following:

- The amount of the transaction

- The date of the transaction; and

- The category of the transaction.

Accountants and taxpayers alike will need to consider whether to revert their default categories to those supplied by HMRC, or stick with more meaningful ones and undertake a quarterly mapping process to align with HMRC purely for submission. There is a whiff of FRS105 about HMRC's categories – in that the accounts produced to that standard are pretty meaningless to the business entity they are supposed to inform. And do we really need to include 'fax' within the ‘Phone, fax, stationery, and other office costs' category? I do have my suspicions there is still a lonely fax machine whirring away in one of the now-deserted broom cupboards of HMRC Shipley, alongside a pile of yellow PAYE booklets and a few postage-paid VAT return envelopes, mind.

End Of Period Notice

Just as for the Update Notice, the End Of Period Notice offers little that we didn't already know. The End Of Period Statement (EOPS) is effectively a replacement for the supplementary pages of today's Self Assessment return and will contain all the same information. It will use the same income and expense categories and include all other tax adjusting information, such as private use, capital allowances and losses. No mention of the balance sheet suggests that information is now superfluous to HMRC, for those still submitting it voluntarily.

The lack of supporting guidance once again leaves many questions unanswered, such as what happens when a taxpayer traverses the VAT threshold and hence the requirement to report either using the cash or accruals basis? Some commentators have been told by HMRC that it is fine to report quarterly under the cash basis but revert to the accruals basis for the EOPS. This seems in contrast to the guidance we've been given as developers – and indicative of the inconsistency of information when it has yet to be presented coherently to all concerned.

Retail sales notice

Lastly, as anticipated, confirmation that a single digital record of the daily gross takings for any retail sales made, is acceptable under the regulations. Enough said.

The wait continues

In a recent cross-department meeting with HMRC, I was assured that further guidance will be on its way. I, once again, reiterated that the path may be smoother for all if we were allowed to 'work together' on the guidance rather than be left to pick holes in its shortcomings post-publication. That proposal was met with an uncomfortable silence, from which I could only infer meant thanks, but no thanks.

As the wait for answers continues, maybe I had convinced myself that these notices would be more than the sum of their parts? Perhaps, as the greatest hits of Atomic Kitten play in the background, it is only they that can make me whole again.

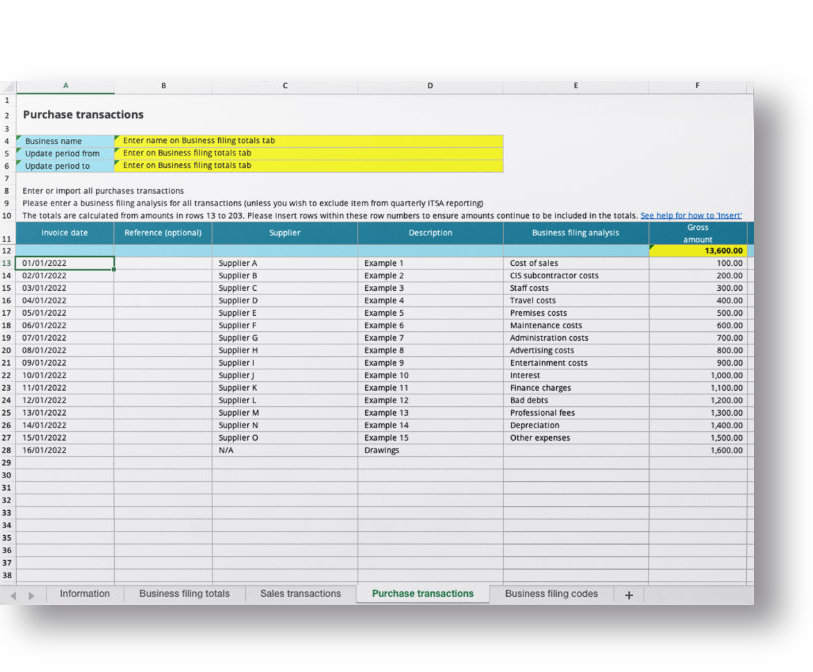

Free MTD for ITSA and MTD for VAT spreadsheets

The spreadsheet is dead, long live the spreadsheet.

Read our blog and download your free spreadsheets designed for you to use with your clients now to get an understanding of what will be required from April 2024 – or earlier

if you wish to join the pilot scheme.